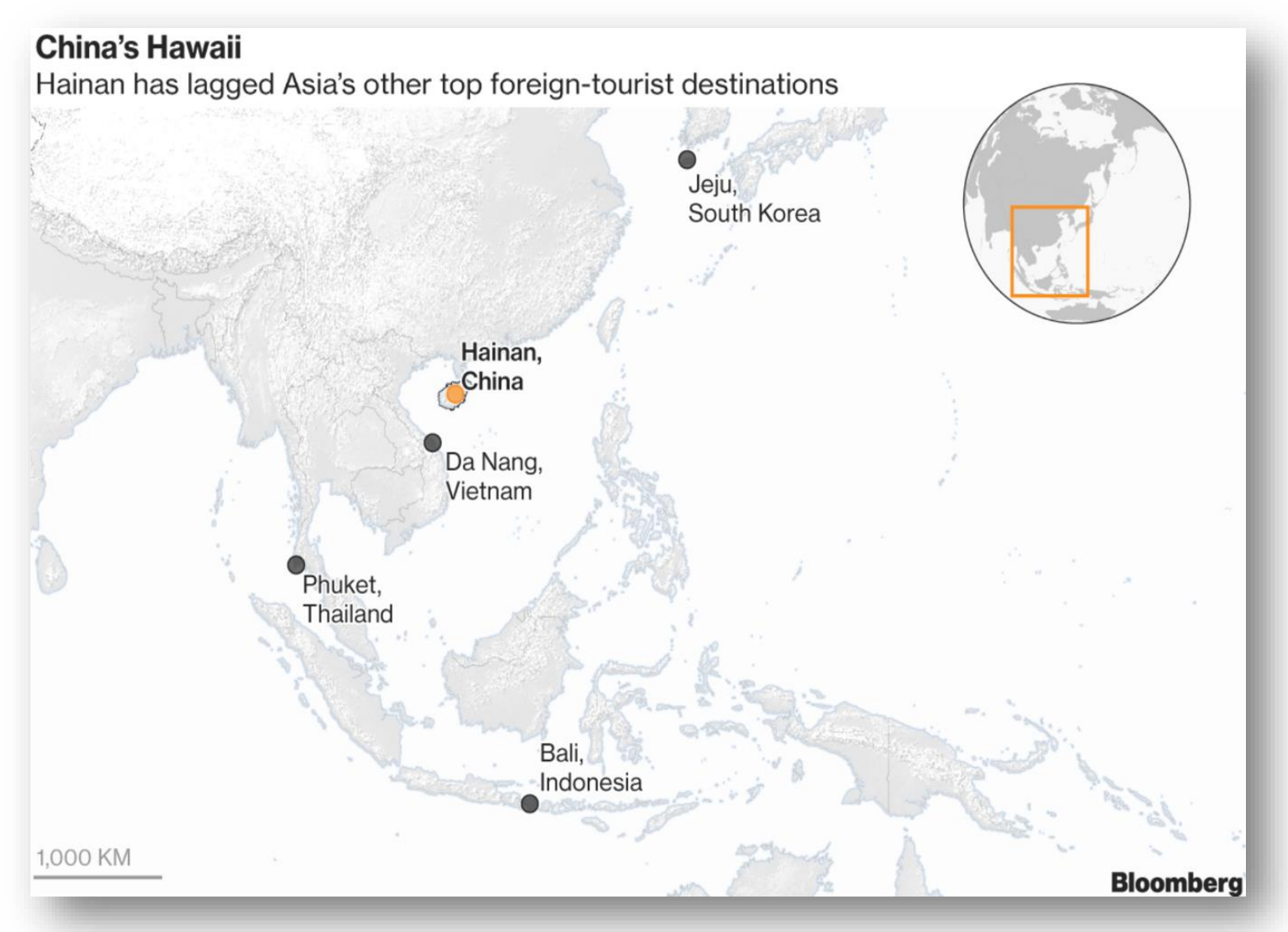

Hainan (海南) is an island province at the southernmost part of China, across the Gulf of Tonkin from Vietnam. “Hainan” literally means “South of the Ocean.” In December 2009, China’s state council announced ambitious plans for Hainan which is its only tropical island province – to elevate it into a world-class international tourism destination by 2020. As is often the case with China these days, this goal has been achieved a few years ahead of schedule.

Known primarily for its stunning coastline and beach resorts, Hainan Island offers a wealth of attractions which have drawn millions of domestic visitors to its shores each year. Hainan’s climate is tropical, characterised by hot and humid summers, with mild, pleasant winters. Temperatures usually range from 24-35°C in the summer, and 19-25°C in the winter which helps facilitate year-round leisure and business tourism.

Hainan boasts a rich cultural heritage, with three important ethnic minorities, the Li, Miao and Hui, playing a significant role in its colourful history. Hainan also has an abundance of natural resources – from its palm-lined beaches, waterfalls and hot springs, to its extinct volcano crater, tropical mangrove and rain forests and is home to more than 4,600 kinds of flora and fauna and over 570 wildlife species.

These days, many wealthy Chinese from the northern provinces own second homes in Hainan, where they move to in the winter months, to escape the bitter cold that characterises parts of northern China. It has also been popular with Russian tourists for decades and has been extensively promoted as “China’s Hawaii”. Nowhere else on the planet have provincial/local or state government authorities made such a significant commitment to tourism development as in Hainan, ensuring that the basic infrastructure was firmly in place before handing over plots of land to developers and investors for their individual hotel or other projects.

The main driver of growth has been this huge ongoing investment, which was estimated to have reached ¥76.3 billion, by 2011. This figure was anticipated to rise by 9.5% per annum to reach ¥189.1 billion by 2021. This massive investment in infrastructure, hotels and resorts, coupled with a commitment by the Hainan Provincial Government to focus on travel and tourism as a strategic priority, has continued to drive leisure and business travel demand, firmly establishing Hainan on the world tourism stage.

Average annual growth in tourism expenditure was expected to be around 12.6% over the 10-year period between 2011 to 2021 (or 16.4% in nominal terms) so that Hainan is predicted to outperform all the world’s national economies by this measure, with visitor spending forecast to hit ¥110.8 billion ($17.2bn) by 2021. According to data from Hainan government this January, the island welcomed 67.45 million visitors in 2017, up 12% compared to 2016. Revenues from tourism in the province also jumped 20.8% to CNY81.2 billion (US$12.6bn).

Hainan recorded 60.23 million tourist arrivals in 2016, including around 740,000 from overseas, to bring in ¥67.21 billion of tourist revenue, according to the provincial tourism development commission. The draft of Hainan’s 13th Five-Year Plan (2016-2020), anticipates that more than 80 million tourists, including 1.2 million from overseas, are expected to visit the island in 2020, with total tourism revenue set to surpass ¥100 billion. By December 2017, the international visitors to Hainan had already surpassed 1 million, reaching the goal of “achieving 1 million inbound visits by 2020” some three years ahead of schedule.

Given that most visitors arrive by air, Hainan’s two airports had been working above capacity for some years. The designed capacity for Haikou Meilan Airport and Sanya Phoenix Airport were 9.3 million and 6.5 million respectively, while the actual throughputs of these two airports were both over 16 million in recent years. The constrains of air routes and airport capacity have made it very difficult for Hainan to sustain a year-on-year growth rate over 20 percent, so this has been the biggest obstacle to demand growth.

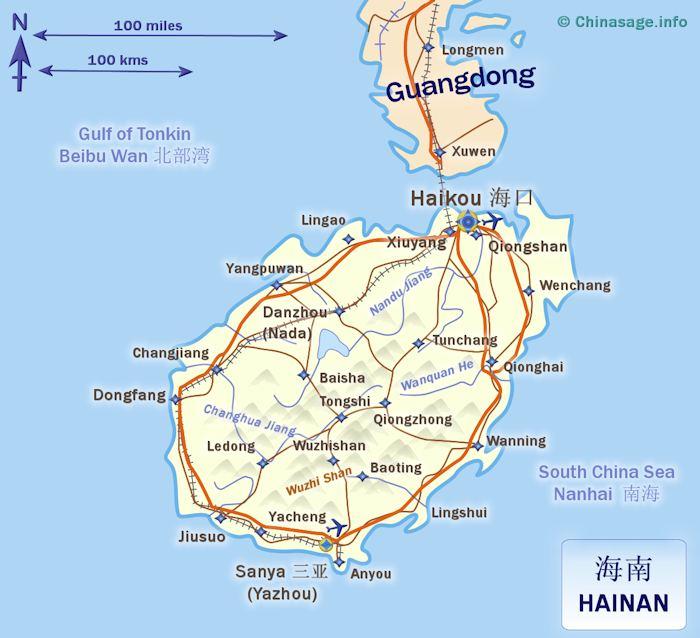

The Sanya Phoenix Airport Phase III extension has been completed and Haikou Meilan Airport Phase II will be opened in 2019. Following the extension programs, the throughput capacity of Sanya Phoenix Airport was raised to 20 to 25 million per year, while Haikou Meilan Airport will reach 35 million. Furthermore, two smaller civil airports will start construction or operation in the next few years in Danzhou and Qionghai (Bo’ao)

How large is Hainan’s Hotel Industry?

Hainan’s hotel market has experienced three main development periods. Before 2000, the hotel developments were dominated by government and state-owned companies, like any other parts of China. The developments were mainly concentrated in Haikou and Sanya and each hotel or resort was independently managed. In the following decade, Sanya was the new hotel development hot spot. A good number of resorts were developed in Sanya Bay and Dadonghai. In addition, several high-end internationally-branded resorts debuted in Yalong Bay between 2006 and 2008, which made Yalong Bay the most expensive tourism destination in China at that time. The CAAG of this first decade in the new century was 15 percent.

During the period between 2010 and 2015, resort developments became more aggressive, paired with vacation home developments, golf courses, high quality hotels or resorts, expanding to all parts of Hainan’s eastern coast. Haitang Bay, Xiangshui Bay, Qingshui Bay, Shimei Bay, Wenchang and Haikou are all popular destinations. At the same time, plenty of aged properties developed prior to 2000, decided to renovate after 10 years of operation, which helped to control the total supply growth. In 2015, the number of hotels (3-star to 5-star rated / quality hotels) on the island was close to the 680 mark and room count surpassed 120,000, representing a 44 percent CAAG rate over the past 5 years.

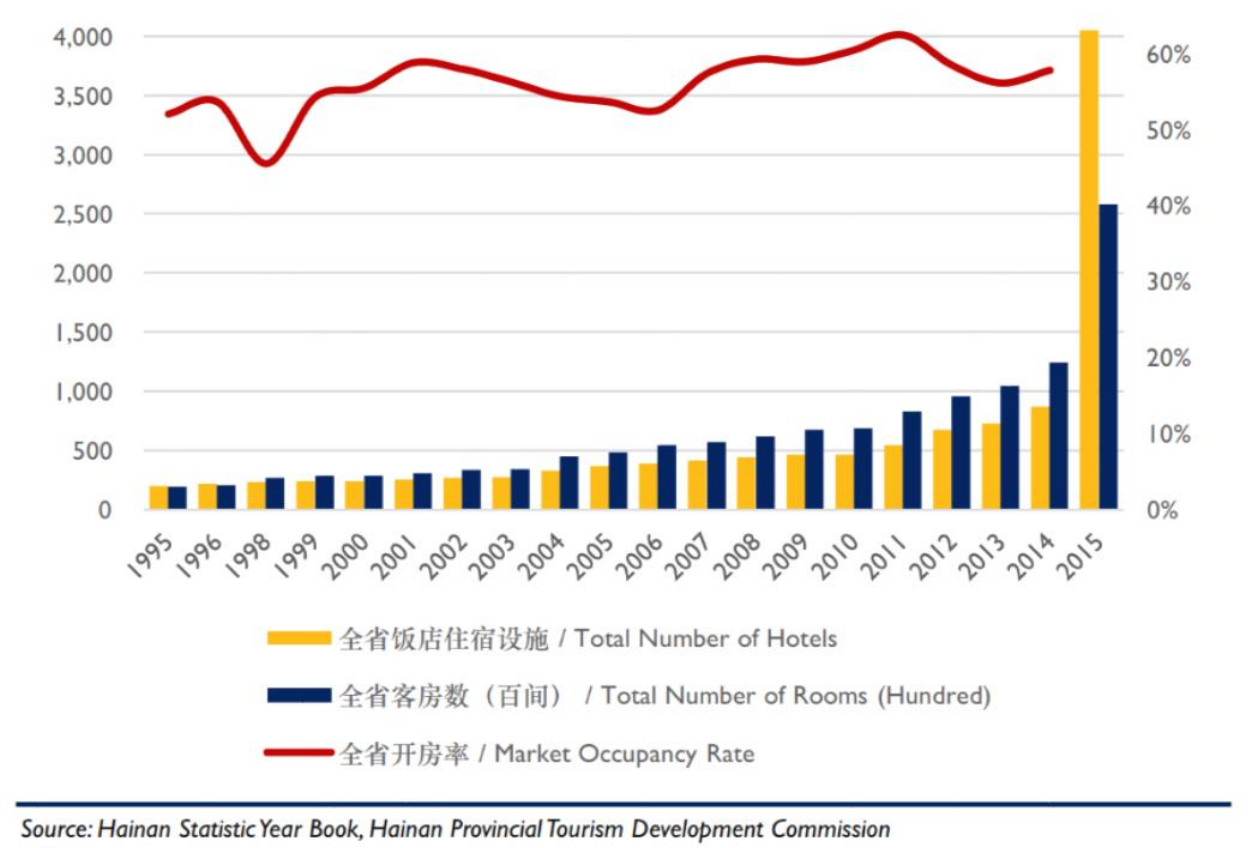

It is difficult to get a precise fix on the size of the tourist accommodation sector where the market has experienced such substantial supply growth in the past few decades. Based on the data retrieved from the Hainan Statistic Year Book, hotel development has been considerably active in the past twenty years, especially after 2010. According to the hotel survey distributed by Hainan Provincial Tourism Development Commission, there were 4,052 hotels with more than 15 rooms in Hainan in 2015, representing a total of 257,705 hotel rooms.

Historical Hotel Supply 1995 to 2015

Source: Horwath HTL Hainan Tourism and Hotel Development Overview, 2015

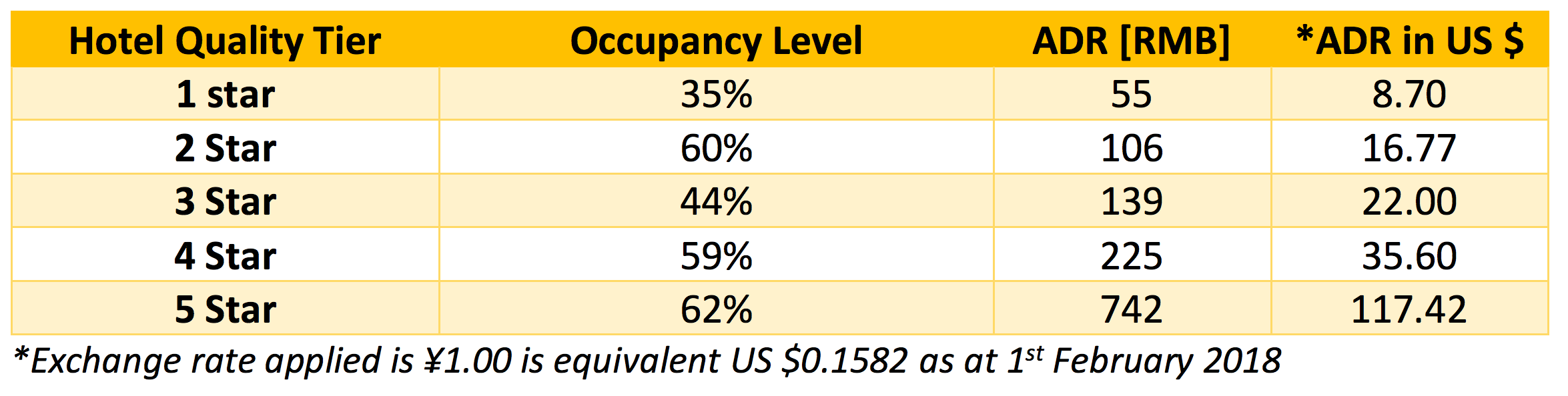

There are a very significant number of unclassified hotels, hostels or B.& B’s within this market although these establishments probably comprise mostly small properties. In terms of occupancy levels and Average Daily Rates, the figures for Hainan at the end of Q3 2017 were reported by CNTA to be as follows:

International brand presence is now extremely strong. Brands such as St. Regis and MGM hotels have joined Hilton on a stretch of white-sand beach on Yalong Bay. Elsewhere in Sanya, Hyatt, Westin, Shangri-La and other prominent chains have built properties. Hilton alone has three hotels in town.

Historically, Hainan’s tourism market has been almost totally domestic although it has been a popular destination with visitors from Russia and has hosted visitors from Hong Kong, Singapore, Taiwan, Korea. Malaysia and the USA. The visitor mix between domestic and international is now changing as new air routes provide connectivity with potential new international source markets.

Main Tourism Hubs

Among the cities and counties in Hainan Province, Sanya, Haikou, Wanning, Qionghai and Lingshui, receive the largest number of overnight visitors (both domestic and international). Sanya is worthy of special attention. Unlike many other tropical coastal destinations around the world, Sanya faces the sea yet is surrounded by mountains on three sides as well as having a river passing through it. The city features classic sea vistas within a beautiful natural landscape creating a blend of mountains, sea and rivers immersed in its long and rich history. Sanya was named one of 52 Places to Go in 2017 by The New York Times.

At the local level, Sanya municipality expects to have invested some ¥200 billion by 2020 in the infrastructure required for Haitang Bay, including a hospital and medical services, schools, public entertainment facilities, a sports stadium, conference centre and a host of other facilities and services – in total, some 102 resort infrastructure projects, or the highest number of any resort in China. Further infrastructure investments include a high-speed railway that zips around the island, completed last year, and a new airport for Sanya is on the way. Private investors have also poured money into expensive golf courses, luxurious hotels and rows of vacation homes.

In addition, it will be home to a unique new destination Resort due to open in April 2018. The Atlantis Sanya resort sits on a 62 hectare (just over 153 acre) site and is being developed by Fosun International and Kerzner International Holdings and will offer guests interactive, larger-than-life experiences including the Aquaventure Waterpark, lagoons, fresh and salt water pools, marine and educational exhibits, entertainment, spa treatments, world-class dining experiences and luxurious accommodations. The resort is located along the Haitang Bay National Coast, overlooking the South China Sea.

One of the reasons that Hainan has a shorter average length of stay for a holiday destination is that the current hotel and tourism attraction offerings in Hainan are relatively homogeneous. Beach and ocean are the biggest selling points for most resorts and attractions. Nevertheless, the situation is expected to improve with the opening of Atlantis in H1 of 2018, Wenchang Aerospace City and other recreation areas and including some other unique facilities such as the FCB Barcelona Football Academy.

The Football Academy initiative is a joint venture between FCB and Mission Hills Group which was announced in February 2017 to make Hainan province a hub of football for China and the wider region. The two giants will jointly open a major football academy in Haikou, the island’s provincial capital city and the partnership is expected to raise the profile of the sport in China and by supporting its growth at the grassroots level.

In recognition of its size and importance, the academy in Haikou, known as FCBEscola, will be the first overseas FCB football academy directly managed by FCB. It is staffed by FCB coaches and has seven football pitches and will eventually be able to enrol 1,000 boys and girls aged between six and 18 years.

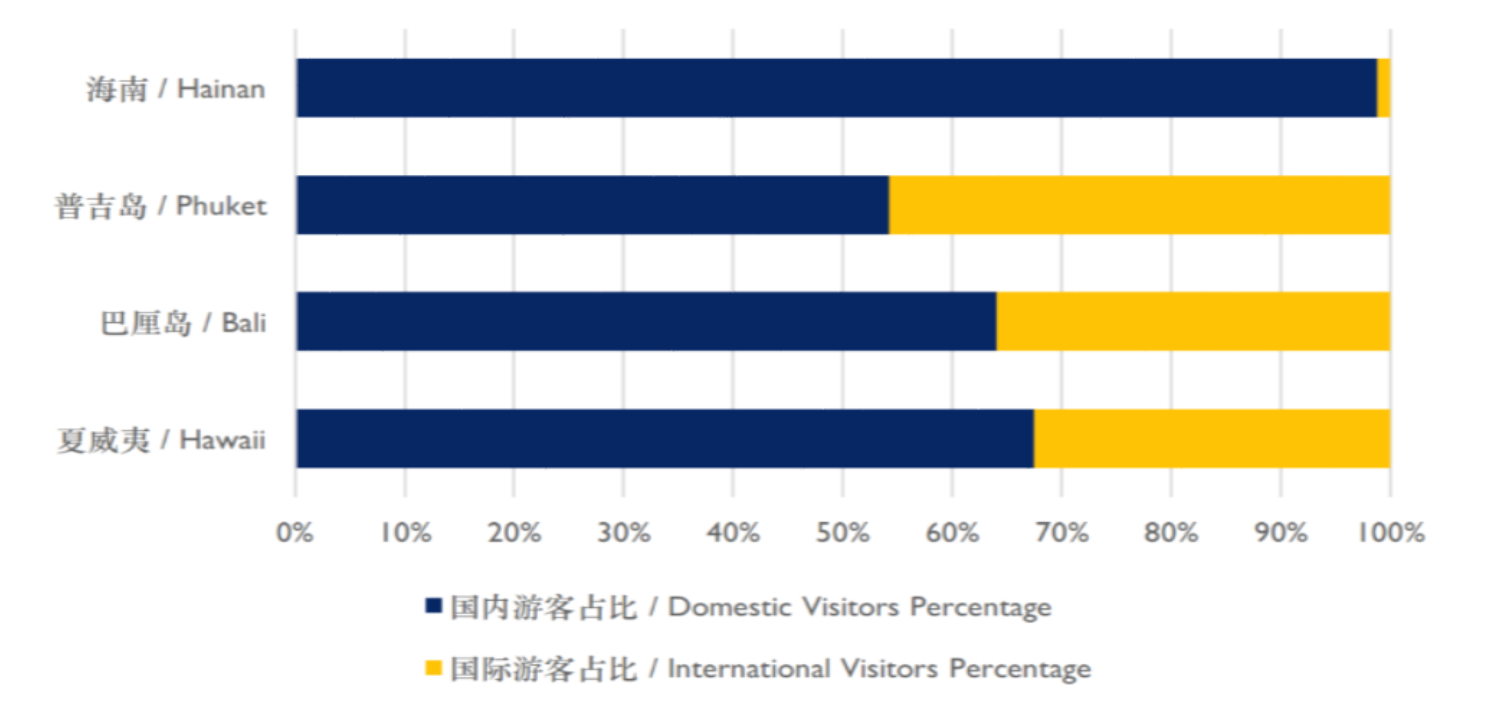

The other reason for the comparative short length of stay in Hainan is the composition of the visitor arrivals. As shown in the graph below, Hainan had the least proportion of international guests compared with three other established Asia-Pacific island destinations, namely Hawaii, Bali and Phuket.

Source: Horwath HTL Hainan Tourism and Hotel Development Overview, 2015

Between 2009 and 2015, Hainan experienced a rapid growth in total visitor arrivals with a CAAG rate of 16 percent compared with all the other leading tourism destinations. Its total visitor arrivals reached 53 million in 2015, 6.2 times of that of Hawaii. By counting total visitor days (total visitor arrivals multiplied by average length of stay), it is clear that Hainan is still behind some of its competitors. International guests typically have a longer length of stay of 7 to 14 days, especially the long-haul visitors. These longer stays help to mitigate the impacts of a location’s seasonality. The historical lack of a significant percentage of international visitors has meant that Hainan has had to rely significantly on the domestic market and has therefore been highly sensitive to the holiday patterns of Chinese guests.

Additionally, within Hainan, tourism development across the Province has been somewhat unbalanced. Tourism development between the eastern part and the western and central parts have historically been at two completely different levels in terms of tourism infrastructure and hotel distribution or overnight tourism arrivals.

Apart from Sanya, Haikou, Wanning, Qionghai, Wenchang and Lingshui, most the other areas receive less than 1 million overnight tourists per year. The limited number of tourism attractions and lack of high-quality accommodation facilities in western and central Hainan have held back local tourism growth.

Condotels and Timeshare Accommodations

In addition to traditional resort hotels, Hainan’s condo hotel market is quite well established. Units typically range in size from around 60m2 to 110m2 and offer different models of financial return and owner usage. However, within the overall Hainan market, condotels comprise only a small percentage of the total supply.

In terms of timeshare development, according to the current Resort Directories of the two leading international Exchange Companies, RCI and Interval International, there are around 30+ timeshare resorts in Hainan Province. The main Developer and Operator has historically been HNA [9 resorts] followed by Boao [6 properties] and Wyndham with 2 resorts. Many of the timeshare accommodations are based upon hotel rooms and suites rather than the western style, purpose-built, well-appointed luxury apartments which include expansive fully fitted kitchens, modern bathrooms and which can accommodate family groups of 4 to 6 people in considerable comfort, rather like a

second home.

Specimen Room Layout for a Western-style Timeshare Unit showing the two bedrooms, each with en-suite bathrooms, full-sized kitchen, lounge area, with foldaway sleeper sofa.

Between 2009 and 2015, Hainan experienced a rapid growth in total visitor arrivals with a CAAG rate of 16 percent compared with all the other leading tourism destinations. Its total visitor arrivals reached 53 million in 2015, 6.2 times of that of Hawaii. However, by counting total visitor days (total visitor arrivals multiplied by average length of stay), Hainan is way behind some of its competitors.

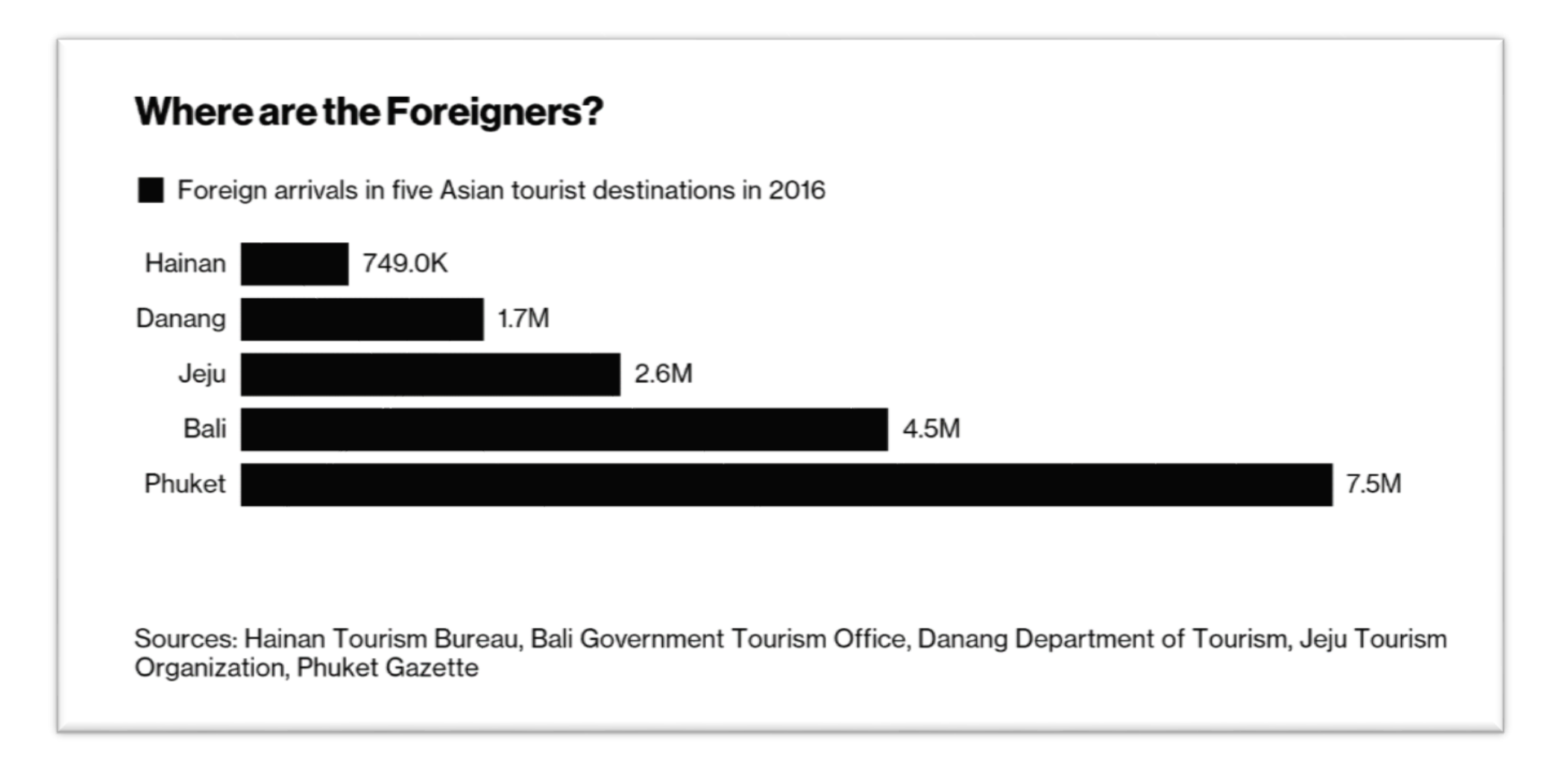

According to a Horwath HTL Hainan Tourism and Hotel Industry Study published in 2015, the average length of stay in Hawaii and in Bali was 9.03 days and 7.66 days respectively in 2015. Comparatively, average length of stay in Hainan was only around 2 to 3 days, which offers considerable room for growth in the future, as Hainan’s international source markets expand. The chart below compares foreign arrivals in five Asian tourist destinations in 2016 and clearly shows that Hainan is significantly behind established destinations such as Bali and Phuket:

According to the public information available at the time of Horwath HTL’s 2015 Hainan Hotel Market Study, many new hotels were projected enter the market between 2016 to 2019. Horwath HTL had recorded 157 proposed new hotel developments within Hainan Province, representing a total of 47,972 rooms, from the period between 2016 to 2022. but there were question marks as to whether all the projects would be realized at the due date, as many of the new hotels would be likely to delay their opening dates to avoid the over-competitive environment. As a result, the actual room supply growth is anticipated to be slower than indicated above but still very significant.

Hainan Accessibility

The primary means of transportation for both domestic and international visitors to Hainan is by air. The leading carrier for Hainan is the privately-owned Hainan Airlines which is China’s fourth largest airline. The company operates a scheduled domestic and international network of 500 routes from its Haikou headquarters, with hubs at Beijing Capital International Airport, Xi’an Xianyang International Airport, Taiyuan Wusu Airport and Urumqi Diwopu International Airport.

Hainan itself has two main Airports, namely the Haiko Melian International Airport, ranked at number 17 in China’s top 50 Airports when measured by passenger throughput, with 22,580,000 passengers in 2017 and the Sanya Phoenix International Airport [opened in 1994] which is ranked at number 20 with 19,390,000 passengers in 2017. Sanya Phoenix International Airport came under the administration and operation of HNA Group in 2002.

From 2016 to the present, there are 42 airlines operating at Phoenix Airport, 28 are domestic airlines, 16 international and regional airlines, which have opened 148 routes. The air network covers the provincial cities and major tourist cities of China, plus a total of 56 direct international air routes now link Hainan to destinations including the Republic of Korea, Thailand, Malaysia, Hong Kong, Israel, Singapore and Germany. The province plans to operate 100 international routes by 2020.

Hainan Airways Route Network 2017

Source: Hainan Airlines website

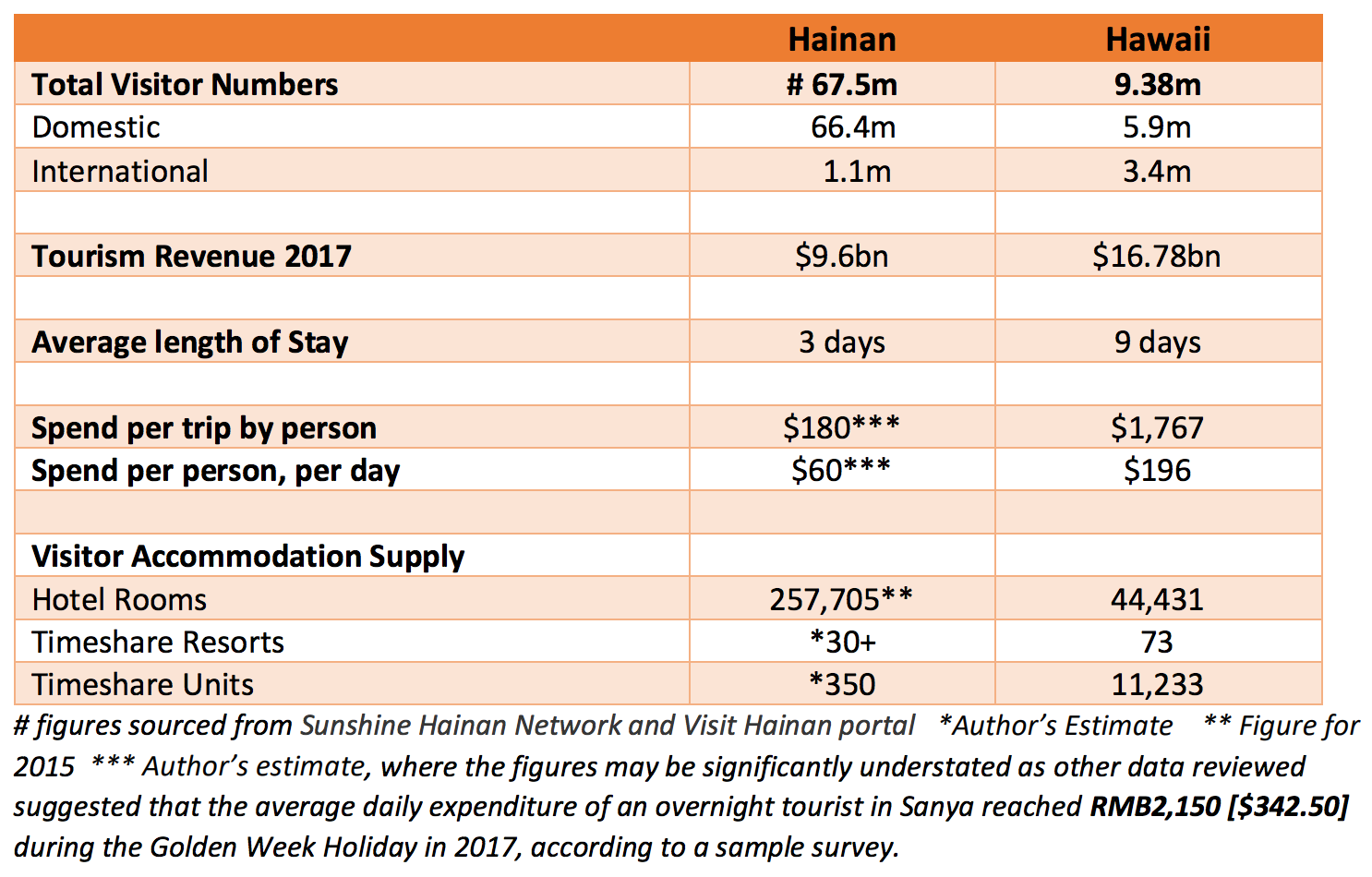

In summary there are a few similarities between Hawai’i and Hainan in terms of climate, tourism infrastructure and attractions, as well as the presence of many global Hotel Brands but there are significant differences in terms of market mix, as between domestic and international visitors, as well as average length of stay add visitor spending which is significantly higher in Hawai’i. Hawaii’s visitor accommodation mix, including more than 575,000 weeks of high quality timeshare inventory, generates strong annual repeat visitation as well as wider and substantial economic benefits. This is considered further in the next part of this article.

Hainan’s much greater annual visitor numbers in part reflect its close proximity to the China market where travel has grown at a phenomenal rate over the last decade. With more than 5 billion domestic trips in 2017 and more than 120 million outbound tourists, China is now number One in the global travel industry. Historically, Hainan’s visitors have been drawn from China’s mainland with international visitation growing slowly as the international air route network continues to expand.

Hainan’s tropical climate makes it a year-round destination. Add to this its rapidly expanding facilities and tourist attractions, plus the significant investment since 2009 in tourism infrastructure, as well as its increasing network of international flights from its two main airports, then all these factors combine to create an excellent platform for future growth.

The Hawai’ian Islands

Tourism began in Hawai’i during the first half of the twentieth century when steamships were Hawaii’s original mode of visitor access. It took around 4.5 days to sail from San Francisco to Honolulu. By 1936, visitors could fly to Honolulu from San Francisco on the Hawaii Clipper, a seven-passenger Pan American flying boat, for $360 one-way. The flight took 21 hours, 33 minutes. Modern tourism was born, with five flying boats providing daily service. The 1941 visitor count was a recorded at 31,846. By 1955, visitor numbers had reached 109,000.

In 1959, Hawai’i became the 50th state of the United States. That year also saw the arrival of the first jet airliners, which brought 250,000 tourists to the state. Waikiki’s room count nearly doubled in 2 years, from 16,000 units in 1969 to 31,000 in 1971, and kept increasing until the authorities finally clamped down on growth. By 1980, annual arrivals had reached 4 million.

In the early 1980s, the Japanese began traveling overseas in record numbers. Their effect on sales in Hawai’i was phenomenal: European boutiques opened branches in Honolulu; duty free shopping became the main supporter of Honolulu International Airport. Japanese investors competed for the chance to own or build part of Hawai’i.

In 1986, the Hawai’i visitor count passed 5 million. Two years later, it went over 6 million. The visitor count was at a record 6.7 million in 1990 when the Gulf War and worldwide recessions burst the bubble in early 1991. The following year, Hurricane Iniki devastated Kauai. Airfare wars sent Americans to Mexico and the Caribbean. Overbuilt with luxury hotels, Hawai’i slashed its room rates, giving middle-class consumers access to high-end accommodations at affordable prices—a trend that continues as Hawaii competes to hold its position as a prized and still exotic holiday destination. Hawai’i’s tourism industry welcomed more than 8.2 million visitors in 2013, who spent around $14.5 billion.

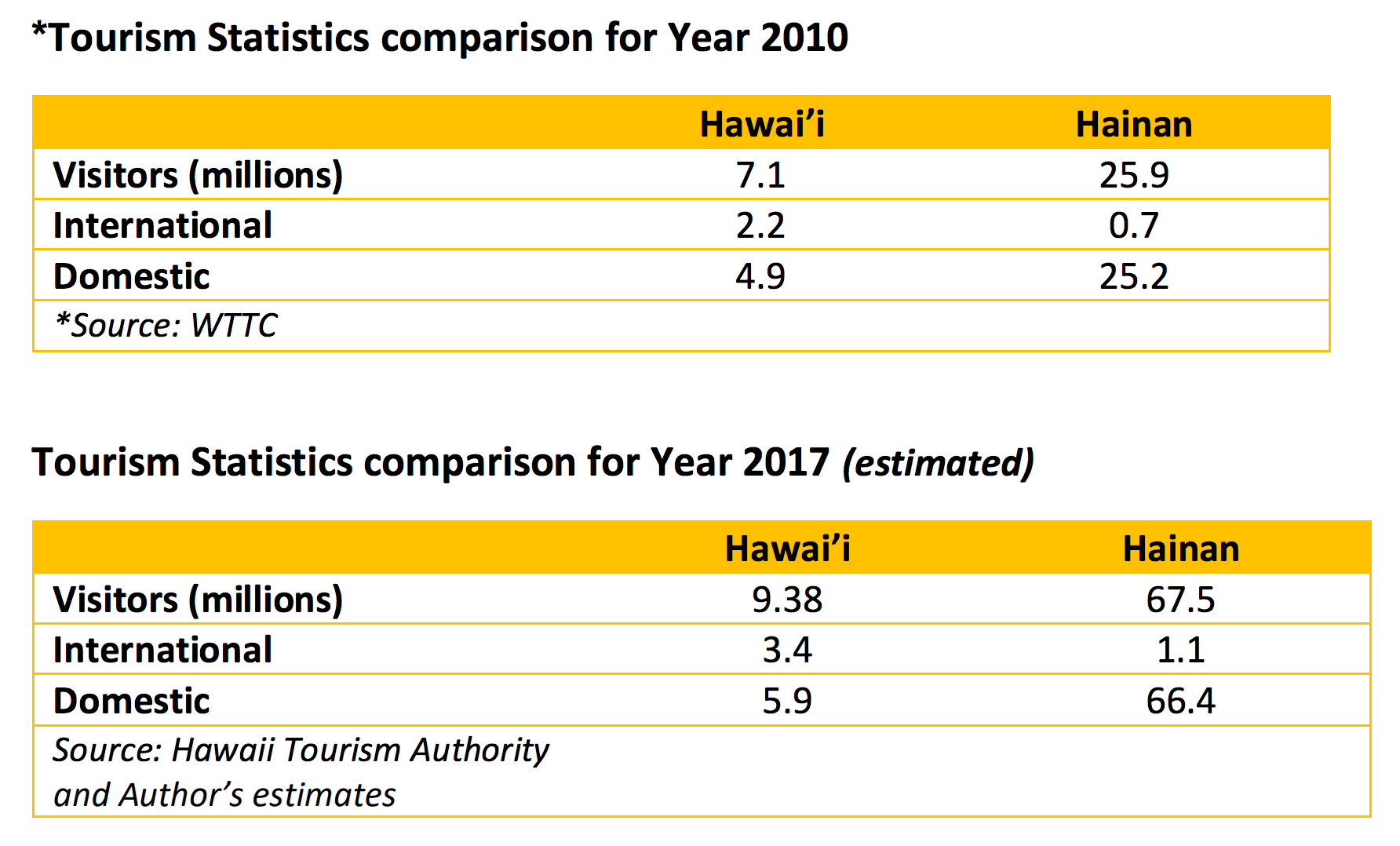

Hawai’i’s tourism infrastructure has been established over a much longer period than in Hainan. It is interesting to look at how Hawaii’s tourism has grown. Before doing so, the table below sets out a comparison of Hawai’i and Hainan’s respective arrivals data for 2010. Hainan’s reliance on its domestic Chinese market in 2010 is virtually absolute.

As can be seen, the growth in Hainan’s visitor numbers over the period 2010 to year ending 2017 is huge – more than double, whilst Hawai’i’s increase over the same period is also an impressive 31%. The key difference is in the visitor mix where Hawai’i draws 63.4% of its visitors from the mainland USA, especially from the west coast and mountain region states [3.84m] whilst some 36.6% are international arrivals.

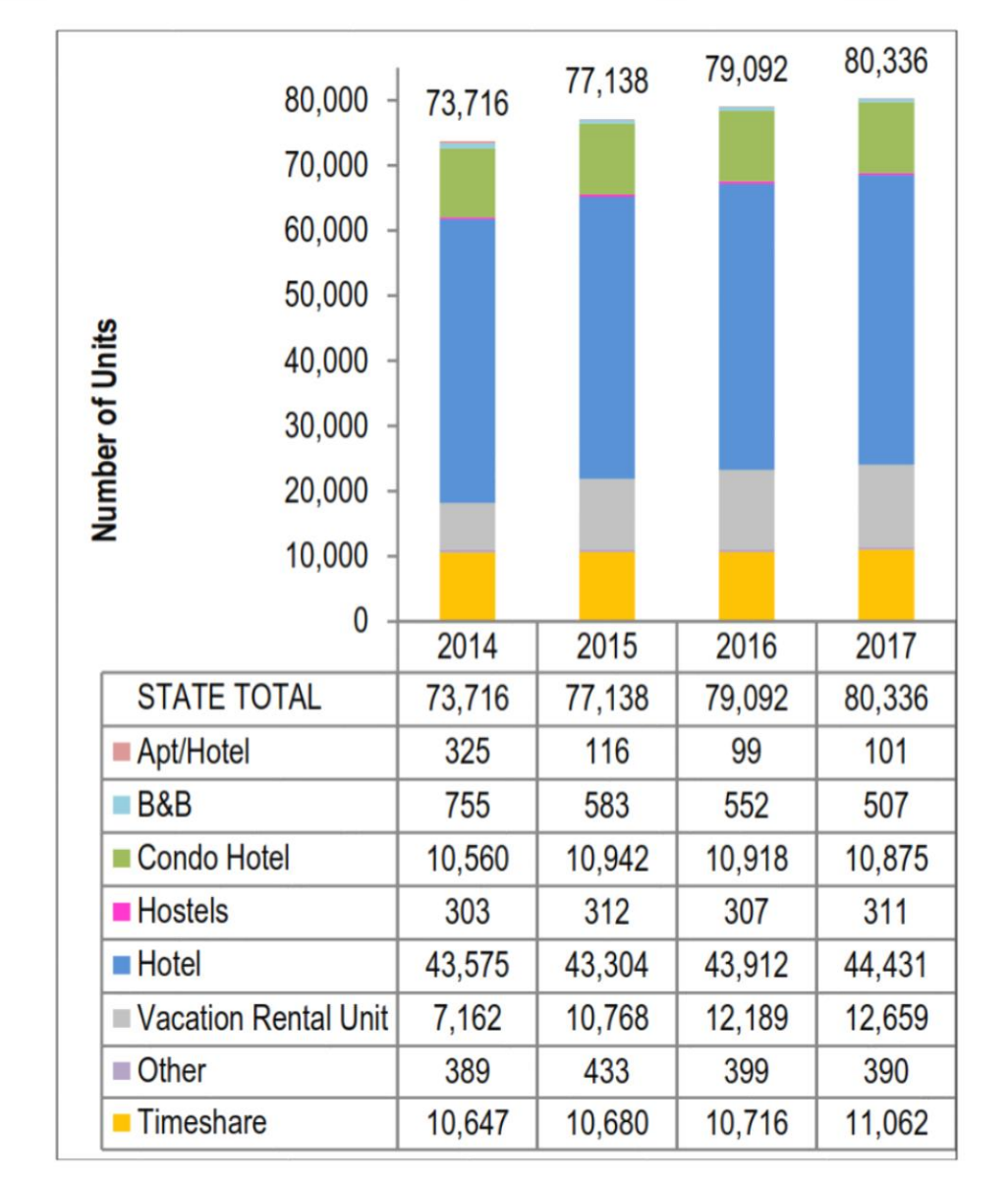

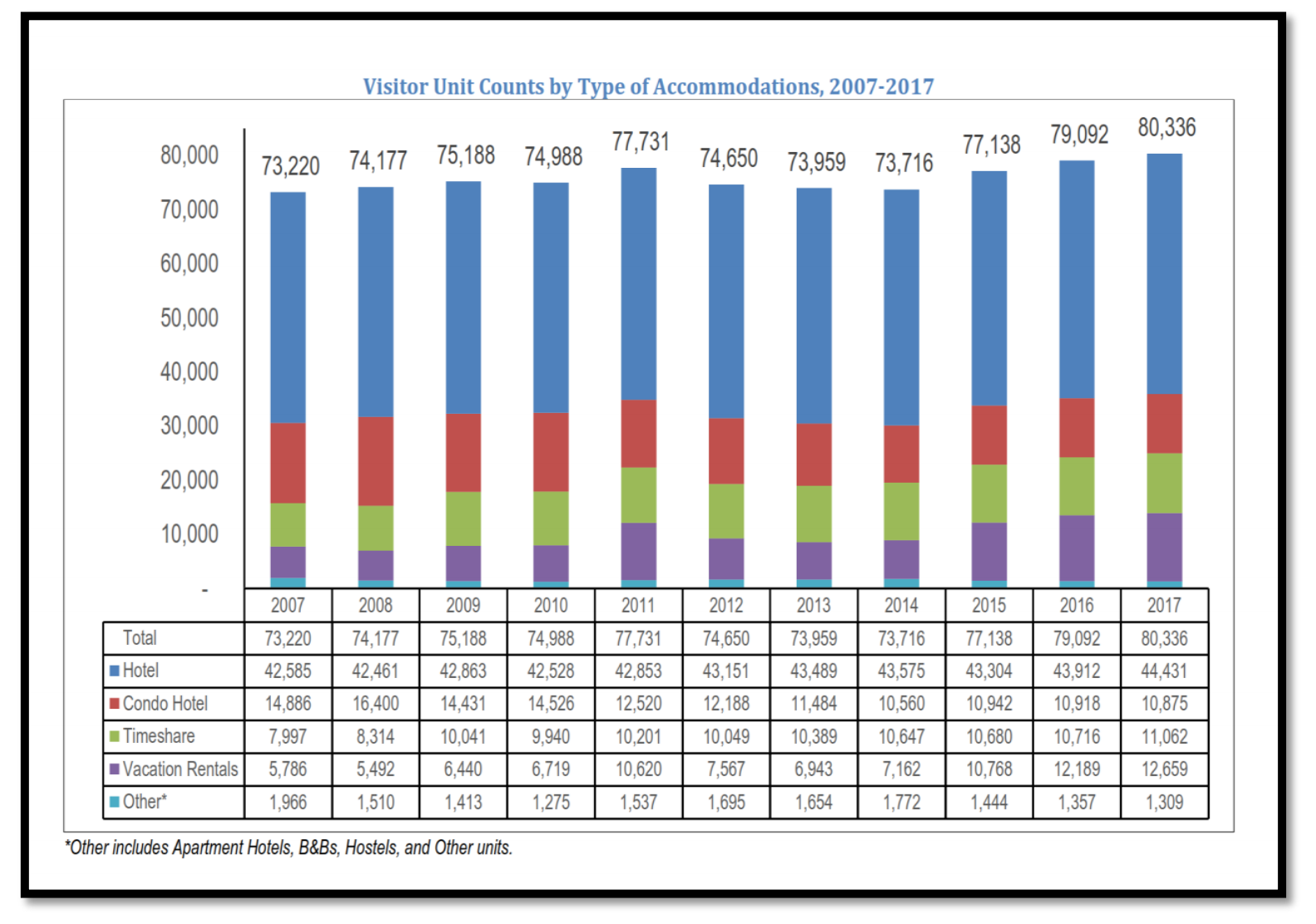

Hawai’i’s main international source markets in 2017

At the end of 2017, Hawai’i had a total of 80,336 visitor accommodation units of various types underpinning its tourism industry. Most of the lodging supply within the State is made up by hotel rooms and suites (55.3 percent) with 44,431 units and with 60.1% of all hotel rooms located on the island of O‘ahu (27,102). Vacation Rental Units [here referring to condominium units, houses, villas, cottages, and private and shared rooms] accounted for 15.8 percent of all lodging units in 2017 (12,659 units). Condotels, accounting for 10,875 accommodation units, consist of individually deeded condominium units but provide hotel-like services such as a front desk and often daily housekeeping service. They account for 13.4per cent of the visitor accommodation pool.

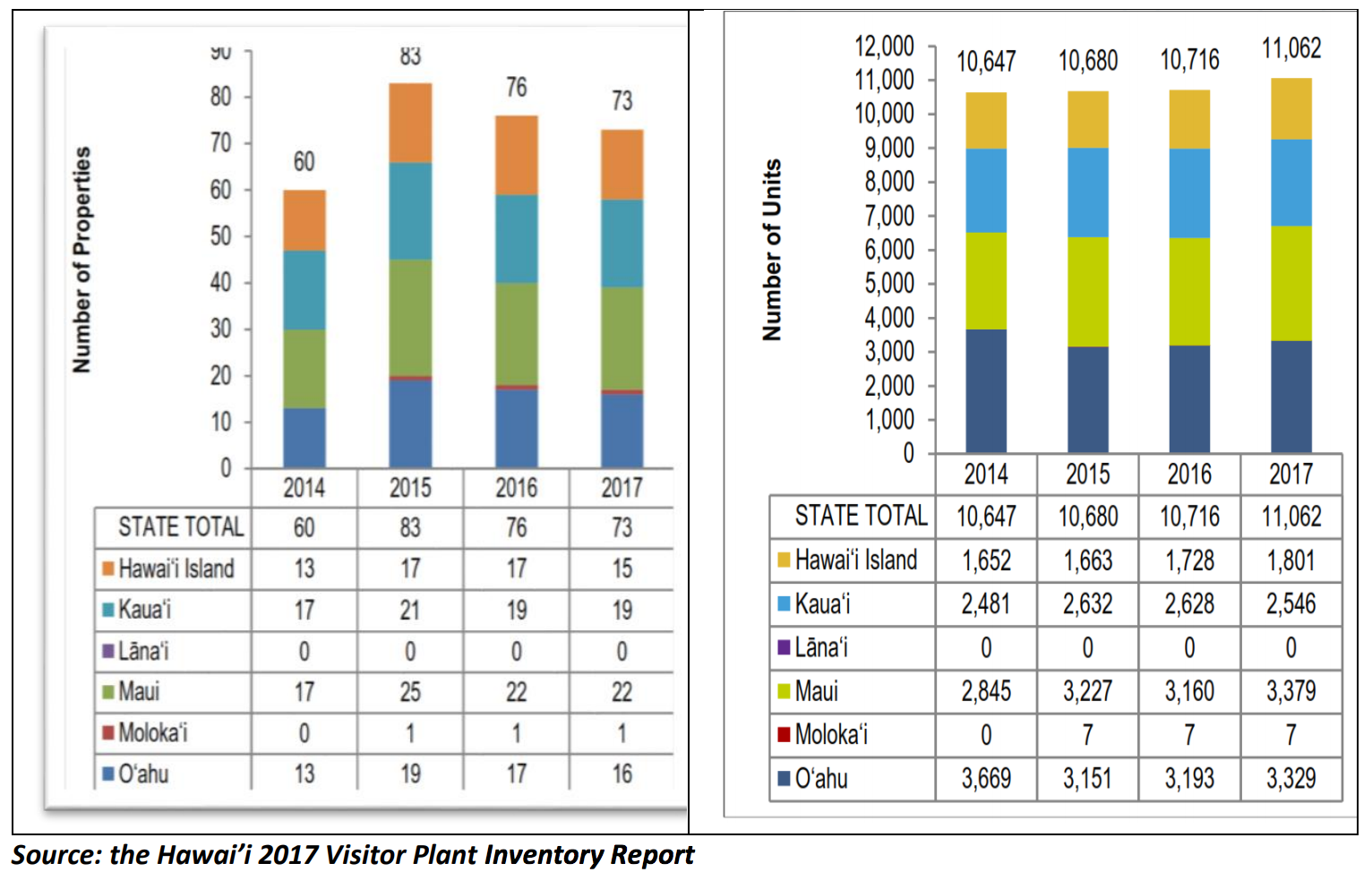

The number of accommodation units within Timeshare properties rose in 2017 with 73 resorts accounting for 11,062 units (13.77 percent of Hawai’i’s total visitor accommodation units) for an average resort size of around 152 units per resort. Key hotel performance data from the Hawai’i Tourism Authority sourced from the press release issued on 25th January 2018, reported that the average daily rate (ADR) of $264 in 2017 for hotels across the entire state, had set a new annual record for Hawai’i. Hotel occupancy state-wide had averaged 80.0 percent in 2017, an increase of 1.0 percentage point over 2016.

Hawai’i Visitor Accommodation Inventory Breakdown for year ending December, 2017

Source: the Hawai’i 2017 Visitor Plant Inventory Report

According to data published in the Hawai’i Tourism Authority Timeshare Quarterly for July to September 2017, the precise number of timeshare accommodation units within the State is now 11,233 which equates to some 584,116 weeks of inventory. The two Charts below show the number of Timeshare Resorts and the number of timeshare Accommodation Units within the Hawai’i Visitor accommodation pool of inventory and their respective growth numbers over the last 4 years.

Other Visitor Accommodation inventory by type for years 2007 to 2017 inclusive.

Source: the Hawai’i 2017 Visitor Plant Inventory Report

Some comparisons between tourism in Hainan and Hawai’i for 2017

As can be seen, with a significantly longer history as a tourism destination but with only 16.17 per cent of the visitor numbers and 31.17 per cent of the total visitor accommodations [but with approximately triple the average length of visitor stay] Hawai’i is still significantly ahead of Hainan [in terms of tourism revenue] which generates around 58 per cent of the Hawai’i’ tourism revenue. This will change in the years ahead as Hainan’s connectivity via airlines, expands its reach as a global tourism destination and higher spending, longer-staying international visitors form a much larger percentage of the total visitor numbers. There will also likely be a marked increase in occupancy within Hainan’s luxury and upper scale hotels as the recognised luxury brands will be the accommodation of choice for many of these international guests.

Some comparisons between Hainan and Hawai’i Tourism- at year end 2017

One of the biggest differences between the Accommodation Sectors in each market is the significantly higher number of timeshare resorts found in Hawai’i, many of which have been developed and are operated by Global Brands such as Hilton, Hyatt, Marriott, Westin and Wyndham. These 73 timeshare resorts provide some 584,116 weeks of high quality timeshare inventory and were reported to have achieved an annual occupancy rate of 90% in 2017. It should also be noted that 63.8% of the timeshare units within Hawai’i are classified by the State as luxury accommodations with rental rates of $500+ per night.

According to data on the website of the Hawai’i Tourism Authority, timeshare visitors numbered 621,815 in 2016 [the latest year for which data is currently available]and consumed 6,115,475 total visitor days. Most had arrived by air and the majority were making at least their seventh visit to Hawai’i. Nearly 300,000 of these timeshare visitors comprised a travel party of 3 or more individuals. This level of activity and accommodation usage has significant economic consequences.

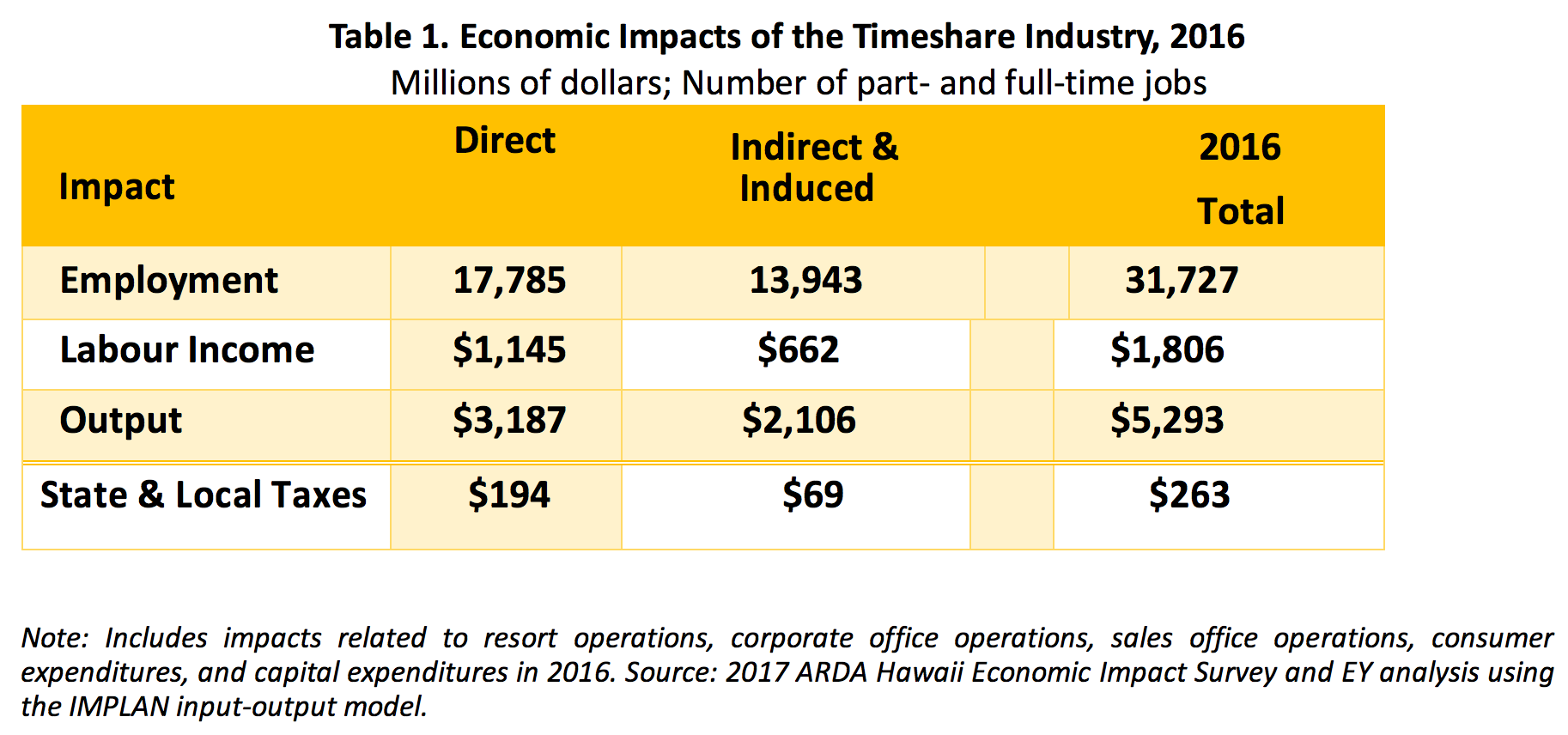

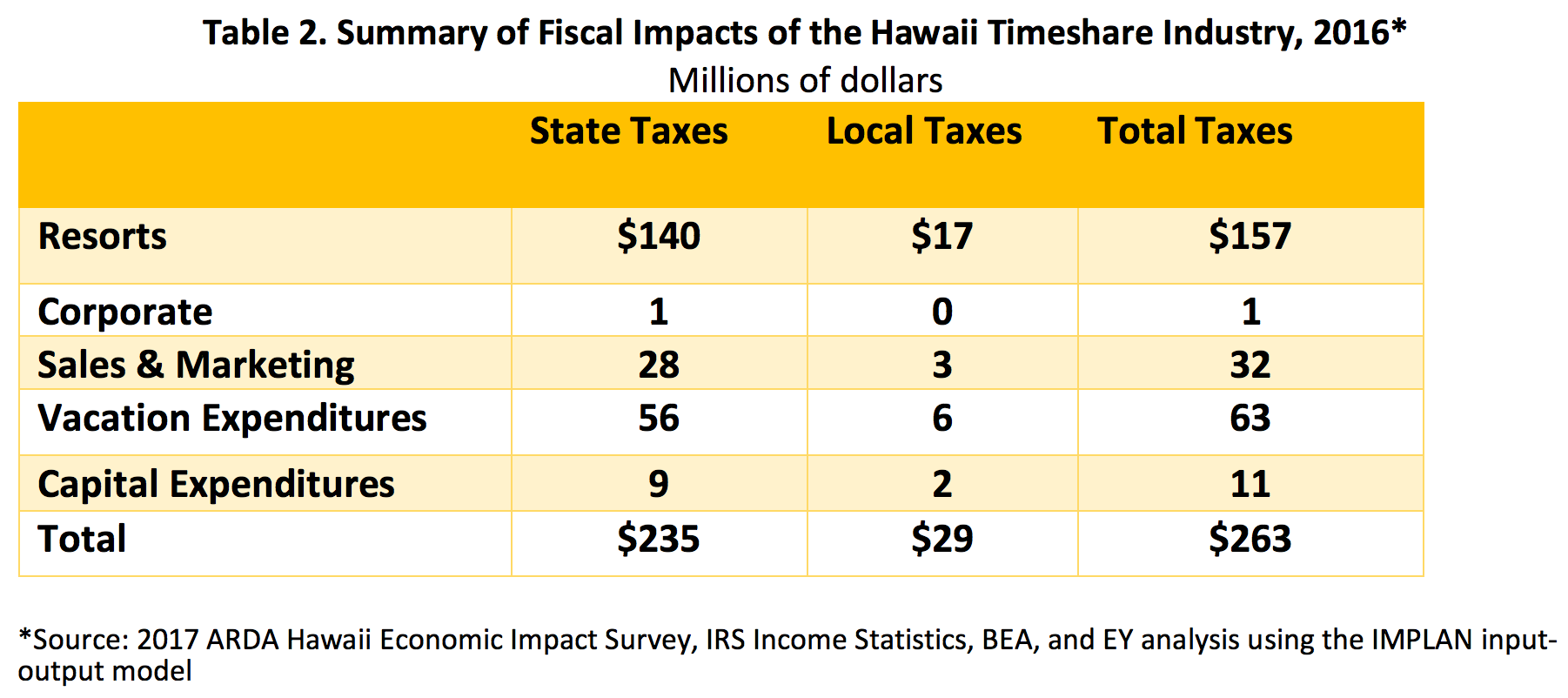

Hawai’i Timeshare Industry Economic Impacts

The Hawai’i timeshare industry extends well beyond the 73 timeshare resorts so that total economic contribution derived from the industry includesthe economic impacts of sales and marketing offices, corporate operations, construction of new resorts and the renovation of existing resorts, and the significant impact of expenditures of vacationers during timeshare stays in Hawai’i. In August of 2017 Ernst & Young produced an estimate of these economic impacts for the ARDA International Foundation. The economic data set out below has been extracted from that Report and present estimates of the economic and state and local tax benefits generated by the timeshare industry in the state of Hawai’i.

As shown in Tables 1 and 2 below, the timeshare industry in Hawai’i accounted for 31,727 jobs, $5.3 billion of output, $1.8 billion in labour income and $263 million in state and local tax revenue.

Some Reflections…

Hainan has developed its tourism offerings at a breath-taking pace since 2009 and has ramped up the marketing of the destination to try to reach a much larger international audience who will want to visit Hainan now that it offers a range of amenities and attractions in addition to its unique culture and natural beauty. Long-haul international visitors will most certainly look to stay for a significantly longer period than the current average length of stay of around 3 days, which augurs well for enhanced occupancy and profitability for Hainan’s upscale and luxury hotels.

Hawai’i represents a more mature travel destination which has had longer to evolve and in addition to its unique culture, it has historically catered to affluent travellers who have sought high quality accommodations, quality dining, recreation and vacation experiences. The cost structures in Hawai’i will be much higher than in Hainan and this is reflected in the significantly higher room rates which are achieved. Local taxation policies in Hawai’i also help raise the contribution to the State coffers from touristic activities.

Hainan’s Tourism Authorities and Developers should consider whether they might want to promote additional accommodation products within Hainan, most notably various forms of Shared Ownership or Vacation Club Memberships, as part of their tourism offering. The proven Business Model for shared ownership is still to co-locate the timeshare accommodations alongside an existing hotel, since there are compelling operating synergies.

Expanding the timeshare industry in Hainan would not only encourage repeat annual visitation but also significantly generate higher spend per capita. Timeshare accommodations, when properly designed, are rather like second-homes with excellent kitchens and bathrooms and are capable of accommodating large families. They resonate well with an increasingly affluent Chinese domestic travel market which is often travelling in family groups and is seeking better quality accommodation and experiences.

Timeshare resorts in all major markets have consistently achieved average annual occupancies that are much higher than the competitive local hotels. Such predictable occupancies help address seasonality issues. There are other operating synergies to be derived from these shared ownership business models, including incremental revenues from operation of service businesses such as food and beverage facilities, spa and wellness therapies and pay-as-you use sporting activities.

The “sharing economy” is now well-established in China. Recent measures by the Central Government to curb property speculation has resulted in some provinces introducing regulations to restrict second-home purchases, especially by prospective buyers who live outside the specific province. Distressed condominium and villa projects in those markets may lend themselves ideally to use as timeshare accommodations, provided that they can be properly operated and efficiently managed.

Although already present within Hainan, there is clearly plenty of room for the timeshare or shared ownership industry to grow, especially with the introduction of innovative products which will appeal to both domestic and international visitors. At the time of writing this article, some press reports have surfaced suggesting that the Chinese government is considering a substantial shift in gambling legislation in a move that could effectively allow Hainan Province to become mainland China’s Macau; the implications of such a move would be enormous, not least for Macau, but also for other destinations vying to increase Chinese tourist revenue with the help of casinos.

According to a Bloomberg report, China is drafting a proposal that could lead to the legalization of online gaming on Hainan, a move that could open the door to physical casinos “over the long-term,” according to anonymous sources quoted by Bloomberg. The Chinese government is intent on reorienting Hainan’s economy toward tourism, with the potential legalization of gambling falling into the greater strategy of making Hainan an attractive destination for Chinese and international travellers alike. Other plans to bolster Hainan as a tourist destination includes potential visa liberalization for foreign visitors plus increased Airport capacity.

About the authors:

PAUL DEAN

Email: paul@dean-andassociates.com

Paul Dean has had over 30+ years involvement with international resort development and recreational real estate, with an emphasis on mixed use resorts. This includes hands-on involvement with the setting up of resorts and product legal structures in more than 20 jurisdictions. He has extensive experience of working with global hospitality brands including Hilton, Hyatt, IHG, Jumeirah, Kempinski, Mandarin Oriental, Marriott and Starwood as well as Gleneagles, Ping An Real Estate, Six Senses, Soneva, Onyx.

His expertise relates to all forms of Recreational Real Estate including Branded Residences, Condo-hotels, Fractional Interests and Private Residence Clubs plus vacation ownership. He provides feasibility analysis, financial modelling, concept development and product design, product legal structuring, usage plan design, preparation of operating budgets, reserve funding, marketing and sales strategies and subsequent project implementation.

Please check out the Dean and Associates website at: www.dean-and-associates.com for more information.

MICHAEL QU

Email: quqin@lawviewer.com

Michael Qu Qin is the managing partner of Law View Partners, a boutique law firm based in Shanghai, China, where his legal practice covers the areas of real estate, foreign investment and mergers and acquisitions. He has extensive experience as a lawyer for over 15 years. Michael has successfully represented investors in the real estate, retail and hospitality sectors, senior housing, asset management, in dealing with commercial transactions and disputes. Michael is active in the hospitality and senior housing industry. He is a frequent speaker in real estate and hospitality seminars, such as Alternative Ownership Conference Asia-Pacific (AOCAP) and International Association for Housing and Services for the Ageing (IAHSA). He is also a lecturer of China’s Legal Training Center, frequently deliver speeches on the topic of the practice on development and operation of commercial real estate.

Please check out the Law View Partners website at: www.lawviewer.com for more information.