The Environmental and Financial Benefits which Glamping Projects can deliver for Developers and Operators

Earlier articles examined the Outdoor Accommodations Industry in its various manifestations around the globe, with the most recent articles focusing specifically on Glamping, given that it is a growing component of mainstream hospitality. Glamping has already been embraced by Global Uber-Luxury Hospitality brands such as Aman, Four Seasons, Ritz-Carlton, and Rosewood, along with brands in other quality tiers. This article examines glamping’s attractiveness to Developers and Operators, its relevance to tourism’s recovery amid heightened awareness of the impacts of and threats posed by climate change, the increased need to focus on sustainability and ESG, as well as changing consumer preferences since the onset of the Global Pandemic.

Glamping’s Attractiveness for Developers and Operators

The previous article identified more than twenty hospitality companies in various parts of the world who offer glamping-type accommodation. For the uber-luxury and luxury boutique brands, superlative tents plus cabins and, to a lesser extent, treehouses, appear to be the most popular accommodation types.

Climate is usually the key factor in determining the accommodation type choice since tented structures have optimal consumer appeal in warmer, temperate climates or locations with extended high seasons, as well as tropical and sub-tropical locations. Glamping Pods, Cabins and Huts are obviously a better accommodation choice in temperate and colder climates given their ability to include heating capabilities for user comfort. Glamping can also work in locations with marked seasonality provided there is an ability to achieve financially viable utilization levels and nightly rates. “Pop-Ups” can also be deployed on a purely seasonal basis.

Many potential tourist locations around the world are not suitable for traditional Resort development due to a multiplicity of challenges including terrain, accessibility, seasonality, and zoning, but these locations could be very well suited to glamping projects. Well-conceived, implemented, and professionally operated glamping projects have a considerable number of attractions for Developers which can be summarized as follows:

- The low cost to develop/construct.

- Ability to mitigate Environmental impacts

- Can provide the ability to develop and operate projects “off-grid”*

- Offers opportunities to engage with local communities in a far more intimate fashion than traditional resorts, to provide authentic experiential tourism

- Facilitates a greater focus by Developers on the benefits of the Triple Bottom line approach to sustainability

- Use of low-staffing models, compared to traditional resorts and hotels.

- Can be established in more remote locations in which the construction of a traditional type of resort would not be possible

- Can deliver strong operating/profitability margins given the limited amenities and services that are sometimes provided

- The ability for glamping projects to deliver unique and even transformative experiences

- Offer an opportunity to establish strong competitive differentiation within a market

- Can consistently deliver a significant Rate Premium

- Usually have broad family appeal as well as appeal to other market segments, especially Millennials

- Are easily transportable when adopting a “Pop-Up” approach, as in the case of Festivals and Events

- Usually provide ease of assembly, especially when using a modular approach

- Utilize durable and often recyclable materials

- Can offer cost-efficient ease of refurbishment

- Are well-aligned with sustainability principles

- Can provide both personal space and privacy

- Can offer very flexible configurations and finishes

- Can be located and adapted to a variety of terrains and climates

- Create minimal environmental impact, especially when compared to traditional resorts

- Can provide speed to market compared to traditional construction methods

- Most importantly can deliver a faster payback than traditionally constructed Resorts

- Ability to scale a project over time

- Usually have limited, if any, local competition

*The term “off-grid” traditionally refers to not being connected to the electrical grid, but can also include other utilities such as water, gas, and sewer systems. Off-the-grid allows for buildings and people to be self-sufficient, which is advantageous in isolated locations which normal utilities cannot reach and is attractive to those who want to reduce environmental impact. An off-grid structure should be able to supply energy and potable water for itself, as well as manage food, waste, and wastewater.

Development models prepared by the author to evaluate the financial attractiveness of Glamping projects have consistently provided positive results using conservative assumptions with payback achieved within the third or fourth year of operation, driven by the lower construction budget, speed to market and amplified by the rate premium which an authentic “glamorous camping” experience can deliver.

Current business models used within the glamping industry were considered in a previous article. More innovative models will appear during the next few years as Developers looking to cast off the shackles imposed by the Pandemic, apply innovative funding approaches to projects in the knowledge that carefully chosen locations, capable of delivering memorable and immersive experiences, developed in line with eco-tourism principles, will have strong market appeal

According to TIES[1] [The International EcoTourism Society] one of the key principles of Ecotourism is to design, construct and operate low-impact facilities. This is where Glamping projects and the various accommodation types previously identified, can be a perfect choice for the creation of new low-impact tourism projects and experiences.

Hotel Construction and Room Costs versus Glamping Accommodations

Data published by Cushman and Wakefield[2] for 2020 relating to hotel construction costs in the USA market for Upscale Tier Hotel projects, identified the costs of Land [10%], Hard Costs [68%], Soft Costs [8%], Working Capital [1%], F.F&E [10%] and a Development Fee [2%] to produce an average room cost figure of $235,000 for that specific tier. Whilst construction costs may be significantly lower in other jurisdictions, the average cost per room is often more than double that of a high-quality tented structure. Applying a recognized brand can provide a halo effect which in turn, delivers a significant rate premium compared to a traditional resort hotel room.

If we examine the luxury hotel tier, then according to the Cushman and Wakefield 2020 Report previously referenced, the average cost of delivering a fully fitted out luxury hotel room was estimated at an average of USD $1,630,000 with the low-end figure at $813,000 and the high-end figure at $2,125,000.

Cost indicators can facilitate comparisons of the development costs for upscale resort accommodations, as against the financial attractiveness of glamping alternatives. Additional up-to-date information relating to hospitality industry construction costs across the Asia-Pacific[3] region can be found at the Currie & Brown website referenced below. Research by the Author suggests that high-quality tented structures with around 45m2 of internal space plus a large deck area, including a high-spec bathroom and shower can be delivered for less than USD $150k.

Another aspect to consider is the need to refurbish traditionally constructed resorts usually at 5-to-7-year intervals, funded primarily by an annual reserve based upon setting aside a percentage [around 3% to 5%] of annual operating revenues depending on quality tier. Glamping structures are continually evolving and are utilizing a range of materials in their manufacture which are designed to be both environmentally friendly, as well as requiring minimal maintenance. If we examine a hybrid type eco-lodge, manufacturers will typically specify the estimated lifespan of the various components with applicable warranties as well as any relevant certifications. High quality canvas and PTFV materials have an anticipated lifespan of around 30 years. Local tax rules relating to depreciation of this type of asset are also an important consideration.

It is also useful to examine a typical scope of works for a resort hotel, recognizing that this will be significantly more complex and costly than the creation of a glamping site.

| Traditional Resort Development – Illustrative Scope of Works |

| Ground investigation and topographical survey |

| Bored piling, using reinforced concrete pile caps, tie beams, substructural columns and walls, ground beams and slabs |

| Superstructure construction, involving in-situ reinforced concrete frames and slabs |

| HVAC installation electrical installation, plumbing, drainage and gas piping system, fire services installation, swimming pool filtration plant, lift and escalator installation, building management system, IT communication and security system. |

| Electrical installation mechanical & electrical EVL [extra low voltage] |

| Fire services installation |

| Lift installation |

| Plumbing and drainage |

| Building management system |

| Communication and security systems |

| Hot water storage calorifiers |

| External works and landscaping |

| Swimming pool filtration plant- where necessary |

| Furnishing, furniture and equipment (FF&E |

| Roof coverings, staircases, internal walls and doors, fittings and sundries, sanitary fittings. |

| Interior floor finishes Granite slab/carpet to guestrooms, granite slab to guest bathrooms, carpet to guest lift lobbies/guestroom corridors, granite slab/timber flooring/carpet to public areas. |

| Internal wall finishes wallpaper to guestrooms, granite tiling to guest bathrooms, wallpaper/timber paneling to guest lift lobbies/guest-room corridors, granite tiling/timber paneling to public areas. |

| Internal ceiling finishes Plaster and paint/gypsum board bulkhead to guestrooms, suspended ceiling to guest bathrooms, gypsum board suspended ceiling to guest lift lobbies/guestroom corridors, decorative ceiling/metal suspended ceiling to public areas. |

When contemplating a Glamping development within different types of locations and terrain, a Developer is usually undertaking a more compact project, with between 10 to 20 glamping units with essential supporting infrastructure. Units are usually well-spaced out to facilitate adequate guest privacy, also ensuring that guests can get closer to and interact with nature and with local communities.

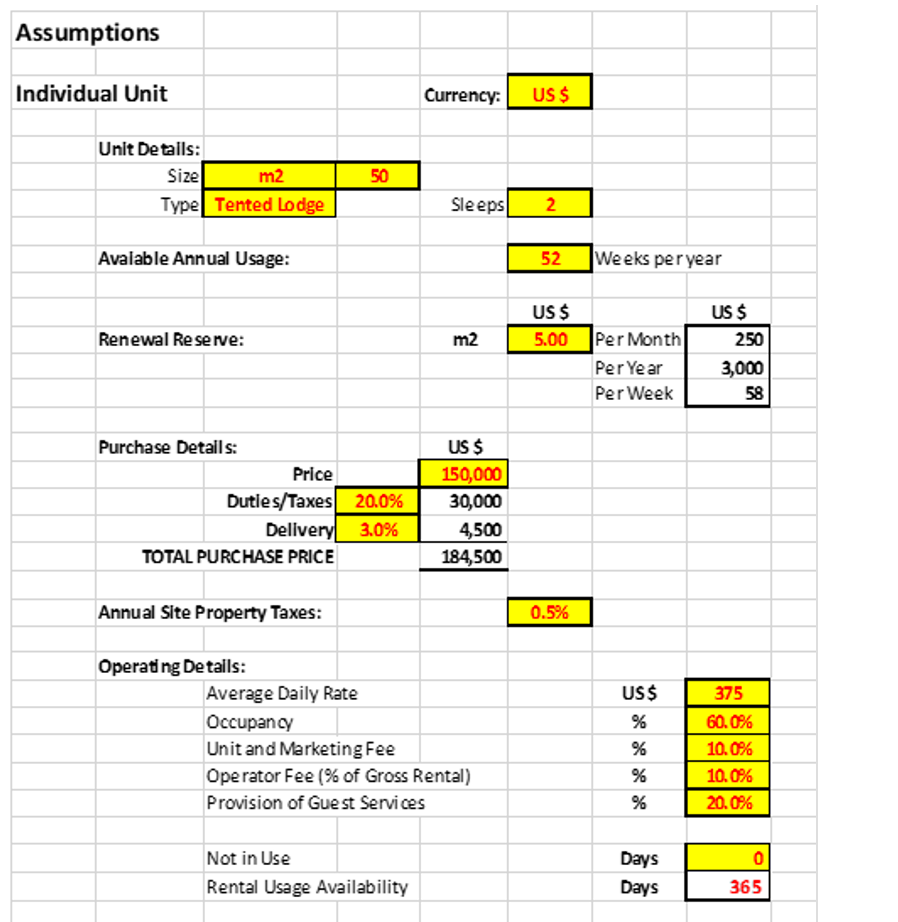

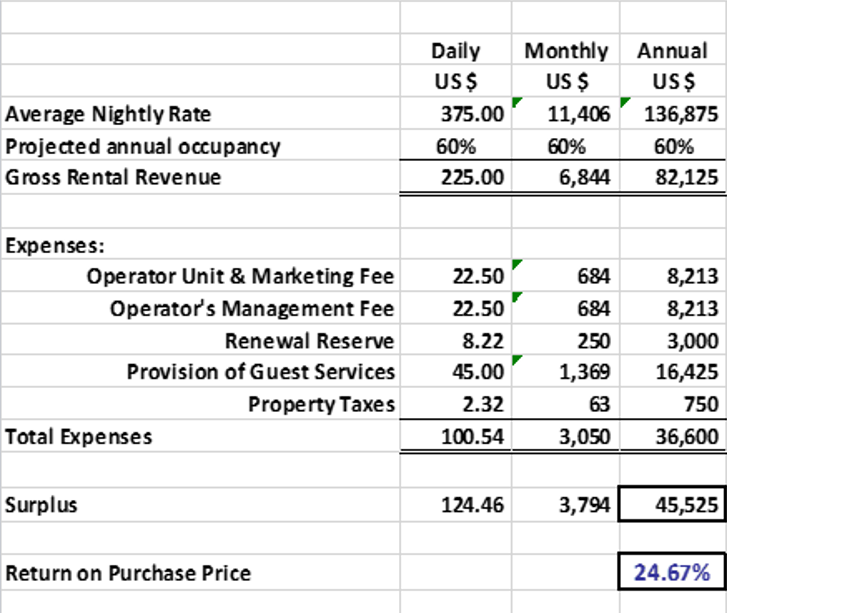

Within a Glamping project, a Developer is buying a customized luxury accommodation product for a predetermined price, in line with his development concept, rather than working on a construction cost per square meter. His development pro forma will examine the returns to determine the payback period and overall return on investment, as shown in the example below:

The assumptions include a reserve fund contribution based on a sum per square meter as well as marketing and management fees to an Operator and an estimated 20% of rental revenues to cover the provision of the necessary guest services.

Service provision is obviously very subjective and the estimate of 20% of rental revenues is purely illustrative at this point. Defining the proposed service levels will necessitate a subjective analysis of what is needed to deliver the desired guest experience within the project location and is subject to a range of factors which are beyond the scope of this analysis.

RESULTS

In this example, the Developer would achieve a payback on each cabin in around 4 years, utilizing a unit with an anticipated lifespan of at least 35/40 years.

Truly luxurious tented accommodations with air-conditioning, superlative bathrooms plus expansive decks, some with plunge pools with between 75m2 to 100m2 of internal living area can be 50% cheaper than a traditional build, as well as being much faster to deliver, generating a healthy rate premium, as already proven with some of the examples identified in previous articles.

If we look at a popular type of glamping accommodations, Pods for example, these can range in price from USD$ 27,500 to $55,000 depending on materials, size, and quality. Manufacture time will vary depending upon the level of customization that a buyer has specified. Typical manufacture time is around six to ten days assuming all materials are to hand, given current well-publicized supply-chain disruptions. More customized designs will usually generate higher average rates than standardized units.

The table below attempts to make comparisons regarding what might be described as “regular” tents, with the materials used in modern Glamping accommodations such as Pods, Cabins and Tented structures as well as comparisons with more traditional construction approaches used in resort development.

| Accommodation Type | Primary Materials | Anticipated lifespan | Cost | Installation Time | Location & Terrain Restrictions | Ability to be “off-grid” |

| Regular Tent | Canvas or Ripstop* Fabric, metal poles and guide ropes | 5 years if used continuously | $ | Less than One Day | No | ✓ |

| Tented Structures | *Ripstop fabrics, water-repellent and UV resistant fabrics; **PTFE fabrics; | At least 20/25 years | $$ | Three Days | No | ✓ |

| Modular Tented Lodges | Galvanized steel foundations, WPC floors, canvas, or high tensile roof fabric, insulated wall panels | Varies for varied materials from 30 to 50 years | $$ | Three to Five Days | None and easily adapted to distinct types of terrain | ✓ |

| Glamping Pods | Timber and composites, metal or timber foundations, cladding, insulation, PVC, glass, | Can last up to 50 years depending on materials used | $$- $$$ | One Day | No | ✓ |

| Cabins and Huts | Timber, various foundation materials, metal, and glass | 30-40 years | $$ | One to Two Days | No | ✓ |

| ***Modular Construction | Wood, steel, cement, concrete | 35 to 50 years | $$$ | 3 to 4 weeks, depending on size and height | Yes | Improbable |

| Traditional Build | Steel, concrete, bricks, blocks, timber | 50 years+ | $$$$ | 6 to 24 months depending on size | Yes | Improbable |

*Ripstop fabrics are woven fabrics, often made of nylon, using a special reinforcing technique that makes them resistant to tearing and ripping.

**PTFE fabrics, or heat-sealing fabrics, consist of a woven fiberglass and are coated with a PTFE resin. They are extremely resistant to elevated temperatures, contain outstanding electrical properties, have excellent release surfaces and superior chemical resistance.

*** Modular construction is a process in which a building is constructed off-site, under controlled plant conditions, using the same materials and designing to the same codes and standards as conventionally built facilities – but in about half the time of a traditional construction methods. Instead of brick and mortar, modular buildings use either a standard wood-frame construction made of lumber or steel and concrete. Both have their unique uses although, steel and concrete are stronger and less combustible. While all modular construction involves a process where the building is constructed off-site and under factory conditions, they still differ in terms of their purpose so that there are two basic types of modular building construction comprising relocatable buildings (RB) and permanent modular construction (PMC).

Glamping projects deliver significant environmental benefits as well as huge cost savings and accelerated payback when compared to traditional resort construction. Some aspects of resort development in remote locations including accessibility, logistics, build costs, infrastructure, procurement, water, energy, and waste management, as well as HR challenges, can either render a development non-feasible or otherwise seriously impact financial viability.

Glamping projects, in sharp contrast, facilitate development of high-quality outdoor accommodations and guest experiences in remote locations at significantly lower cost [and lower environmental impact] which can satisfy consumer desires for authenticity and provide interaction with local communities which are not found within traditional resorts.

Payback periods for a glamping project will vary, depending upon glamping accommodation type and cost, location and seasonality, average achieved nightly rate and average achieved year-round occupancy level. Some interesting insights were provided by Luca Franco, the Founder of the award-winning Luxury Frontiers in an interview with Hotels Magazine back in April 2021 in which he is quoted thus: “Franco estimates that after two to three years, a Luxury Frontiers add-on project will break even. Within five years, a resort will see a return of investment of about 40%. For a project that is a circuit of camps and lodges (meaning guests can spend three nights at one camp and three nights at another camp in the same destination), owners can expect a 20% to 25% internal rate of return.”

Compared to the typical payback period for resort type hotels, which can take between 7 to 15 years [with only casino resorts able to achieve payback significantly quicker] then Glamping projects, when properly conceived, positioned and operated, can deliver stellar financial returns.

CURRENT FOCUS ON CLIMATE CHANGE and SUSTAINABILITY

The UN Secretary-General António Guterres said that the recently published report by the Intergovernmental Panel on Climate Change [“IPCC”] was nothing less than “a code red for humanity. The alarm bells are deafening, and the evidence is irrefutable”.

The Report prepared by 234 scientists from sixty-six countries, extends to 4,000 pages and highlights that human influence has warmed the climate at a rate that is unprecedented in at least the last 2,000 years. Since 1850, human activities have driven up CO2 concentrations by forty-eight%[4].

Global surface temperature has increased faster since 1970 than in any other 50-year period over at least the last 2,000 years. Meanwhile, global mean sea level has risen faster since 1900, than over any preceding century in at least the last 3,000 years. The document shows that emissions of greenhouse gases from human activities were responsible for 1.1°C of warming between 1850-1900, and finds that averaged over the next 20 years, global temperature is expected to reach or exceed 1.5°C of heating.

A crisis can stimulate both opportunity and innovation, especially when recognizing the concerns for the loss of biodiversity and preservation of the environment since climate change was identified as an existential threat to humanity. Environmental concerns are being echoed across many different Forums. Booking.com, for example, produces an Annual Sustainable Travel Report. The 2021 report[5] states “The findings from the Booking.com annual sustainable travel report is even more poignant this year, as the travel industry looks to rebuild after the Coronavirus pandemic. Our research uncovers how the travel hiatus has opened travelers’ eyes to the impact, both positive and negative, that their trips can have on local ecosystems and communities around the world.”

The Report contains insights gathered from more than 29,000 travelers across thirty countries, suggesting that the pandemic has been the tipping point for travelers to finally commit to their own sustainable journey, with 72% of global travelers believing people must act now to save the planet for future generations.

For the Global Hospitality Industry, which has had to come to terms with the biggest single crisis it its existence, the parlous state of the industry has prompted industry stakeholders to call for the industry to “re-set.” The re-set could cover numerous aspects of hotel operations including (1) embracing digitalization, (2) greater guest centricity and personalization, (3) more efficient waste management (4) adopting touchless technology, (5) MOST IMPORTANTLY a reset which could contribute significantly to meeting the challenge of achieving “Net Zero”[6].

Adoption of net zero targets worldwide is key in climate action. The Paris Agreement sought to keep the global temperature increase to well below 2°C and to pursue efforts to keep it to 1.5°C. Meanwhile, research[7] has shown that to avoid the worst climate impacts, carbon emissions need to be halved by 2030 and to reach net zero by the middle of this century.

Some of the world’s leading Hospitality Brands[8] working through the International Tourism Partnership and the Sustainable Hospitality Alliance[9] have committed to hold the global average temperature to well below 2 degrees Celsius and as close as possible to 1.5 degrees Celsius. Achieving this goal is essential to prevent the worst impacts of climate change, including fires, flooding and water shortages which threaten the tourism industry in many parts of the world. Research commissioned by ITP highlighted that the hotel industry must reduce its carbon emissions by 66% by 2030 and 90% by 2050 to stay within the 2˚C threshold agreed at COP21. It will be fascinating to see what Global Leaders agree upon at COP 26 given that according to the UK Prime Minister the world is now at “one minute to midnight” in its response to the threats posed by climate change.

INDUSTRY INITIATIVES

Corporate Social Responsibility [“CSR”] had its origins in the USA in the 1970’s and is well-entrenched within the Hospitality Industry. It has evolved from the understanding that a company should look after not only its investors and customers but also its employees, the larger society and community, and the environment, thus giving rise to the triple bottom-line approach of enhancing profit, people, and planet, a concept developednearly 30 years ago by author John Elkington who coined the term “Triple Bottom Line” of People, Planet and Profit (also known as TBL, the 3Ps, or 3BL) which is illustrated in the diagram below.

To CSR and TBL can be added another acronym which will have far-reaching impacts on the Hospitality Industry, namely “ESG” which stands for Environmental, Social and Governance and in practical terms, is an evaluation of a firm’s collective conscientiousness for social and environmental factors. It is typically a score that is compiled from data collected surrounding specific metrics related to intangible assets within the enterprise. For an understanding of how EDG is impacting the Hospitality Industry please refer to the Cornell SC Johnson College of Business article [10] referenced below, as a detailed review of this topic is beyond the scope of this Article. Suffice to say that it is becoming increasingly important for Banks and Investors to be satisfied that a prospective Borrower has a well-defined and implemented ESG strategy.

Sustainable or eco-tourism has never been a more pressing issue. The pandemic has forced Developers, Hospitality Brands, and travelers to reflect on the impact that tourism has on the environment. Tourism holds immense influence regarding the way that natural, cultural, and environmental resources are preserved and kept for future generations. The hospitality industry, given its large footprint both in terms of employment and consumption of natural resources like food, water, and energy, has often been at the forefront of implementing practices geared to minimize the negative impacts of its business on the environment. This has become an imperative considering the current climate change situation.

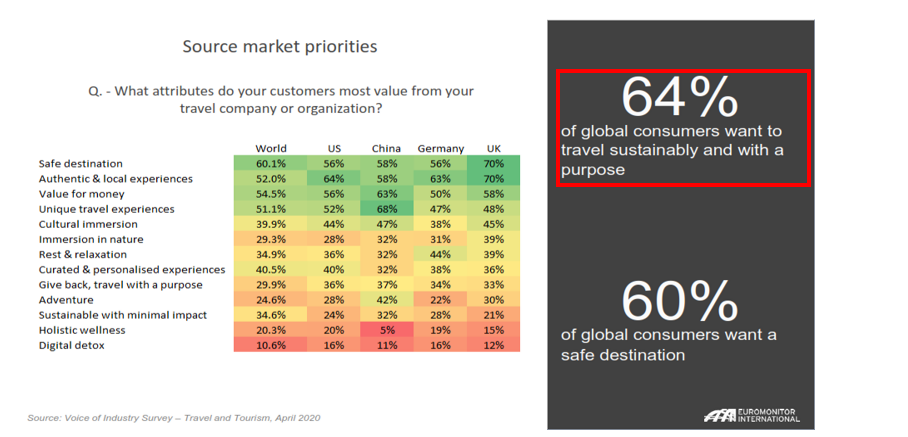

Shifting Consumer Preferences and their relevance to Glamping

Research groups have provided pointers to new consumer travel preferences. The Chart below is taken from a Euromonitor International Report[11].

Demand for Glamping was growing prior to the Pandemic due to a range of factors:

- Growth in experiential travel*, driven especially by Millennials.

- Greater personal and environmental awareness.

- The staycation trend which has grown exponentially during the Pandemic and may remain a feature of the travel industry for some time to come.

- Consumer desire to re-connect with nature in search of inner peace, as a relief from the pressures of urban life.

- The switch to domestic travel

- The rise of the Digital Nomads in consequence of the digital transformation of work

- A wider movement away from “hyper-consumerist, bucket list-driven” travel

- The rise of social media and the pervasiveness of the internet has opened up new avenues for travelers who seek “Instagram-able” moments, to have the opportunity to reach out to a huge audience and share their travel stories.

- Greater awareness of health and wellness elements which the outdoors can help deliver

- Popular culture has also been instrumental in encouraging people to explore offbeat experiences and destinations.

- The desire to become re-acquainted with nature after prolonged spells of working from home and to be able to access unspoiled natural locations whilst they still can!

*Experiential travel revolves around cultural exploration and activity-based travel experiences. Tourists and travelers do not want to simply check things off their bucket list anymore. They want to seek out experiences that enrich them and make them engage with a place and a culture in a more intimate way. Authenticity has assumed greater significance with affluent traveler in recent years. With glamping accommodations, travelers can immerse themselves in transformative, authentic experiences while simultaneously enjoying an elevated level of comfort and proximity to nature.

PwC’s June 2021 Global Consumer Insights Pulse Survey[12], reported that half of all global consumers surveyed said they had become even more eco-friendly. Globally, business leaders and analysts have been pondering which of the consumer behaviors accelerated by the pandemic would persist and deepen and which would recede.

PwC’s survey, conducted more than a year after the first outbreak of COVID-19, suggests that eco-friendly consumerism is here to stay. PwC’s survey revealed that consumers in the Asia-Pacific region were more eco-friendly than the global average, and a large majority of respondents reported becoming more eco-friendly. In Indonesia, it was 86%, and in Vietnam and the Philippines, it was 74%. There has also been substantial movement within demographic cohorts. Millennials showed the most change. Fifty-eight percent of “core” millennials (those ages 27 to 32) surveyed by PwC said they have become more eco-friendly.

We are at an inflection point regarding climate and sustainability, evidenced by ever more frequent extreme weather events and rising temperatures. The COVID virus is now recognized as “endemic” in many countries and the tourism industry is still a long way from recovery to 2019 levels. As we are being exhorted to “Build back Better,” eco-friendly consumerism is a trend which has to be recognized.

The Hospitality Industry is already responding to some of these current challenges but building new resorts is likely to continue, as confirmed by recent “pipeline” data from Lodging Econometrics indicating that for Q2 2021 the total global hotel construction pipeline stood at 13,420 projects with 2,253,499 rooms. Data relating to the percentage of the proposed new projects which are “resorts” as well as the ways in which such projects will be addressing sustainability issues is not available.

The travel industry re-set will challenge even the most inventive minds in the near term. During that re-set, Glamping should not be ignored as an avenue for the creation of low-impact, eco-friendly resorts which can be precisely aligned with changing consumer preferences, especially the desire to get closer to and appreciate nature’s bounties, before we are forced to rely on Sir David Attenborough’s documentaries to remind us of the natural wonders of Planet Earth.

Article 8 will examine in greater detail the changes in consumer awareness of the need for eco-friendly travel options in consequence of the Global Pandemic and how this may assist the transition to more sustainable travel and the choice of low environmental impact holiday accommodations. The article will also look at both experiential and transformative travel and consider how the Outdoor Accommodations Industry is well placed to respond to changing consumer preferences and demand.

[1] ecotourism.org/what-is-ecotourism

[3] curriebrown.com/en/media/client-bulletins/2021/apac-hospitality-cost-benchmarking-report-q3-2021

[4] nationalgeographic.co.uk/26facts?utm

[6] Put simply, net zero refers to the balance between the amount of greenhouse gas produced and the amount removed from the atmosphere. We reach net zero when the amount we add is no more than the amount taken away.

[7] wri.org/insights/net-zero-ghg-emissions-questions-answered

[8] unfccc.int/news/un-works-with-global-hotel-industry-to-reduce-

[9] sustainablehospitalityalliance.org

[10] business.cornell.edu/hub/2021/05/06/esg-innovations-in-hospitality/

[11] Pivot to Purpose – Building Sustainable Tourism for Success October 2020

[12] strategy-business.com/article/The-rise-of-the-eco-friendly-consumer