Travel and Tourism Habits Quickly Changing

Chinese travelers are becoming more sophisticated by doing their own research on Western websites and making their own fully independent travel decisions.

The rise of the Chinese Free Independent Traveler (FIT) has been swift and is illustrative of wealth, desire for luxury, and willingness to invest in unique vacation experiences worldwide. In 2012, outbound Chinese travelers surpassed both Germany and the United States—previously the number-one and number-two markets by expenditure. They spent over $118 billion, up over 19% year over year.

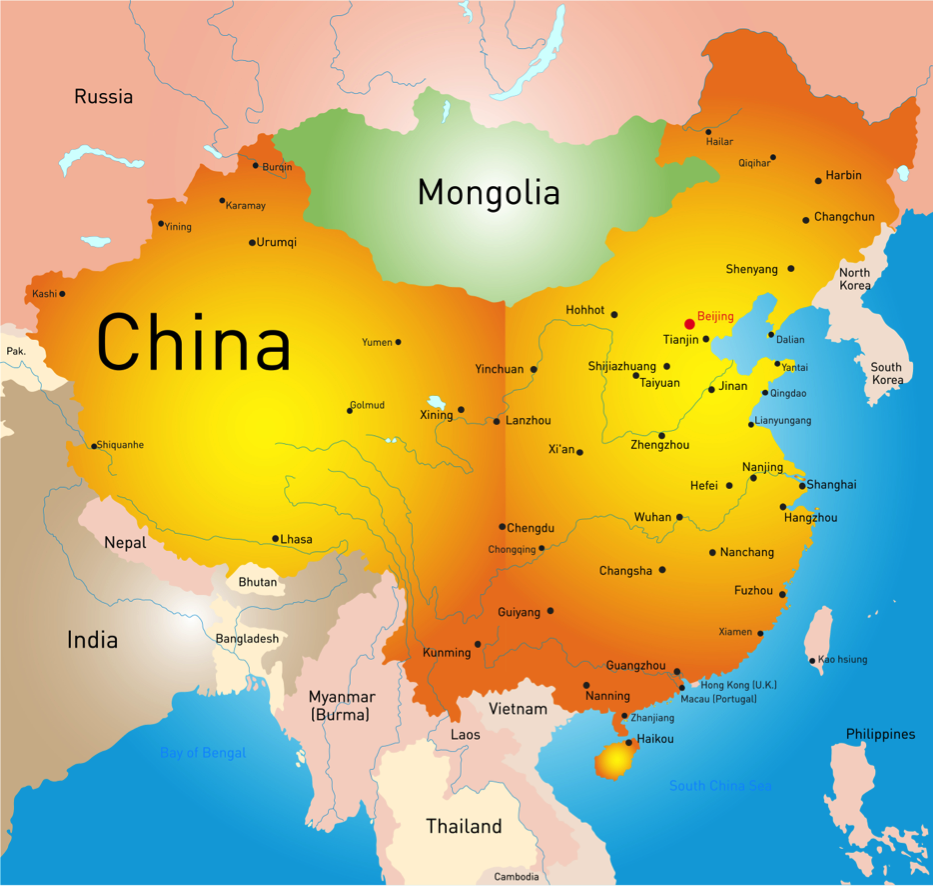

In-bound tourism is also growing rapidly. Last year, there were 132 million foreign visitors to China, who spent over $50 billion—the United States was the 4th largest in-bound market. Domestic tourism has been increasing at the rate of at least 10% for the last decade. It contributes over 4% to the nation’s GDP, a fact that is not lost by the government, which aggressively promotes tourism within the country.

The Operations Differential

The following is a brief overview of a few unique market characteristics and challenges of shared ownership in China.

First, the industry is still in its infancy here. There is a dearth of exchange property within China, and what does exist is generally not four- or five-star quality. There are, however, some excellent properties in nearby countries and resort areas that Chinese travelers now frequent (Phuket and Koh Samui in Thailand and Bali in Indonesia, for example).

Upwardly mobile Chinese consumers are extremely brand-conscious and will pay a premium for a known brand, so investing in additional research about brand perception in your target market is recommended. In the absence of a brand, you will need to work that much harder to gain your client’s interest and trust.

There is a very small labor force of experienced Mandarin-speaking timeshare personnel at the operational level. You will compete for them internally and with other Asian timeshare companies who have discovered that China mini-vacs can generate extraordinarily high sales efficiencies with the right product. But you will require sales and marketing personnel with both local knowledge and the appropriate language skills. This requires training and could take some time.

Chinese clients are willing to make an investment but are prudent shoppers and will very often be researching you on their smart phones while at the presentation. They will research Sina Weibo, Ren Ren, and other social media (there’s no Facebook, Twitter or YouTube), so you should become familiar with and build a communications strategy for these specific channels. Also, there are more than 500 million Internet users in China—more than double than the U.S. base.

Luxury shared ownership product has been sold to Chinese citizens outside the country for $30,000+ average purchase price and is beginning to be sold within the country at that level. Overall, approximately 60% will finance their purchase, but the capital markets in China are still rudimentary, as most of the Chinese don’t borrow money. (Unlike the United States, the Chinese household debt is a small fraction of its assets.) As such, you will need to offer financing or look to outside sources of capital. Note: there has been some success with imputing the interest on the loan within the purchase price rather than as a separate item.

The typical Chinese owner feels a strong sense of ownership and will expect superior treatment. They value precision in promises made and expect you to deliver. Service levels should be high-standard and individually personalized, and conflicts should be the subject of internal compliance review before they begin to escalate.

Currently, there is no timeshare legislation in China, so it is recommended that you provide your own internal governance—including compliance committees, proactive complaints resolution guidelines, and a self-imposed rescission period. It is also advisable to have an executive team on the ground full-time. If you are a foreign company setting up business, you should be prepared to work closely with established local counsel who are experienced in foreign businesses, real estate transactions, and governmental affairs.

I hope I have not underemphasized the positives and the extraordinary potential that China can provide for the right operator. Many companies may be right to wait out the market, given the high level of commitment. But the right business with the right resources and ability to forge the way for the industry could capitalize on the world’s largest market for generations to come.

Jim Sabot is a principal at Dean & Associates, based in Australia. He has served the Asia Pacific region’s largest publicly held vacation ownership companies at the executive level and has recently provided consulting services to the developer of one of China’s largest multi-use recreational sites. His e-mail is jsabot@dean-and-associates.com.