The Glamping Industry outside North America

Article Six. Part One examined the Glamping Industry’s Business Models and the supply side of the industry in North America where access to capital has contributed to significant recent growth in the sector. This second part looks at the supply side in other regions where access to capital has been challenging. It also identifies the Hotel Companies which have put their brands on glamping projects as the concept has established its place within the mainstream hospitality industry. Regions covered include Africa, Asia, Australia and New Zealand, China, Europe, India, Central and South America, Russia, and the Middle East.

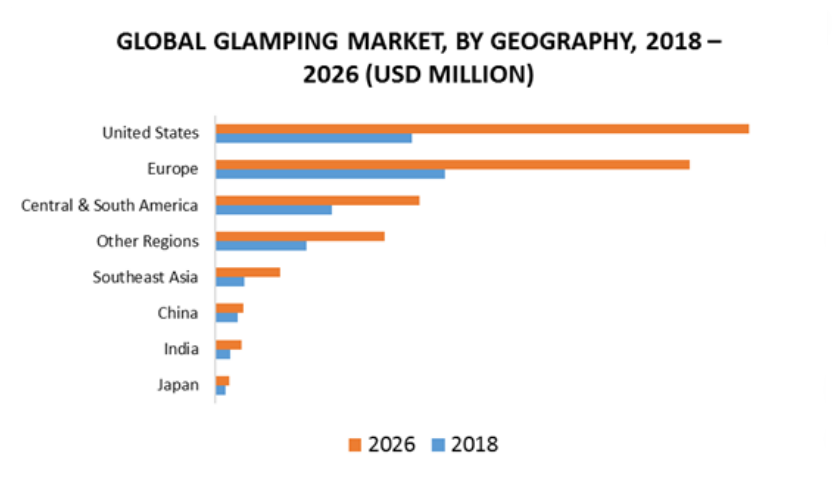

Proprietary Market Research[1] has delivered some forecasts of Global market growth for the Glamping industry, broken down by regional markets for the period 2018 to 2026 and, as can be seen from the chart below, the United States and Europe are clear leaders, followed by Central and South America.

Part One of Article Six examined the Glamping Industry’s Business Models as well as the supply side of the North American Industry. Part Two covers the industry supply side within each of the markets mentioned above, based upon the author’s own research. It is beyond the scope of this Article to try to assess precise numbers of glamping sites and accommodations, as well as accommodation types. Care needs to be taken in determing what may be considered as genuine “Glamping” properties since what became clear during the research is that there are many individual properties or small resort projects which appear to be “tired” and which, because they can validly be described as “huts” “cabins” “pods” or “tree houses”, would clearly NOT provide a luxury or glamorous camping experience. Quoted rates per night provide some pointers as to quality and thankfully, some of the OTA’s do undertake checks on their listed properties in an effort to ensure minimum quality standards. Jumping onto the “Glamping” bandwagon by listing accommodations because they fall into some of the categories mentioned above, which are obviously sub-standard and which cannot deliver quality experiences and services, is against the best interests of responsible, professional Developers as well as future industry growth. Standards within the industry will be considered in a subsequent Article. Coverage of some of the regions specified is unfortunately rather sparse, due to limited information being available within the public domain.

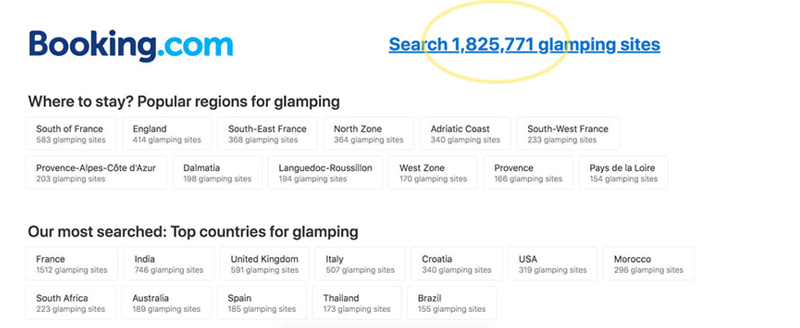

The extent to which glamping-type accommodations have expanded in recent years is indicated in the chart below.

Each of the Regions identified in the Preamble above will be examined in turn.

Africa

In the 1900’s, the African continent was the main destination for what we now know as glamping. Following Theodore Roosevelt’s steps in 1909, affluent Americans and Brits traveled to Africa and experienced camping safaris. Not willing to sacrifice the comfort of their own home, they would stay in safari tents that had all the amenities they needed. As the spiritual home of glamping with its long history of luxury tented safari accommodations, it is no surprise that glamping projects are today found across South and East Africa as well as on the Mediterranean coast.

One of Africa’s key competitive differentiators as a destination is its ability to offer raw natural beauty, vast open landscapes and the luxury of silence, all of which are particularly attractive to affluent travelers who wish to escape the pressures of everyday life. Glamping accommodations which open up remote locations in which traditional hotel or resort development would be impossible, appeal to this afluent market. Glamping.com lists 81 glamping sites in Africa with 35 located in South Africa, 19 in Tanzania, and 10 each in Kenya and Zambia. Some of the best glamping experiences available in South Africa are fully described and illustrated in the article[2] which is identified in footnote 2 below.

As might be expected, the Glamping industry is again fragmented with many single site specialist Operators [and virtually no international brands] offering unique locations which showcase the natural assets of the Continent, its flora and especially, its fauna. A search on the Glampinhub.com website on 21st September 2021 disclosed a total of 456 glamping properties within Africa with 197 of those located within South Africa, 89 in Morocco, 63 in Kenya, 30 in Tanzania, 15 in Botswana, 12 in Zambia 10 in Namibia, 10 in Egypt, 9 in Mozambique and Madagascar, 6 in Malawi, 4 in the Gambia and 1 in Senegal and 1 in the Seychelles.

Within the African Glamping Industry, one of the most recognizable brands is AfriCamps, founded by the coming together of two separate companies which were focused initially on student accommodations. The Founders, Manou Bleumink and Jeroen van Rootselaar, had witnessed the glamping concept expanding rapidly in Europe often using a “safari” style tent with double bedrooms, kitchen and bathroom which seemed more like canvas cottages suitable for the whole family.

Their idea was to import the glamping trend to South Africa, but they could not find local tents that met their requirements and importing tents was too expensive. They decided to buy a sewing machine and learn how to work with industrial sewing machines and canvas. After eight months of designing, sewing canvas, building furniture and welding couplers, they built a life-size glamping tent. On 1 November 2015, exactly two years after the purchase of the first sewing machine, they opened their first camp at one of the biggest working ostrich farms in Oudtshoorn. They now have 8 camps in beautiful locations including the Klein Karoo, the Cape Winelands, Overberg, the Garden Route, The Midlands, Zululand, Magoebaskloof and around Kruger National Park. Since 1 July 2018, there is also a camp in Hazyview, Mpumalanga.

All camps can be booked separately, or as a multi-site tour. The custom-designed boutique glamping tents are spacious and fully furnished with excellent kitchens, comfortable bedrooms, and large showers. AfriCamps is all about boutique glamping at the most beautiful working farms and estates in South Africa. AfriCamps partners with local landowners and farmers to set up unique boutique glamping experiences on their properties.

Guests are welcomed by the landowners and their teams who offer a unique, behind-the-scenes peek into SA’s various farming industries. Guests can explore and unwind in the great outdoors, experiencing everything from biking and hiking to seclusion and serenity, all while staying comfortably in the fully equipped boutique tents.

Another established brand is Singita. The Company’s website says that it is dedicated to environmentally conscious hospitality, sustainable conservation, and the empowerment of local communities since 1993. Singita provides restorative sanctuaries and encounters in the bush that guests will not find elsewhere. Sought-after locations, intuitive diligence and the utmost privacy underpin every stay. Singita’s story dates back a century ago and started on a piece of land in a remote corner of the Lowveld, which was purchased by the grandfather of the Company’s Founder, Luke Bailes.

This 30,000-acre traversing land, which would later become the Sabi Sand Reserve, was transformed over time from a former hunting concession into an exclusive conservation reserve where all species are protected. The company now has over twenty sites, including Pamushana Lodge in Zambia. The Resorts offer lodges and tented camps, including the recently re-imagined Singita Sabora Tented Camp in the Serengeti. It has won multiple international awards from the likes of Conde Nast, Travel + Leisure, Departures, LUXlife, World Travel Awards and many more.

On the distribution side, whilst luxury African glamping supply is offered on dedicated sites like Glamping.com, there are also local sites focused on glamping such as the award-winning Art of Safari[3]. Inspired by a deep love for Africa and the desire to promote sustainable safari tourism, the Founders objectives were simple: to inspire travelers to visit by highlighting the continent’s best safari experiences, and to tailor-make safari trips that help manifest each traveler’s personal safari dream.

Another award-winning company based in South Africa is &Beyond[4] which was established 30 years ago. Today, over 2,000 “&BEYONDers” set out to leave the world a better place by delivering an extraordinary guest experience. The company has shared this ethos of caring for the land, wildlife, and people, since its inception in 1991; where a humble pledge was made in Africa and now applies to Asia and South America. The Company offers customized, luxurious itineraries throughout Africa, Asia and South America highlight the diversity of landscapes, wildlife, culture, history, and wellness that these continents’ extraordinary destinations have to offer. &BEYOND has twenty-nine extraordinary lodges and camps in iconic safari, scenic, and island destinations in Africa and South America. It also designs personalized, high-end tours in 13 African, four Asian and four South American countries.

Mention should be made of Asilia Africa[5] which is one of East Africa’s long-standing safari companies. “Asilia” means ‘genuine’ or ‘authentic’ in Swahili, and the Company has built a reputation for providing exceptional safari experiences and their unwavering commitment to empowering both people and nature alike in the region. Asilia was built by passionate people with deep roots in East Africa’s original family-run safari companies: Rekero Camp in 1986 and Oliver’s Camp in 1992. In 2004, they combined their experience, family spirit and commitment to East Africa and formed Asilia. Today, Asilia is a fast-growing, leading safari operator, employing nearly 1,000 people in 19 bespoke camps and lodges in Kenya, Tanzania and Zanzibar and offering over 40 camps and Lodges on its website.

Finally, another entity which offers glamping sites is the Moivaro Group was founded in Tanzania in 1999. What started as a dream, with only one lodge and four jobs created, has grown into a large company, with hundreds of employees on the payroll and a spin-off to the wider community. The company operates six tented camps and several Lodges in Tanzania where the declared aim is to provide guests with an exceptional Africa experience with excellent value for money and to create intercultural exchange and understanding through the hospitality industry in Africa.

Glamping resorts are also found in Egypt, Madagascar, Malawi, Morocco, Mozambique, and Seychelles where the Four Seasons Seychelles Resort on Mahe Island offers treehouse villas. Nightly rates at some of these resorts are more than $2,500.

Australia and New Zealand

The Australia glamping market size was valued at USD $90.1 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 14.0% from 2021 to 2028. Australia’s population at the end of 2020 was approximately 25.7m with more than 80% living along the coastal zones where most of the large cities are located and with 85% living within 50kms of the coast. It is no surprise that many of the country’s best glamping spots are located inland in National Parks, in addition to coastal locations.

In terms of the total number of glamping properties in Australia, a search on Glaminghub.com on 21stSeptember 2021 disclosed a total of 493 luxury camping accommodations. The author’s view is that some of the properties listed do not fall into recognizable “glamping” categories as they include rental villas, barn conversions and cottages. By comparison, Glamping.com lists eighteen glamping properties in Australia and ten in New Zealand and specifies against each listing what the “Glamping Options” accommodations comprise.

Given Australia’s climate, unique and varied landscapes, and its well-established, globally recognized, love affair with the great outdoors, it is no surprise to find a myriad of individual glamping sites[6] ranging from Longitude 131 close to Uluru in the Northern Territory, where stays can cost over AUS$1,000 per night, to a variety of coastal, vineyard and wilderness sites offering all types of unique experiences[7]at various price points.

Glamping is now well-established in every State in Australia and has been on a stellar growth trajectory over the last few years, in part due to the overseas travel ban resulting from the Pandemic. Because of Australia’s isolation, it is reasonable to assert that its Glamping Industry has matured at a faster rate than many other markets, except for North America but having said that, the industry in Australia is still comprised primarily of single site projects and is therefore fragmented.

One notable exception is Baillie Lodges[8], a dynamic portfolio of luxury lodges established in 2003. They comprise standout luxury lodges in extraordinary destinations, where an opportunity existed to provide a genuine experience of place through connections to the landscape and wildlife, to regional food and wine producers and to the community and its local culture. Baillie Lodges’ management boasts an impressive record of operating lodges in remote locations, often included in World Heritage-listed areas or bordering national and marine parks. Their tented accommodations are found at their Longitude 1310 destination close to Uluru. The portfolio is also a member of Luxury Lodges of Australia, a collection of nineteen independent luxury lodges and camps offering unforgettable experiences in some of Australia’s most inspiring locations.

We have previously touched upon Pure Pods in New Zealand; their Australian equivalent would have to be Unyoked[9]. Both companies are providing what is a rustic, immersive experience usually in isolated locations, as close to nature as one can get, where are the Unyoked website is effectively encouraging site visitors to escape city living’s usual constraints. The author’s research has not been able to identify any multi-site Operators at the luxury end of the market but only individual sites. Similarly, there does not appear to be any websites in the region dedicated to showcasing glamping inventory for the benefit of both operators and consumers. Carefully planned glamping projects can minimize their environmental impacts and for this reason, they will continue to proliferate in Australia where environmental considerations are always foremost when new resorts are being planned.

Asia [within this Article comprising Cambodia, Indonesia, Japan, Laos, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam] with its varied climates, topographies, natural assets and unique cultures, is home to a significant number of glamping projects but lags behind other major markets despite the appeal of the various countries and their large populations [Indonesia: over 270m; Japan 126m; Philippines 111m; Vietnam 97.3m; Thailand 70m; Taiwan 24m; Cambodia 16.8m]. The introduction of glamping projects, especially in more remote locations which would otherwise be both inaccessible and unsuitable for traditional resort development provides a means to meet the growing demand for travelers wanting to get closer to nature and patronize projects which are “off-grid” and have strong sustainability credentials. The region is currently under-served in this respect and offers significant opportunities for glamping development.

Using Glampinghub.com as an initial reference point, the site is host to 417 glamping accommodations broken down as to 21 in Cambodia, 72 in Indonesia [of which 64 are in Bali] 9 in Laos, 21 in Malaysia, 26 in the Philippines[10], 68 in Sri Lanka, 66 in Thailand and 15 in Vietnam. It does not have any listings for Taiwan where camping per se is extremely popular with over 1,700 campsites where glamping projects are still a niche segment of the outdoor accommodations industry. Booking.com lists a total of 37 glamping sites in Taiwan. Separately, Glamping.com list 5 glamping resorts in Cambodia; 7 in Indonesia; 2 in Laos; 2 in Myanmar; 2 in Mongolia; 4 in Nepal; 6 in Sri Lanka; 8 in Thailand and 2 in Vietnam.

An independent 2016 Study by C9 Hotelworks[11] reported that Southeast Asia’s market size then stood at 29 properties with 533 tents. It noted also that this lodging segment was in its early stage of development in the region. The Study identified 14 standalone and 15 hybrid resorts in operation. In terms of market composition, most of the tented accommodations were independently owned and operated properties providing a limited number of tents. On average there were 19 tents per property at that time. Forest and beach locations made up 83% of the properties and Thailand led the market at that point with 39% of the total south-east Asia supply and the highest median average rack rate of US$340. In 2016 C9 identified a total pipeline of 4 properties with 89 tents representing a 14% increase to existing supply.

Many Asian markets have a strong tradition of camping, but the addition of Glamping accommodations is still relatively new. This is the case in Hong Kong [where the glamping concept has experienced growth during the Pandemic and related travel restrictions, as well as in South Korea where camping is hugely popular. The major global websites do not list projects for South Korea but they can be found on yanolja.com and the flavour of what South Korean glamping has to offer can be checked out on another site[12] identified in footnote 12.

Given that love of and affinity with nature is part of Japan’s culture, it is no surprise that Japan offers an enormous range of glamping experiences. As early as the mid-1900’s, luxury camping became increasingly popular, driven by those born during the 1940’s who comprised the original baby boomers and were the first to establish luxury camping in Japan. The increase in glamping activities has more recently been driven by Gen-Xers who were born in the 1970’s. Glamping’s popularity in Japan is still growing, as evidenced by the 2021 list of best glamping sites on travel.rakuten.co.jp/mytrip/ranking/glamping which has so far garnered more than 2m views this year.

One Japanese company which offers a spectacular glamping experience is Hoshino Resorts, a hotel management company founded in 1914 in Karuizawa in Nagano Prefecture. Today, 4th-generation family member Yoshiharu Hoshino runs it. The company has expanded rapidly out of Karuizawa since 2001 and now operates more than 40 accommodations both in and outside Japan with a range of unique lodgings under its distinct brands. Its first glamping resort in Japan opened in 2015 – the Hoshinoya Fuji Resort[13]. An interesting Japanese tented glamping experience can be found at circusoutdoor.com. This chic collection of quirky permanent tents is set within a rural area in Chichibu-Tama-Kai National Park, near Okatuma, a short drive from Tokyo

Research relating to Glamping has been undertaken in Indonesia by a company called TASK Cikaldana[14] which is focused on tourism destination management. At the end of 2019, Task had identified 36 glamping projects and noted that around 4 per year had been added over the previous 5 years, with varying types and quality grades.

West Java contains around 36% of the supply and Bali has around 31%. Domestic tourists favour West Java whilst Bali, Bintan and Nusa Tenggara are more popular with foreign visitors. Around 72% of the glamping projects are in mountainous areas and the remaining 28% are found in beach locations. TASK graded around 5% as being “luxury”, 22% as “Upper”, 42% as middle-up and the remainder as middle-low. Fifty-three percent of total glamping supply was tented accommodations [31% safari tents; tented cabins 17% and bell tents 14%] cabins comprising 17% and the remainder being huts, cottages, domes, tipis, and yurts.

The Natra Bintan Resort shown below, which is part of Marriott’s Tribute Portfolio is a large glamping retreat set along the Crystal Lagoon where the lush hotel grounds host safari-inspired tents with private patios boasting garden or lagoon views. Every glamping accommodation features king-sized beds, LED TVs, mini-refrigerators, sofa beds, outdoor rainforest showers, free Wi-Fi, and air conditioning. Deluxe tents have generous main rooms and large whirlpool tubs.

A recent entrant to the Glamping Industry within Indonesia is Hong Kong-based Invest Islands which has launched its own luxury tented suite option. The company won the “Best Upcoming Hotel Development” at the PropertyGuru Indonesia Property Awards for its Torok Hill Resort project on the island of Lombok which offers 130-square metre tented suites with many luxury fixtures and amenities.

Glamping is present in Thailand but is still in its early stages of growth, despite the Kingdom being host to internationally recognized, branded luxury Glamping projects [identified in the last section of this article] where according to Glamping.com. the nightly rates range from around $46 to over $3,000. The Kingdom has enormous potential for the development of Glamping projects within its borders, where its beaches, mountains, forests, National Parks, and even well-established destination resort areas might enhance their appeal to both domestic and international travelers seeking sustainable, eco-friendly vacation experiences through the addition of well-designed and located glamping projects.

The TripCanvas website[15] features 17 of Thailand’s existing glamping projects. The variety of existing glamping accommodations is broad, for example at the more modest end of the spectrum, Roost Glamping offers an eco-friendly, boutique glamping property located in the south of Phuket between Naiharn and Rawai. It features 19 bell tents, an infinity pool, and a Cafe/Bar & Restaurant. Guests are immersed among nature with tropical gardens and landscaping. Kwan Beach Resort in Surat Thani also offers tented accommodations at a much higher price point of around $225 per night. Whilst a night at the Four Seasons Tented Camp in the Golden Triangle will set you back over $2,500!

A hospitality company which has entered the glamping industry, and which has considerable experience with unique outdoor accommodations, is a chain named SERENATA[16] Hotels and Resorts which has eighteen individual brands and 974 rooms. One of their best-known properties is the Hintok River Camp @ Hellfire Pass. During the period between July and September 1943, Hintok River Camp was a British PoW camp holding 300 prisoners, 79 of whom died. Today’s camp pays homage to its predecessor in name and theme, by using tents, reminiscent of the PoW’s bell tents, motifs such as railway ties and a guard tower. Elsewhere within the portfolio, Serenata also offers floating accommodations, jungle rafts and treehouses.

A high-quality glamping resort is the 9Hornbills tented accommodations located in Phang Nga, north of Phuket. Rates here start at around $340.00 per night. Tents provide a total footprint of 108 sqm and include a private garden, private swimming pool, extra-long bed, reading area and bathroom area with classic clawfoot bathtub and vanity, as well as indoor and an outdoor open-air rain shower. Environmental considerations include low-impact insulated tented structures with special bed air-conditioners, low energy fans, FSC[17] wood, and the use of fibre-optics. Guests have access to a 24-hour buggy service between the tented villas and the secluded beach at their sister property, Koyao Island Resort

Cambodia is home to one of the world’s most spectacular Glamping resorts, conceived and executed by internationally renowned resort designer Bill Bensley who had identified an unprotected wildlife corridor connecting the Bokor National Park with Kirirom National Park in Cambodia, and set out to protect this 350-hectare river valley from poaching, mining, and logging. Shinta Mani Wild[18] is set along 1.5 kilometers of river and waterfalls, with 15 custom designed tents which are sited adjacent to swift moving waters and waterfalls, providing a view and experience unlike any other resort in Asia. Each tent has been meticulously designed to deliver unforgettable experiences. Nightly rates start from $2,345.

A company called Khiri Travel, founded in 1993, is focused entirely on sustainable travel. In Cambodia, Khiri Travel has created an authentic experience at the Banteay Chhmar temples, located about 3 hours’ drive from Ankor Wat, where a tented camp has been set up in partnership with the local community with custom designed tents offering a unique low-impact travel experience.

It will be interesting to follow the growth of Glamping projects in this region in the post-pandemic period, as travel and tourism gradually returns to some degree of normality, where Developers may want to pay more attention to the type of experiences which they propose to offer, based on their understanding of their market demographics, the increasing consumer demands for greater focus on wellness, privacy and a meaningful connection to nature.

China

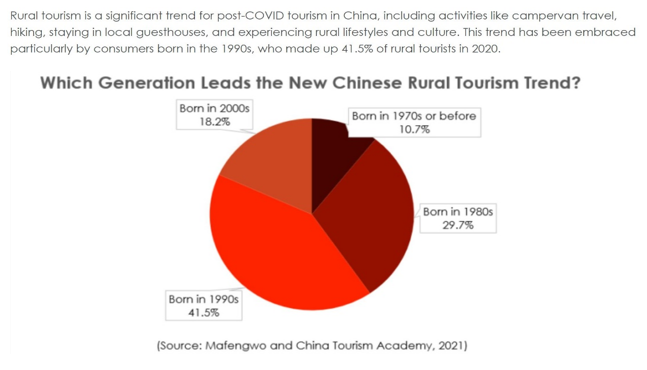

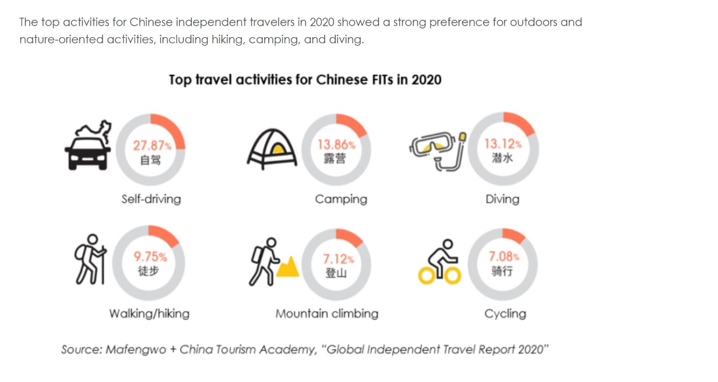

According to the “Global Independent Travel Report 2020“, the main activities of Chinese independent travelers in 2020 were outdoor and nature-based activities, including hiking and camping.

Recreational camping is not a new concept to Chinese consumers, but about a decade ago it was more of a niche recreational activity reserved for hardcore outdoor enthusiasts, aka the “donkey friends” or “luyou” (驴友) in Chinese. But nowadays, the Chinese outdoor and camping market is both large and growing as it penetrates a wider consumer base. About 3% of China’s population, or about 30 million people go camping every year.

To put that in perspective, 40 million Americans or about 10% of the American population go camping every year, indicating the potential of the Chinese market.

The Chinese government introduced new legislation in 2017 addressing the reinvention of tourism and sustainable development of land. Among the keywords present in this plan were “ecotourism,” “self-driving tours,” “RV campsites,” and “service stations.” In consequence, the number of campsites grew from 958 in 2016 to 1,778 in 2019

Whilst “hardcore” campers are prepared to rough it, “softcore” campers want a more comfortable camping experience, so much so that the Glamping concept has now entered the Chinese lexicon. This idea has been popularized by KOLs on platforms such as Xiaohongshu and Douyin, a major short video platform. Unlike traditional hardcore camping where campers take all their own equipment to the campsite, the comfort factor provided by Glamping accommodations and the fact that these accommodations are already in place and ready for use onsite is a big part of their consumer appeal. Moreover, since over 90% of Chinese campers typically spend only one night in their tents, the accommodations and their and related amenities need to be more “Instagram-worthy” than sturdy.

It should also be remembered that Huttopia, a French Company began development in China where it launched a first pilot project in 2015 under its indigo brand in Sichuan, in association with the Sichuan Tourism Group. It went on to open a new site in Huashan near the ancient capital Xi’an in Shaanxi Province. Huttopia focuses in China on the creation and management of sites and has designed a dozen nature campsites. A new Huttopia site is being set up near Hangzhou, opening in 2021. Huttopia China has its headquarters in Shanghai, its base camp and appears to be the only international brand with an established presence in China’s glamping market.

According to an article in the Beijing Review dated 24th September 2021, urban explorers have now turned their sights to camping and started spending their money on quality facilities and shared their camping pictures on social media. The idyllic views of tents in a grassland or by a river soon attracted growing public interest in camping. Facilities that allow people to get close to nature while still able to enjoy the comforts of modern luxury have given wings to this new camping style in China—hence the growth of glamping.

The growing glamping trend has also been reflected on Xiaohongshu, the previously mentioned popular lifestyle social media platform. Statistics from the platform showed that in 2020, the number of users searching for the word “camping” was double that of the previous year. By June 2021, there had been over 200,000 posts on the platform related to camping and glamping; by September, this number had jumped to 460,000.

Although there is no precise standard of what exactly constitutes glamping in China, estimates indicate that as much as 20% of camping in China might be categorized as “glamping”, although only eight glamping sites are currently listed on GlampingHub.com.

Europe

In Europe, the Glamping Industry, despite being fragmented, still offers an enormous range of luxury glamping experiences[19] see, for example, the article from Forbes identified in the footnote below. A search on Booking.com conducted on 17th September identified 526 glamping sites in Croatia, 268 glamping sites in Spain, 248 in Germany, 645 in Italy and 162 in the United Kingdom.

A search on Glampinghub.com on 24th September 2021 produced quite different figures to those on Booking.com – for example, France had 789 glamping accommodations, the UK had 724; Spain including the Canary Islands had 577; Italy had 462; Portugal had 264; Slovenia had 128; Greece had 116; Croatia had 59 whilst Germany had only 20. A total of 2,889 glamping accommodations in Europe were listed on the website. Separately, the site disclosed that Sweden had 60 glamping properties and Norway had 23.

By comparison, a search on Glamping.com listed only 111 glamping projects across 19 separate countries, as follows: Austria 1; Belgium 2; Croatia 10; Finland 1; France 8; Greece 6; Hungary 1; Iceland 1; Italy 19; Montenegro 2; Netherlands 1; Norway 1; Portugal 14, Russia 4; Slovenia 12; Spain 11; Sweden 1; Switzerland 2; and the UK 14. – but see below regarding a website called Pitchup.com in respect of UK based Glamping sites. The most expensive sites were in Switzerland and most projects charged a nightly rate of between $100 to $190 with no recognized branded product listed.

According to a recent research report[20], the European Glamping industry was expected to grow at a CAGR of around 12% during the period 2019−2025. The Report noted that:

- Movements such as “hygge,” [this is a Danish concept which refers to finding comfort, pleasure, and warmth in simple, soothing things such as a cozy atmosphere or the feeling of friendship]. Consequently, consumers are increasingly participating in activities such as camping, meditation, and tai chi, which are becoming part of the glamping proposition.

- Leading vendors are focusing on sustainability, wellness, health, and experience concepts, beyond simply offering a shelter with technically advanced features, comfort, and convenience to provide high-quality and curated experiences.

The UK was the stand-out growth market in Western Europe from 2011 to 2016, growing at an average of 7.3% annually, while the rest of the region grew by 0.4% per annum. However, the Global Pandemic and resulting foreign travel restrictions led to the decline of inbound foreign visitors and outbound travel. Demand from domestic vacationers has ensured that UK glamping resorts have performed well during Spring, Summer, and early Autumn seasons.

Pitchup.com[21] lists 978 UK-based glamping holidays on its website of which a total of forty-five sites can boast a Tourist Board 5-star rating with camping pods, bell tents and shepherd’s huts [climate-related] appearing to be the most popular. A further 124 sites enjoyed a 4-star rating.

France is characterized by a diverse landscape, cuisine, and culture with 9,000 campsites in the country reflecting its diversity, offering everything from vineyard stays to wild forests to coastal sites. Glampers tend to gravitate to the west and north coasts of France, but the south is also well populated with high quality sites where the mild winter climate helps extend the season.

Italy has a host of attractions spread across the cities of Venice, Rome, Florence, Naples, and Verona. Campsites, located in North Italy, along the Mediterranean and the Adriatic Sea, and Tuscany, are among the most frequented glamping sites. While the summer months of July and August witness the highest tourist influx, there is a growing realization that the country is an all-year destination, particularly among young crowds, thereby expanding the glamping industry’s opportunities. Glamping is, however, still in its infancy in Italy compared with countries such as Croatia, France, Spain, Slovenia, and the UK.

Spain is noteworthy from a Glamping perspective given that it has been a hugely popular tourist destination ever since the 60’s, thanks to a mild climate boasting three hundred days of sunshine a year, almost 5,000 km of coastline along the Mediterranean and Atlantic Ocean, coupled with great cultural cities and stunning countryside.

The Spanish camping sector has always been popular and has become the second holiday accommodation offer after hotels, generating a turnover of €1.5bn per year. The arrival of cabins was a revolution for Spanish campsites, many of which have since upgraded their image and offer by incorporating glamping accommodations into their projects.

The glamping options in Spain vary from Balinese and Tahitian themed bungalows in the large Marjal Camping and Resort on the Costa Blanca for example, to tree houses, ecolodges and cabins at the Monte Holiday Ecoturismo resort in the Guadarrama National Park in Madrid to luxurious Mongolian yurts in Lanzarote.

As previously noted, the European industry is driven by small independent Operators, many of which are startups which have been in operation for less than 15 years. Notable exceptions include Canopy & Stars, Eco Retreats, and Wigwam Holidays[22] among the leading vendors but with few multi-site Operators with real scale, save for Huttopia, considered in detail previously.

India

A search on Glampinghub.com on 25th September 2021 identified 131 glamping accommodations within India. They are spread across the sub-Continent but with more concentrated in the northern region, with nightly rates ranging from a low of $72 to a high of over $1,400 and with a total of four destinations at above the $1,000 per night level. Glamping.com listed nine glamping properties in India at nightly rates between $52 to $1,750.

An article in “India Today” published in November 2019 noted that the camping industry’s growth within India had been a recent manifestation with greater numbers of the urban population looking for weekend getaways in the lap of nature. New concepts such as glamping had come to the forefront. Glamping was expected to be the biggest disruption India’s camping industry had witnessed in the past decade. Thus, with the growth of this new form of camping, new businesses have now appeared which are redefining the idea of camping outdoors.

Within India, glamping is perceived as a new way of experiencing nature and is becoming popular among mid-range and affluent travelers and is growing in areas like Ladakh and the Northeast. The trend has grown since 2017 and is experiencing around 20% annual growth. Popular destinations include wildlife parks, forests, deserts, and the plateaus of Leh Ladakh and is also picking up in places where resorts are far away from unexplored locations and accommodation becomes difficult.

The increasing number of companies getting into this segment is spurring more experiential travelers into trying glamping. In the domestic market, this segment is growing at between 10-15%, according to some travel portals. Players such as The Ultimate Travelling Camp and Black Swan Journeys offer a gamut of services including nature walks and local cultural experience in addition to accommodation. Part of this growth is being driven by globe trotters who have experienced glamping elsewhere and now are trying the experience in India

One travel portal, Deyor is noteworthy in the camping sector. This is a lifestyle community for Indian millennials who love engaging with each other through unique online experiences and tailored experiential trips. Deyor has and continues to grow as the largest community of millennial travelers across India. The startup’s website allows users to discover campsites by location along with information on accommodation options and amenities. The Company partners with local vendors to set up camps and invest in them to create an acceptable alternative for leisure and corporate travelers. They are present in eleven countries offering 1,000 adventure activity experiences after its successful fund-raising activities in 2016 and 2017. According to Crunchbase, the company’s website receives around 13,700 hits per month.

The image below is of a luxury glamping tent located at CHAMBA CAMP, DISKIT – LADAKH (IN THE NUBRA VALLEY) created by The Ultimate Travelling Camp[23] which have developed four separate Luxury Camps in amazing locations in India, where nightly rates can range from $800 to $1,750.

Oberoi Hotels, founded back in 1934 was the first international Hospitality Company in India to develop tented resorts with the Oberoi Vanyavilas Wildlife Resort in Ranthambhore established in 2001 on a 25-acre site which is only 5% developed and is sometimes referred to as India’s first luxury jungle camp. Tents are air-conditioned, with teak floors, marble bathrooms, free-standing bathtubs, separate shower stalls, TV and all the luxuries of a 5-star hotel. Other high-end tented camps in India can be found at www.greavesindia.co.uk/six-stunning-luxury-tented-camps-in-india whilst the D.A.T.A. Resort [www.delladata.com] in the hills of Lonavala is India’s first military-themed glamorous camping resort offering a curated experience consisting of adventurous activities in a controlled and safe environment, combined with uber luxury and amenities.

Central and South America

Examining each of the eight Countries which collectively make up Central America on Glampinghub.com discloses a broad range of glamping accommodations across this region including 34 accommodations in Belize; 205 accommodations in Costa Rica; 10 within El Salvador, 14 accommodations in Guatemala; 37 in Honduras; 126 in Mexico; 43 in Nicaragua and 9 in Panama. Glamping.com list 4 glamping projects in Belize; 22 in Costa Rica; 2 in Guatemala; 6 in Panama and 10 spread across various Caribbean Islands.

The spread of nightly rates is considerable, ranging from $40 to $595, as is the range of accommodation types.

South America[24]

The preamble to the individual country listings on Glamping.com describes the variety of glamping experiences thus: “Stretching from steaming Amazonian jungles to the penguin playgrounds near Antarctica, South America represents incredible opportunities for eco adventures, cultural learning and otherwise exploring a unique part of the earth. Whether your desire is to chase down a blue-footed booby on the Galapagos Islands, walk where the Inca did on Machu Picchu, or explore the vast wonders of the Andes, glamping provides excellent basecamps. From unmatched luxury in a posh Patagonian lodge, to astronomy-focused lodgings in Chile, from eco-luxury in Ecuador to the beautiful beaches of Brazil, glamping puts you in touch with this intriguing continent in ways no other type of travel ever could.”

The range of experiences for Glamping enthusiasts across this Continent are vast and varied, as might be expected with the rich cultural traditions of its fourteen countries. GlampingHub’s accommodations by country are as follows; Argentina 65; Brazil, 59; Chile 86; Colombia 220; Ecuador 25, Paraguay 11, Peru 2, Uruguay 88; Venezuela 4, with none listed for Suriname or French Guiana. Glamping.com’s current listings for South America are as follows: Argentina 3; Bolivia 1; Brazil 4; Chile 15; Columbia 4; Ecuador 4; Paraguay 1; Peru 4 and Venezuela 1.

The range of glamping accommodations offered includes Airstreams in Bolivia at the[25] Salar de, Uyuni, luxury Yurts in Argentina’s Patagonia to a [26] Safari Camp in the Galapagos Islands as well as opportunities to Glamp the treks of Machu Picchu to a unique celestial experience within a Dome at Luna Glamping in Cundinamarca some 40 minutes away from Bogota, Colombia or Elqui Domos in Coquimbo, Chile which is one of seven astronomic hotels worldwide, and the only one in the Southern Hemisphere where the accommodations are Dome Rooms or Observatory Cabins.

The Middle East

Luxury camping facilities, between deserts and Arabian mountains have witnessed a huge rise in popularity since the onset of the Global Pandemic. From Oman to the United Arab Emirates, the “glamping” concept has grown rapidly. Resorts are located across the UAE [Abu Dhabi, Ajman, Dubai, Fujairah, Sharjah, Ras-al-Khaimah and Umm Al Quwai, as well as in Oman and Saudi Arabia where the Ashar Tented Resort [the Kingdom’s first glamping project] featuring forty-seven ultra-luxury glamping suites spread over 10,800m2 will be added to the existing resort. 28 will have one-bedroom, 15 will be 2-bedroom and 4 will be 3-bedroom.Booking.com currently lists 10 glamping sites within Saudi Arabia.

Other examples include Hatta in the UAE, an ecological project has recently re-opened, transforming the mountainous enclave into a refuge with multiple trailers. It is the first accommodation of its kind in the region, developed by Dubai Holding who announced that the fourth season of Hatta Resorts and Hatta Wadi Hub would reopen to the public from 1st October 2021 until April 30th, 2022, and will see the addition of the region’s first luxury caravan park. Hatta Caravan Park will include 11 luxurious, bespoke caravans, with amenities including a television, a kitchenette, and Wi-Fi access. Each caravan can accommodate up to two adults and two-three children. The prices for these caravans start from Dhs1,350 [USD $365 approx.] per night.

Apart from the Caravan Park, the site will also see the addition of the Hatta Dome Park this year which will offer glamping experiences. It comprises 15 dome-shaped permanent luxury tents that can accommodate two adults and two children. Hatta is also home to the first glamping trailers and mountain lodges in the UAE, with two distinctive accommodations, Hatta Sedr Trailers Resort and Hatta Damani Lodges Resort.

Hatta Resorts and Hatta Wadi Hub have welcomed over 1.1 million visitors from more than 120 nationalities to date since they first opened to the public in 2018. The third season witnessed an increase of 105 per cent in footfall compared to the previous season and an increase of 5 per cent in resorts’ occupancy, with a strong overall occupancy of 98 per cent.

Near the Omani border in Kalba, Kingfisher Lodge offers about 20 luxury tents and lodges facing the Indian Ocean, worthy of the finest hotels. Similarly, near Muscat, Oman, travelers looking for more authentic experiences can choose to spend the night under the stars in Sheikh tents made entirely of goat and sheep wool.

In Jordan, Wadi Rum, known as “the valley of the moon” due to its red and arid landscape, has recently hosted air-conditioned “bubbles” or Domes including a bed, mosquito net, bathroom, and electricity. In this luxury camp that gives the impression of spending the night on another planet, glamping makes sense. According to the regional press, Industry players have cited glamping as a welcome departure from mass-market tourism. Colliers’ International, MENA office ascribes the growth in demand for glamping can be attributed to the rise of ecotourism, wellness tourism, adventure tourism and agritourism (EWAA). The emergence of the ‘consumer with a conscience’ and ethical consumerism, which has seen hoteliers adopt environmentally friendly amenities, is expected to continue driving the expansion glamping.

In the UAE, the hot summers traditionally deter individuals from engaging in outdoor activities between May and September, meaning the bulk of the glamping businesses, like Hatta, only operate outside of these months.

Kersten Hospitality[27], based in Dublin, is an innovative group of industry professionals with a focus on mixed-use developments, spread across 5 international offices, including a presence in the Middle east where it has now launched several glamping projects in Ras Al Khaimah including Cloud7 Camp AlSawan glamping retreat as well as the Cloud7 Camp Jebel Jais in a real Mountainous getaway in the heart of the UAE.

A recent Conde Naste[28] article identified numerous exotic glamping projects across the Middle East although the most comprehensive list of family glamping sites within the region as at December 2020 can be found at www.familytravel-middleeast.com/best-glamping-uae. Expect to see more glamping resorts developed within many of the Middle East jurisdictions, beyond just the GCC states in the coming years as the concept gains wider acceptance.

Russia[29]

The Russian Federation may seem like a surprise inclusion. A Glamping Trade Association was established in Russia in 2018. In that year, fifteen glamping sites were identified within the Federation. This number rose to sixty-three in 2019[30]. It is understood that the concept is currently not defined within Russian law[31]. As Russian travelers become more aware of eco-tourism and the concept gains traction, then glamping accommodations may have wider appeal to Russian outbound travelers.

Countries such as Turkey which has been the premier outbound destination in recent years [pre-Pandemic] plus China, Egypt, Estonia, Finland and Thailand have all been popular destinations for Russian outbound travelers and glamping accommodation options will likely have appeal to this market as they seek new travel experiences.

Hospitality Brands and Glamping

It is widely acknowledged that Glamping is now part of mainstream hospitality. An attempt has been made to list the Brands which now participate in glamping, either with dedicated tented resorts or camps or through the addition of a glamping component within an existing resort property or even as a “pop-up” in an urban destination. The list below is by no means exhaustive. There are undoubtedly many more hotels and resorts around the world which have added some type of glamping accommodation to their existing portfolio. Additionally, many brands have been able to capitalize on the growing appetite for glamping by a broad range of travelers and especially millennials, by repositioning existing types of accommodation which conveniently fall into some of the glamping industry’s main accommodation types, including but not limited to beach huts, cabins, chalets, containers, pods, treehouses, and villas.

Hotels and Brands offering Glamping Accommodations

| Brand | Country/State | Location | Accommodation |

| Alila | California | Ventana, Big Sur | Tented camp alongside existing hotel |

| Amangiri | Utah | Canyon Point | Camp Sarika 1 and 2 bed tented Pavilions |

| Aman-i-Khas | India | Ranthambore | 10 Luxury tents of 108m2 |

| Amanwana | Indonesia | Moyo Island | Ocean and Jungle Tented Suites |

| Anantara | Abu Dhabi | Qasr al Sarab | Camp Nujum Bedouin Tents |

| Anantara | Thailand | Chang Rai | Jungle Bubbles |

| Bensley Collection | Cambodia | Cardomom National Park | 15 Private Tents of varying sizes set in a spectacular location alongside a river |

| Capella | Indonesia | Ubud, Bali | 22x 1-bed tents + a Lodge |

| Dan Hotels | Israel | Eilat | New glamping resort opening in 2022 |

| Four Seasons | Thailand | Near Chiang Rai | Tented Camp -15 originally themed tents |

| Four Seasons | Seychelles | Mahe Island | 67 Luxury Villas on stilts |

| Four Seasons | Africa | Tanzania | Serengeti Safari Lodge |

| Four Seasons | French Polynesia | Bora Bora | Huts and Cottages |

| Hamak Hotels | Mexico | Riviera Nayarit | Siari – Luxury tents |

| Hoshinoya Fuji | Japan | Yamanashi | Mountain Tents |

| Hoshinoya Karuizawa | Japan | Nagano | Traditional Japanese Ryokan |

| Hoxton | United Kingdom | Oxfordshire | Pop-up Tents |

| Langham | Australia | Melbourne | In-room Kids’ glamping package |

| Luxury Collection | Illinois | Chicago | The Gwen Luxury Rooftop glamping tent |

| Luxury Family Hotels | United Kingdom | Wooley Grange, Bath | Pop-up Luxury Glamping tents |

| Marriott | Indonesia | Bintan | Resort with all Tented Accommodations |

| Nayara Resorts | Costa Rica | Arenal National Park | Tented Camp |

| Oberoi | India | Vanyavilas | Luxury Tents |

| One&Only | Mexico | Mandarina | Tree Houses |

| One&Only | Rwanda | Volcano’s Nat’l Park | Gorilla’s Nest – Freestanding Lodges |

| Ritz Carlton | Ras al Khaimah | Al Wadi Desert | Luxury Tented Villas |

| Rosewood | Laos | Luang Prabang | Luxury tents |

| Singita | Africa | Tanzania | Sabora Tented Camp + Mara River |

| Soho House | United Kingdom | Oxfordshire | Small Cabins in farmhouse environment |

| Soneva | Thailand | Koh Kood | Soneva Kiri luxury tented Villas |

| Time and Tide | Africa | Zambia + Madagascar | 9 separate Safari camps |

| Virgin Hotels | Africa | Morocco | Kasbah Tamadot |

| W | Indian Ocean | Maldives | Fesdu Island, North Ari Atoll |

| Waldorf Astoria | China | Beijing | Glamping Terrace Suite |

Author’s Note: Inevitably, many spectacular glamping projects outside of North America will not have been identified and recorded within this Article and to the Developers and Architects who have created those amazing places, apologies are necessarily due. The author’s intention has always been to provide a high-level view of the industry’s reach rather than a precise chronicling of each and every glamping project within these regions

There are numerous reasons why glamping has caught the attention of major brands. Investment in glamping accommodations, as well as the rationale for glamping’s attractiveness for top tier hotel brands and Resort Developers will be examined in more detail in Article 7 along with some of the trends influencing current and future traveler preferences and behaviour.

[1] verifiedmarketresearch.com/product/glamping-market/

[2] travelground.com/blog/glamping-getaways-23-tented-camps-in-sa

[3] artofsafari.travel/10-best-glamping-safari-lodges

[4] andbeyond.com

[5] asiliaafrica.com

[6] australiantraveller.com/australia/the-best-glamping-spots-in-australia

[7] glamping.com/destinations/australia/

[9] unyoked.com

[10] tripzilla.ph/glamping-philippines/11249

[11] c9hotelworks.com/news/tented-accommodation-market-rises-across-asia

[12] mustoutdoor.com/lifestyle/the-best-glamping-sites-in-south-korea-you-can-fully-enjoy

[14] task.co.id/index

[15] thailand.tripcanvas.co/glamping

[16] serenatahotels.com/en/thailand/hotels/about

[17] Forest Stewardship Council®—and it signifies that the wood or paper product originated from a forest that was managed carefully with trees, animals, and local community benefit at heart

[18] wild.bensleycollection.com

[20] Arizton’s Glamping Market in Europe – Industry Outlook and Forecast 2020-2025

[22] All three companies already examined in Part One of this article

[23] tutc.com

[24] glamping.com/destinations/south-america

[25] explorationscompany.com/latin-america/experience-latin-america/bolivia/salar-de-uyuni

[26] galapagossafaricamp.com/camp/glamping-galapagos/

[28] cntravellerme.com/destinations/middle-east/21080-your-desert-glamping-guide-for-the-uae-oman

[29] laplageemrevista.editorialaar.com

[30] See also: Russian Economic Journal DOI:10.33983/0130-9757-2019-5-48-55