Previous articles have identified the size and breadth of the Outdoor Accommodations Industry, a segment of the Global Tourism and Hospitality Industries which is still subject to rather scant academic research. These prior articles have examined camping and caravanning around the globe with particular attention paid to the recreational vehicle [“RV”] industry which is now experiencing stellar growth in China and is already a pillar of the outdoor accommodations industry in markets such as North America and Australia, as well as in some parts of Western Europe. It has also looked at the concept of “glamping” and the various types of accommodations which international glamping projects offer these days.

This article looks at glamping in greater detail. It identifies who goes glamping and their motivations for choosing glamping as their preferred holiday option. It looks at glamping’s relevance to the tourism industry’s gradual recovery, given the many unprecedented challenges for global tourism which have arisen during the Pandemic.

GLAMPING VERSUS CAMPING

What makes glamping different as compared to camping? According to Wikipedia, “Camping” is an outdoor activity involving overnight stays away from home, with or without a shelter, such as a tent or a recreational vehicle. Typically, participants leave developed areas to spend time outdoors in more natural ones in pursuit of activities providing them enjoyment. The nights spent outdoors distinguishes camping from day-tripping, picnicking and other similarly short-term recreational activities.

Glamping, as the name suggests, refers to “glamorous” or luxury camping. It is characterized by exemplary locations, guest comfort and high-quality services through the blending of a camping experience with more traditional lodging services and amenities. Glamping appeals to couples as well as to families. It can offer privacy combined with memorable experiences, recreation, adventures, health and well-being benefits and eco-friendly environments, taking participants closer to nature. In effect, glamping can facilitate a unique outdoor travel experience without bringing (or buying) equipment, and at certain properties, it also offers luxury amenities and services typical of an upscale or even a luxury hotel.

Accommodations that fit into leisure travelers’ definitions of glamping are many and varied including canvas “safari” tents, covered wagons, teepees, yurts, tree houses and cabins. These accommodation types and other glamping accommodation options were identified in the previous article. Glamping therefore offers a broad variety of accommodation types to an ever-expanding global market within a variety of location types.

TRAVEL TRENDS AND THEIR RELEVANCE TO THE GROWTH OF GLAMPING.

With international leisure travel likely to be constrained, at least in the short-term, many markets have witnessed significant growth in domestic tourism, and especially with what have been termed “staycations”. As you might expect, the word “staycation” is a neologism deriving from the words “stay” and “vacation”. It refers to a holiday that someone spends in their own country or at home rather than traveling somewhere else.

Amongst the positive factors staycations offer are (1) avoidance of the need to fly, thereby reducing carbon emissions; (2) traveler peace of mind whilst travelling within their own country, with no language barriers and reduced security concerns; (3) an understanding of available health services and infrastructure and, most importantly, (4) opportunities to access a range of different experiences covering for example, sports, medical or wellness tourism, healthy living, eco-friendliness, gastronomy, reconnecting with nature as well as the opportunity to become more familiar with one’s own country and culture.

The staycation trend was recognized by the UNWTO and in September 2020 it published a paper entitled “Understanding Domestic Tourism and Seizing its Opportunities”[1] UNWTO data confirmed that:

- An estimated 9 billion domestic tourist trips (overnight visitors) were recorded around the world in 2018, of which well over 50% were in Asia and the Pacific.

- Worldwide, domestic tourism was over six times bigger than international tourism (1.4 billion international arrivals in 2018) measured in number of tourist trips.

- With travelers considering destinations closer to home in the early stages of travel normalization and with still important travel restrictions in place for international travel because of COVID-19, countries with higher shares of domestic tourism are likely to recover earlier and faster.

- According to available data, the world’s largest domestic tourism markets in terms of tourist trips were India, China, and the United States of America, mostly the result of their large populations and geographical size. Other large domestic tourism markets include Japan, Brazil, France, and Spain.

- The highest ratio of tourist trips to population can be found in the United States with 5 domestic trips per capita in 2018. Among the larger markets Australia, Spain, the Republic of Korea, and France, all recorded 3 to 4 domestic trips per capita.

- Domestic tourism expenditure is higher than inbound spending in most large destinations

- The largest domestic tourism markets in terms of expenditure among OECD countries were the United States (USD 1 trillion), Germany (USD 249 billion), Japan (USD 201 billion), the United Kingdom (USD 154 billion) and Mexico (USD 139 billion).

- Tourists from the United States spent more than four times the earnings generated by inbound travel to the United States and Japanese tourists six times more.

- In OECD countries, spending on domestic tourism is three times the amount generated from inbound tourism spending, in US dollar terms.

The publication identified ways in which destinations around the world were taking proactive steps to grow domestic tourism, from offering bonus holidays for workers to providing vouchers and other incentives to people travelling in their own countries. These initiatives focused on marketing and promotion as well as financial incentives. Examples of countries taking targeted steps to boost domestic tourist numbers included:

- Italy, where the Bonus Vacanze initiative offered families with incomes of up to EUR 40,000 contributions of up to EUR 500 to spend in domestic tourism accommodation.

- Malaysia allocated US$113 million worth of travel discount vouchers as well as personal tax relief of up to US$227 for expenditure related to domestic tourism.

- Costa Rica moved all holidays of 2020 and 2021 to Mondays for Costa Ricans to enjoy long weekends to travel domestically and to extend their stays.

- Thailand subsidized 5 million nights of hotel accommodation at 40% of normal room rates for up to five nights.

Increased domestic travel was also evident in China. An article published in February 2021 by Xinhua SHANGHAI, reported that a total of 4.1 billion domestic tourist trips would be made in China in 2021, up 42 percent from 2020, according to a recently released report by the China Tourism Academy. China was projected to gain 3.3 trillion yuan (about USD$ 511 billion dollars) in revenue from domestic tourism in 2021, an increase of 48 percent year on year, according to the report. In 2020 China saw approximately 2.88 billion domestic tourist trips, a 52.1 percent year-on-year slump, according to the Ministry of Culture and Tourism because of the Pandemic.

In the wake of the Pandemic, consumers in many parts of the world, as well as many brands, have pivoted to domestic staycations as international borders have been closed by travel bans and restrictions, thereby creating a set of circumstances which are especially conducive to the growth of the Outdoor Accommodations Industry.

Having considered the factors behind the growth of domestic travel. the rest of this Article looks at who goes glamping and examines consumers’ motivations, as well as Glamping’s wider appeal. It will consider glamping’s relevance to responsible tourism and try to identify the factors which are precipitating significant growth within the Glamping industry.

WHO GOES GLAMPING?

It is probably no surprise to readers that the best consumer-side research currently available comes from the North American market and specifically, from a publication entitled “The 2019 North American Glamping Report”[2] sponsored by Kampgrounds of America. The study disclosed that North American travelers interested in glamping wanted services and amenities associated with that of hotels or resorts.

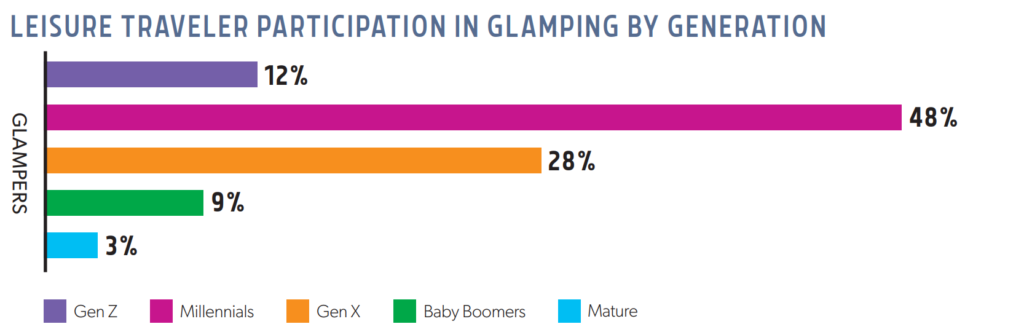

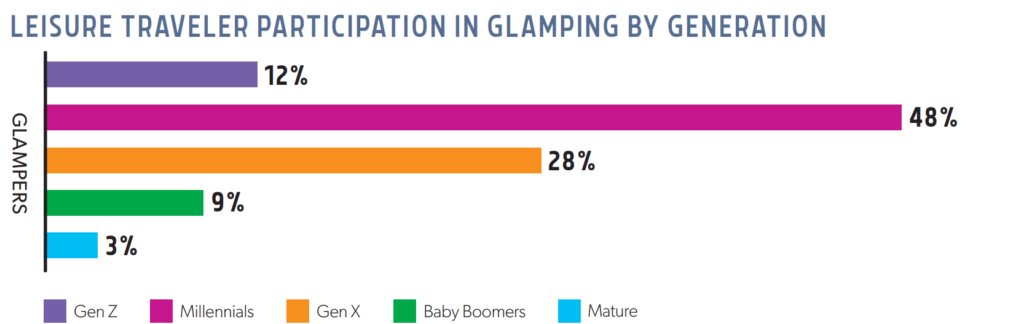

Table 1[3]

The Study disclosed that in North America, interest in Glamping was highest amongst Millennials [i.e., those born between 1981 and 1996] at 48% followed by Gen X-ers [i.e., those born between 1965 to1980] at 28% as shown in Table 1 above.

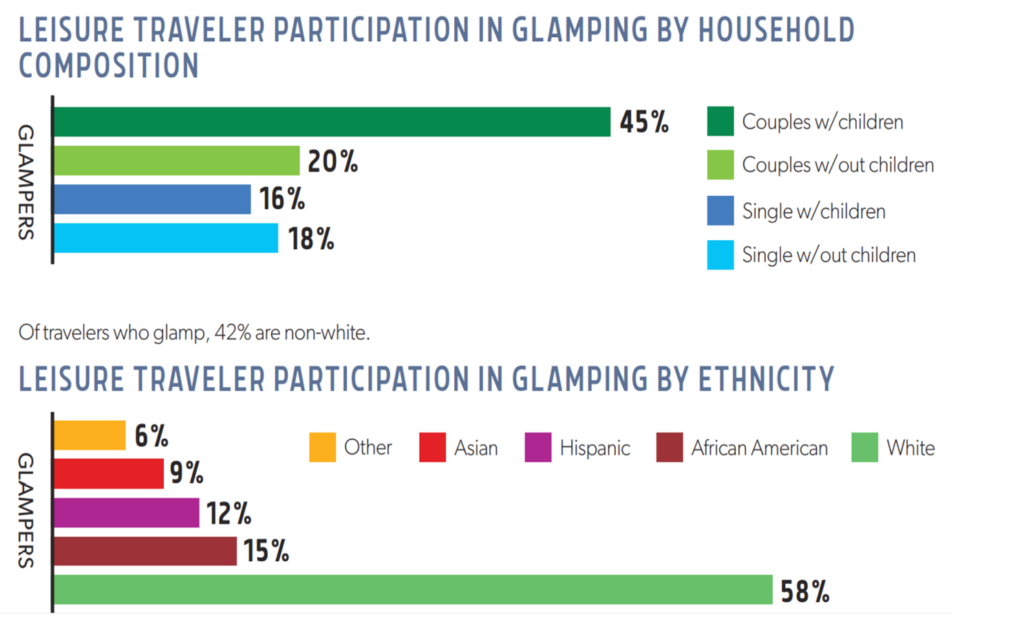

Table 2[4] illustrates North American leisure traveler participation in glamping both by household composition as well as by ethnicity, with couples with children plus couples on their own comprised 65% of the participants.

Table 2[5]

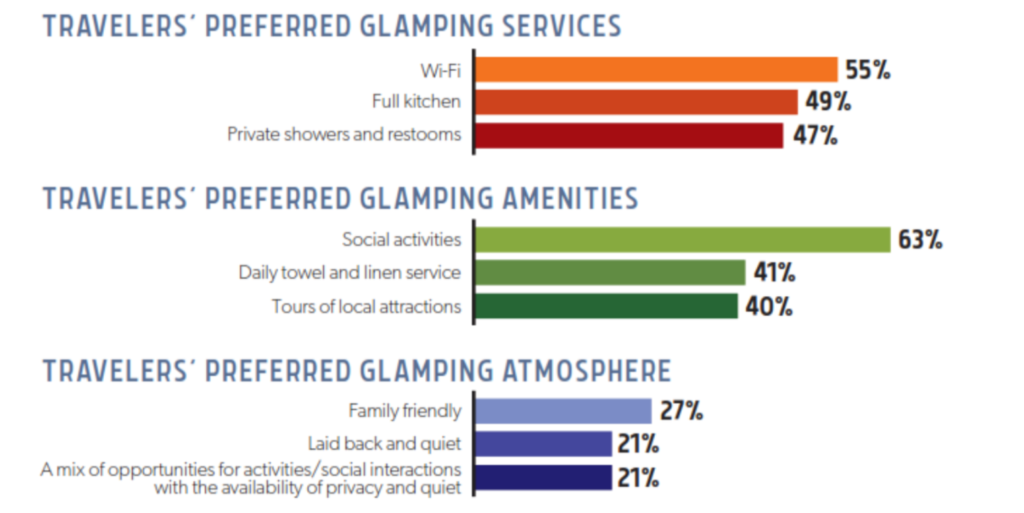

In table 3 below, Respondents prioritized their preferred services and amenities including social activities, wi-fi, a full kitchen and private toilets – and they wanted them in a family-friendly, laid-back atmosphere which offered a mix of activities as well as providing opportunities for peace and quiet.

The author’s view is that the full kitchens preference may well be specific to the North American market where according to this Study, the primary accommodation preference for glamping accommodations are cabins, treehouse, and yurts.

In many other markets, glampers seem to prefer luxury tents. Whilst many of the high-end glamping sites will have tented accommodations which include luxury bathrooms, showers, Jacuzzi’s and the like, the provision of food and beverages is often undertaken by the Operator, with many purpose-built glamping projects providing onsite cafes so that the guests’ own food preparation and cooking activities may be limited to the use of high-quality barbecue facilities offered by the Operator.

The services preferred by North American Glampers are highlighted in Table 3 below. As are the preferred amenities and the desired atmosphere.

Table 3[6]

Table 4[7]

Table 4 above sets out similar preferences by reference to generation.

In 2020 there was a very significant uptick in North America in terms of the numbers of people going camping, in large part due to the Pandemic. In a related study[8], first-time campers reported participating in a variety of camping experiences in 2020 with glamping highest at 45%.

According to this Study, first-time campers in 2020 were significantly more likely than first-time campers in 2019, or when compared to experienced campers, to have started camping in glamping accommodations. Of first-time campers, 28% said that they started their camping experiences in some type of glamping or unique accommodation (compared to only 11% of experienced campers, and 14% of first-time campers in 2019). Additionally, close to half of first-time campers said that they had a glamping type of experience for the first time in 2020 (up from 3-in-10 in 2019). Overall, it is estimated that about 4.7 million of the additional North American camping households in 2020 could be accounted for by at least some level of exposure to glamping.

The study reported that these first time Campers were young and diverse and, inter alia, that:

- Nearly 60% were under the age of 40.

- 6-in-10 were from non-white groups.

- 41% had a household income of $100,000 or more.

- Three-quarters comprised households with children.

- Two-thirds stayed at campgrounds with at least some amenities and services.

Table 5[9]

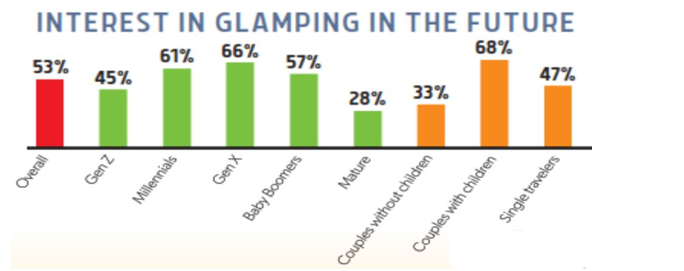

Table 5 above summarizes the levels of interest in Glamping in the future, with Gen-X and Millennials, Baby Boomers and Couples with children showing the highest levels of interest.

Non-proprietary research in other major markets is somewhat scant but some data is available which tends to reflect the findings in North America. For example, a research paper published in November 2017[10] which was based on consumer surveys conducted in Croatia involving a sample of 472 questionnaires within 19 of Croatia’s top glamping sites, completed by guests of 18 different nationalities [36% German; 15%, Austrian; 11%, Slovenian; 10.2%, Dutch plus other nationalities] confirmed that glampers were usually younger guests: 34% of participants were 36-45 years old, 26% were older than 46, and 17% belonged to the 18-35 age group.

Glamping guests were well-educated; 48% had undertaken higher education, 34% had further education and 18% had completed secondary education. They were permanently employed and had good incomes: 40% had an income between €3,000- €5,000 per month, 39% had an income below €3,000 euros, and 22% had an income above €5,000 euros per month. Glampers also tended to have had good occupations. Among the respondents, men accounted for 56% and women, 44%.

A more unique approach has been taken to try to identify potential glamping consumers within the well-established Australian market[11]. Ross Honeywill, an internationally recognized social scientist who has worked primarily in Australia and the USA, is recognized as the creator of the “NEO premium consumer typology”, a powerful economic model that maps and measures high-value consumption. He developed this innovative population classification which reveals that society is split primarily into two consumer mindsets comprising the New Economic Order or “NEOs”, and the traditional economic order or “Traditionals”.

The NEO is the socially progressive, high-spending, high discretionary-choice consumer, 91% of whom are in the Big Spender category (top third of elective spenders in the economy). Their traditional counterpart is more conservative socially and generally regarded as reluctant spenders and passive investors, irrespective of their income or net worth. Traditionals value features, functions, and the right deal, more than the quality and a premium relationship (valued by the NEO’s). NEO’s are a quarter of the Australian population and have a powerful social and business influence; decisions are made based on what others say more than anything.50% of the Australian population are considered to be “NEO” consumers. (NEO’s – (24%) 4.7 million, and aspiring NEO’s (26%) 5.3 million). Together they are responsible for approximately $512 billion in the economy, in comparison to the $364 billion attributed to the Traditionals.

NEO’s spend more, and more frequently, and more than anyone else. NEO’s spend less on traditional products and choose to spend on creating emotional experiences by buying brands and experiences that are authentic. This is where Glamping comes in; they’re taking their holidays in places which enrich their spirit; they’re seeking and buying more experiences, more frequently. Australia’s huge land area, varied climate, its traditional outdoor lifestyle, and truly unique landscapes [the Kimberley region, the Blue Mountains, the Margaret River wine region, Tropical North Queensland, and Tasmania’s pristine natural environment being prime examples] make it the perfect market for many and varied Glamping experiences.

Consumer Motivations for choosing Glamping

According to the results of another piece of consumer-side research[12] undertaken in Portugal, consumers’ motivational drivers to go glamping were related most of all with comfort, privacy and simultaneously with proximity to nature. The participants in this study clearly articulated the main characteristics of glamping tourism, emphasizing luxury and comfort which facilitate a privileged experience of nature.

The proximity to and immersion with nature was apparently the most important aspect, thus making glamping very different from other luxury accommodations, such as traditional resorts or hotels. According to the study participants’ responses, glamping is still markedly associated with wilderness or remote places and different cultural settings. It seems that glamour and luxury will work better when combined with exclusive and quite different locations where high-quality accommodation offers are scarce and natural attractions are particularly relevant.

The popularity of and need for outdoor recreation, together with the growing sensitivity to sustainable development and concern for nature, are some of the reasons international glamping sites with varied or unique accommodation types [see previous Article for an analysis of the range of glamping accommodations] have been accelerating over the last fifteen years.

As noted in the North American research, millennials have given strong support to the development of glamping holidays. When glamping, the members of that generation are excited to share their experiences via social media. The fast development of glamping in the last fifteen years can be seen not just in North America, but also in many parts Europe but especially in Great Britain. Glamping is also widely popular in Croatia, France, Greece, Portugal, Slovenia, and Spain as well as in other Mediterranean countries.

In recent years, glamping accommodation has become a world-wide attraction not only because of the inclusion of glamping holiday options within most of the major Online Travel Agencies and other specialist booking sites but also because established holiday parks have introduced glamping accommodation alongside classic camping and are offering innovative and desirable accommodation in their regular camping offering. For new glamping guests, glamping is a new and exciting way of camping, without any of the negative experiences associated with more traditional camping.

Consumer motivations to go glamping can be summarized as:

- A desire to get closer to Nature

- A need for privacy and escapism, especially for city-dwellers

- A desire for greater levels of comfort than are found with traditional camping

- The increased demands for sustainable as well as experiential or transformative travel

- Reflecting the pivot to domestic vacations because of the Pandemic

- A growing desire for personal as well as environmental wellness

- An appetite amongst affluent leisure travelers for new and unique travel experiences

- The ability to enjoy an outdoor experience with a high level of comfort and service

- Opportunities to undertake new adventures and outdoor activities

- Perceived health benefits provided by the outdoors

- Glamping’s ability to create sites with minimal environmental impact or degradation

- Wider consumer appetite for wellness and wellbeing vacations

- The ability for families to holiday together in diverse habitat styles, providing the fun of the outdoors without the hassles associated with traditional camping

- The availability of amenities such as bathrooms, hot tubs and especially wi-fi

- Pursuit of interest in special outdoor activities [e.g., hiking, rafting,

Additional factors impacting the growth of glamping

- The growth of nature-based tourism [“NBT”]

NBT is a type of tourism which offers participants the opportunity to indulge in natural, cultural, architectural and landscape heritage. Concerns with nature preservation and environmentally responsible tourism practices are other characteristics associated with NBT. Leisure travel involving the outdoors has grown over time in many parts of the world and reflects a major trait within modern society, namely the stress often associated with city living and urban lifestyles which prompts city-dwellers to seek an escape from city living to enjoy the benefits which nature has to offer. As one commentator put it, in an era of “tech burnout,” travelers are beginning to seek refuge from their screens in favor of real-world experiences. A recent Study published by Euromonitor[13] stated that City dwellers were “searching for an Outdoor Oasis to support their mental and physical wellbeing.”

According to a 2019 Booking.com report[14],70% of global travelers affirmed that they would be more likely to book an accommodation knowing it was eco-friendly. Consistent with overall intentions to make more sustainable travel choices, sustainable stays were growing in popularity, with almost three quarters (73%) of global travelers intending to stay at least once in an eco-friendly or green accommodation when looking at the year ahead.

This was the fourth consecutive year that Booking.com research had seen this figure trend upwards, from 62% in 2016 to 65% in 2017, and 68% in 2018. Additionally, 70% of global travelers said they would be more likely to book an accommodation knowing it was eco-friendly, whether they were looking for a sustainable stay or not.

Related to this sub-heading, mention should also be made, firstly of the greater awareness of the need for sustainable tourism development. This has been defined as “tourism development meeting the need of present tourists and host regions while protecting and enhancing opportunities for the future. It is envisaged as leading to management of all resources in such a way that economic, social, and aesthetic needs can be fulfilled while maintaining cultural integrity, essential ecological processes and services, and biological diversity”. Secondly, an increased awareness of the ability of future tourism-related development to recognize the importance of ecotourism, focused upon responsible travel to natural areas that conserves the environment and improves the well-being of local people, should also be acknowledged.[15]

- Experiential or transformative travel

Much has been written in recent years about the transformation of “luxury” from conspicuous consumerism which was focused on bling and the like, to immersion in unique or memorable experiences. Within the hospitality industry, and especially within the Resort segment, the ability to establish strong competitive differentiators can create barriers for competitors [think, for example, of luxury island destinations in the Maldives which are able to sustain average nightly rates above $1,000 per night because of the unique experiences which they offer].

This differentiator is enduring because few, if any competitors can replicate the experiences sought by affluent leisure travelers who repeatedly visit the Maldives premier luxury resorts. This is a perfect example taken from the Blue Ocean Strategy playbook.

Skift identified travel focused on personal fulfillment as one of its 2018 Megatrends[16]. According to Skift, the evolving wants and needs of travelers in the luxury sector were undergoing a tangible shift. While memorable, bespoke experiences were still important to these travelers, as evidenced by the focus on experiential travel over the last decade or so —they’re no longer enough. From Skift’s perspective, the personal fulfillment and self-improvement that luxury travelers might gain from an experience now takes precedence.

Travelers today are increasingly drawn to travel as a form of self-actualization and personal transformation. They want more than a simple visit to a new destination or days spent relaxing on a beach. Instead, the travel they’re seeking is an experience of the world that goes deep — one that changes them in ways they may not even be aware of. We will look at some examples taking from the Glamping sector which correlate precisely with these ideas later.

- The Global Pandemic

The Global Pandemic has impacted tourism and hospitality in ways that were unimaginable just 3 years ago. International leisure travel, as understood and undertaken back in 2018/2019, is unlikely to return any time soon and the pivot to domestic tourism was noted earlier in this article.

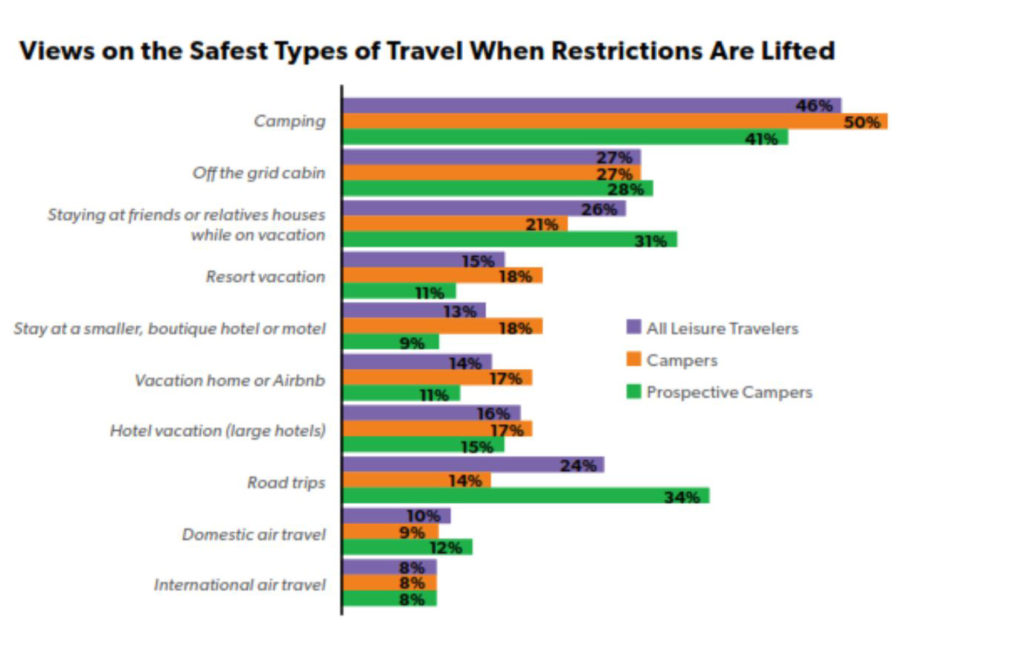

A special survey undertaken by Kampgrounds of America in 2020 to measure the impact of the Global Pandemic on Campers’ intentions found that half of campers ranked camping as the safest type of travel once travel restrictions had been removed. This increased to 72% among Baby-Boomer campers. In looking at leisure travelers overall, including those who do and those who don’t camp, this group also ranked camping as the safest type of trip (46%). The Table below sets out the survey findings regarding the safest types of travel when travel restrictions are finally lifted.

Table 6[17]

The survey also found that campers were more likely to consider different types of camping experiences and accommodations. Four in ten campers said they were interested in becoming a full-time RV-er (or living the #VanLife), trying glamping or trying a backcountry experience. Perhaps not surprisingly, prospective campers were less certain which type of experience they were interested to try though nearly 1-in-3 were interested in trying glamping!

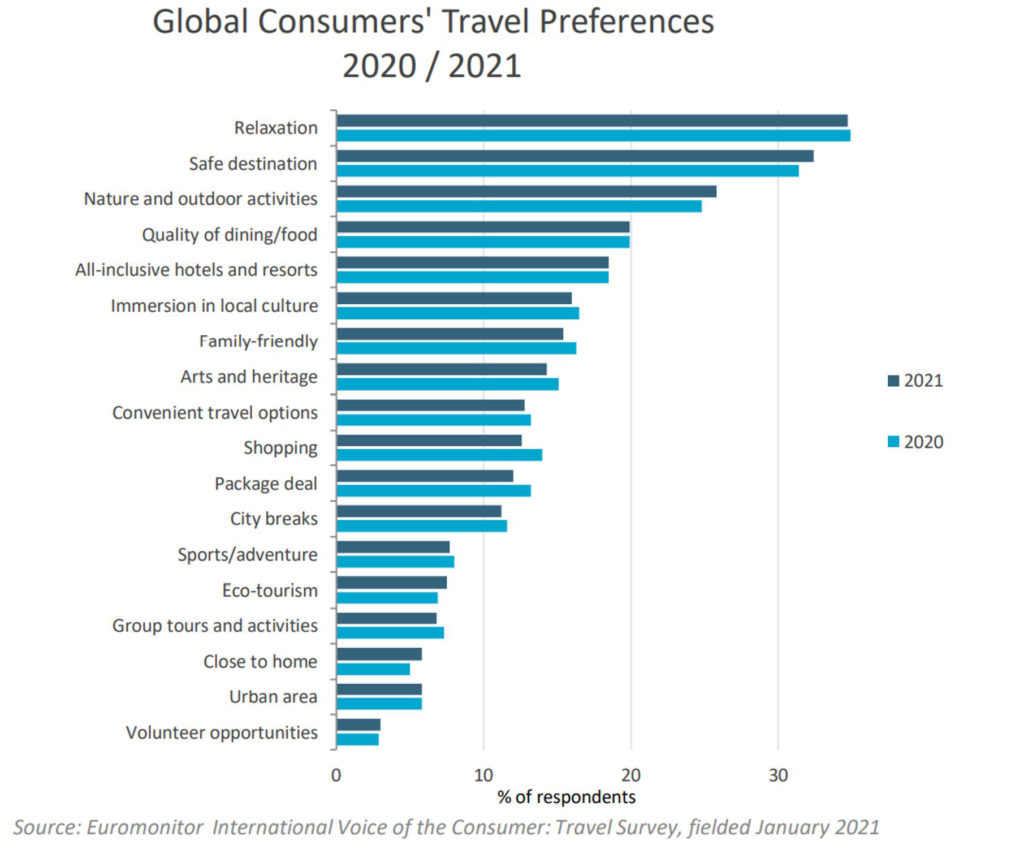

The trend noted previously towards the nature and outdoor activities for vacations have been mirrored by consumer research in other markets as illustrated in Table 7 below[18] since outdoor holidays can provide greater opportunities for privacy and social distancing in addition to the unique or potentially transformative experiences which glamping in can provide.

Table 7

- Hospitality Brand participation

The recent growth in Glamping supply has been undertaken primarily by individual non-branded Developers offering boutique-type developments in a variety of locations or as add-ons to existing camping facilities. Because of the broad range of accommodation types, there is an absence of any generally available basic domestic or international standards or guidelines for glamping accommodations. The absence of standards has already created negative publicity for the industry plus disappointment for consumers, as recently reported within the UK press[19]. Simply adding a couple of basic amenities to an existing campsite does not turn it into a Glamping experience and the problem is exacerbated when overnight rates have bumped up on the promise of “luxury” experiences which cannot be delivered.

This is not to detract from the efforts of responsible, professional Developers who are creating truly exceptional glamping experiences based upon exemplary locations

At the other end of the spectrum, luxury tented accommodations have also been available within mainstream hospitality for many years [see, for example, Oberoi[20] ; El Questro[21] in the Australian Kimberley region; Rosewood[22] in Luang Prabang and especially Shinta Mani Wild in Cambodia[23]]. There will undoubtedly be more branded glamping opportunities in the coming years. The next article will look specifically at the supply side of the industry, including branded glamping and the industry’s existing business models. Hospitality brand participation is likely to introduce glamping to new and affluent consumer segments in search of those unique or transformative experiences previously discussed.

In conclusion, wider appreciation by travelers of the environmental impacts of tourism[24], greater worldwide awareness of the need for sustainability and responsible tourism, as well as an increasing recognition of the importance of health and wellness, allied to consumer demand for meaningful, unique, and experiential travel opportunities all support the growth of the Glamping industry as an increasingly important element of the Outdoor Accommodations Industry.

This article is intended to provide insights into Glamping’s appeal to consumers, especially considering the pivot to domestic tourism evident around the globe because of international travel constraints which may be with us for some time. Article 6 will examine the supply side of the Glamping industry, identify some of the main players, consider the various Business Models currently in use and identify a range of factors which render Glamping such an attractive alternative development proposition to traditionally constructed hotels and resorts.

[1] https://www.e-unwto.org/doi/epdf/10.18111/9789284422111

[2] The North American glamping survey was conducted by Cairn Consulting Group, an independent market research firm with extensive experience in the hospitality and services industries. The survey was conducted in July 2019.

The sampling methodology targeted a randomly selected sample of U.S. and Canadian households. Sampling was designed to obtain n=4,034 completed survey among representative U.S. households and representative Canadian

households. A sample of n=3,554 U.S. households is associated with a margin of error of +/- 1.66%. Among Canadian households, a sample of n=500 is associated with a margin of error of +/- 4.37%

[3] Ibid.

[4] The North American Glamping Report 2019

[5] The North American Glamping Report 2019

[6] The North American Glamping Report 2019

[7] Ibid

[8] The North American Camping Study, 2021

[9] The North American Glamping Report 2019

[10] Glamping- Creative Accommodation in Camping Resorts: Insights and Opportunities

[11] https://rosshoneywill.com

[12] Tourists’ Motivations and Obstacles for choosing Glamping: An Exploratory Study, September 2018.

[13] Top 10 Global Consumer Trends 2021 published in January 2021

[14] www.booking.com/sustainabletravelreport2021.pdf

[15] For readers wishing to understand responsible tourism in greater depth, please refer to the CREST paper entitled “The Case for Responsible Travel: Trends and Statistics 2019”

[16] Skift: “Personal Fulfillments the New Ultimate Luxury.”

[17] The 2020 North American Camping Special Report

[18] Euromonitor “International Voice of the Consumer: Travel Survey January 2021

[19] See article in the Times on 3rd August 2021 at https://www.thetimes.co.uk/article/luxury-campsites-a-boring-mess-say-not-so-happy-glampers-z0bbz9wdc as well as a separate Daily Mail article at https://www.dailymail.co.uk/news/article-9851383/Misled-glampers-pay-2-000-three-nights-site-Chernobyl.html

[20] https://www.oberoihotels.com/hotels-in-ranthambhore-vanyavilas-resort/luxury-tents/

[21] https://www.elquestro.com.au/camping

[22] https://www.rosewoodhotels.com/en/luang-prabang/accommodation?group=hilltop-tents