(Part II)

The Sharing Economy in China

China is undergoing a shift from a manufacturing and resource extraction lead economy to a service-based economy, in line with rising incomes, a rapidly growing middle class and higher spending power. In the last decade, China’s sharing economy has grown from a fringe concept to an economic powerhouse, reshaping various industries like tourism and mobility at a rapid pace. The sharing economy uses digital platforms to allow consumers to share access to under-utilized assets at a price. The peer-to-peer nature of the industry has led to rapid increases in scale. For example, it took Hilton Hotels 93 years to operate a total of 600,000 rooms per year, while home-sharing site Airbnb added that many to its platform in just four years.

According to the World Economic Forum, consumption is on the rise in China; in 2016 growth in domestic consumption accounted for some 64% of domestic GDP growth and 20% of global GDP growth. A growing proportion of this consumer spending is going to the sharing economy. In 2015, the sector was reportedly worth $229 billion and is predicted to grow by 40% annually over the coming five years. China’s state information sector recently announced that by 2020, it could account for over 10% of domestic GDP, and that the ratio will continue to grow to roughly 20% by 2025. The report also says that the transaction volume of China’s sharing economy topped $500 billion in 2016, up 103% year on year. During the past year, 600 million people were involved in the sharing economy in China, a surge of 100 million from 2015. Meanwhile, sharing economy platforms created 5.85 million jobs, an increase of 850,000.

Inspired by the huge success of companies that make a business out of sharing cars, bicycles and accommodation, China is experiencing a sharing boom, with increasing number of seemingly shareable products and services from accommodation to power banks, to basketballs, to baby strollers.

Shared Ownership Product Types

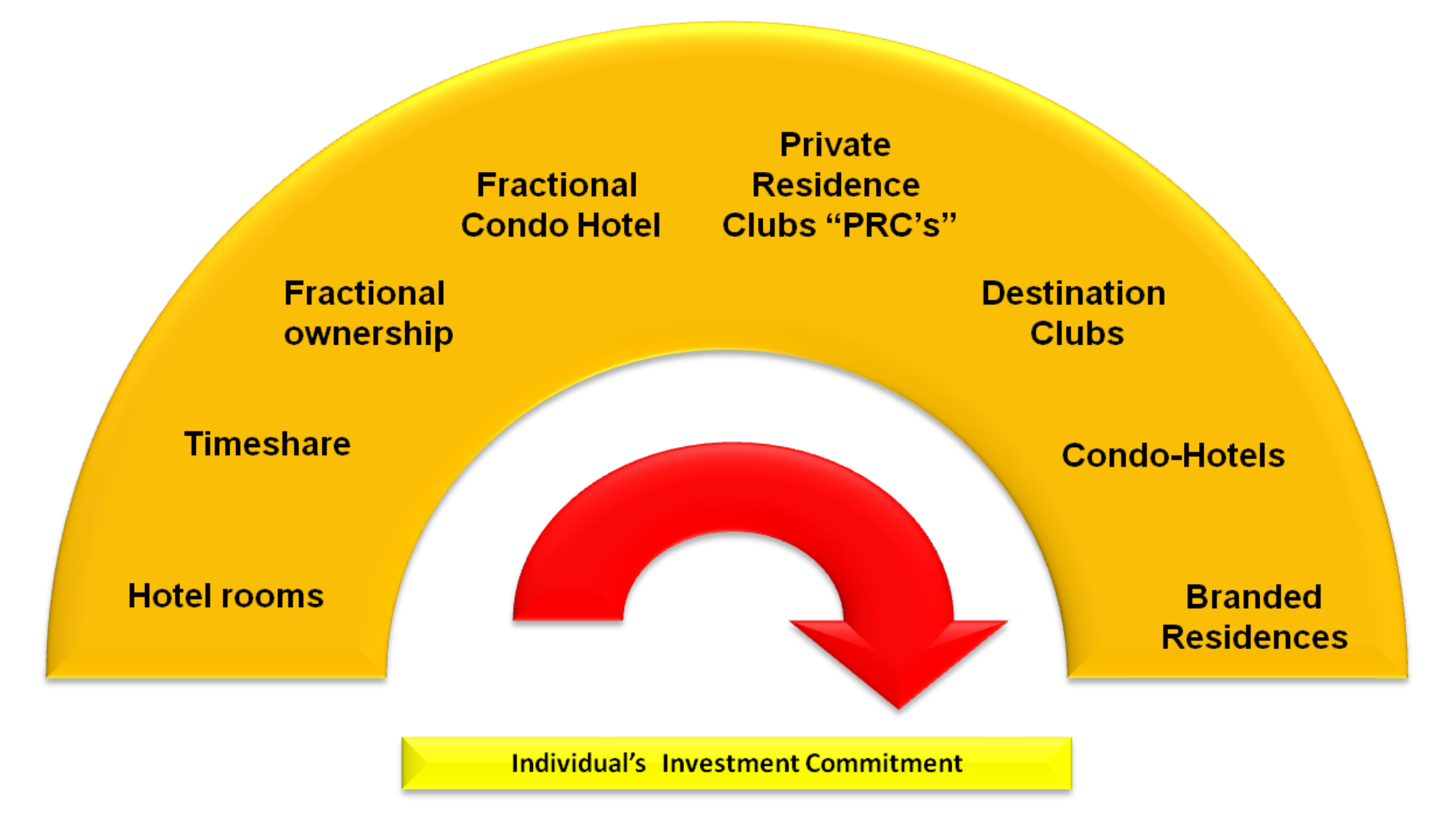

The diagram below illustrates the range of shared ownership offerings which have been successful across many international markets and also demonstrates the level of financial commitment made by an individual Buyer, which increases as you move from left to right.

Hotel rooms

Hotel rooms are often sold as an investment-type product when strata-titled, with buyers being offered specific levels of financial return, usually for a defined period, as well as some limited annual usage. The product probably has little appeal to large families or frequent multi-generational travellers as the hotel room will usually only accommodate two adults. This type of product was pioneered in Europe and in the Middle East and has been well-received in circumstances where a recognised hotel brand has been the Operator of the property but it can be a potentially challenging product where such management is absent.

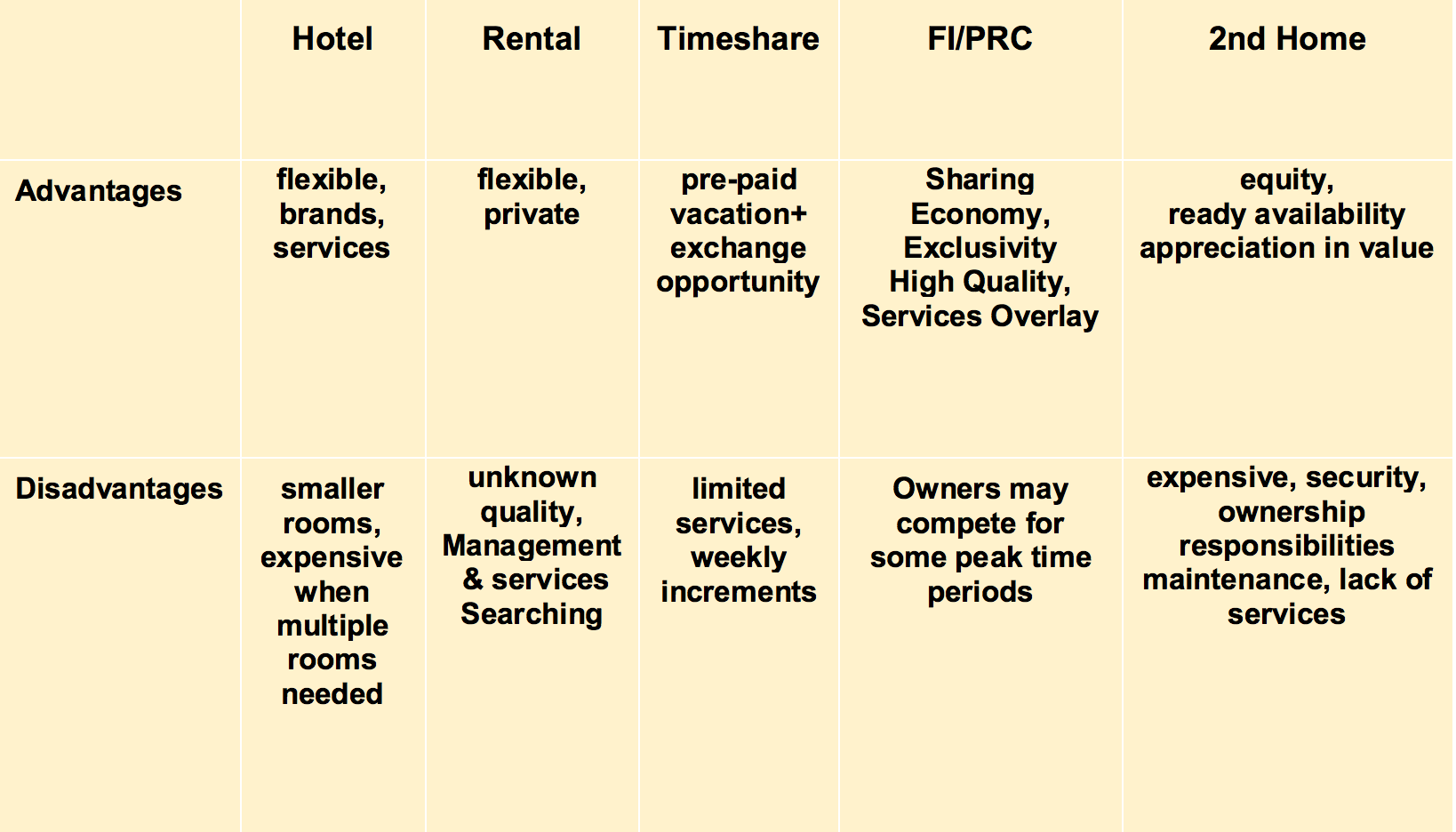

Consumers’ primary choices for Holiday Accommodation

Timeshare

The Timeshare product is structured in a variety of different ways, depending upon the jurisdiction in which the projects are located. Within the USA market, timeshare interests will usually comprise a right to the use of vacation accommodation, linked to a deeded real estate interest. In Europe and elsewhere, timeshare is more often structured as a “right to use” which entitles owner to use one or more weeks in the resort’s accommodations together with the use and enjoyment of the resort’s amenities whilst in residence. The “right to use” is usually conceptualised as a Club Membership. The unencumbered ownership of the timeshare accommodation units is held under the control of an independent Administrator to guarantee the Club Members’ ability to exercise their future occupancy rights.

Purchasers of timeshare interests pay an initial purchase price (sometimes with the assistance of a consumer finance plan provided by the Developer) and thereafter, annual maintenance fees which cover the costs of maintaining the property and the provision of management services, utilities and insurance.Some timeshare products are fixed time (e.g. the owner has the 30th week of the year, every year). Many Timeshare products are floating time programmes, where the occupancy rights will float within a defined Season, requiring the owner to make an annual reservation. Timeshare is not an investment product. It is a holiday or leisure product where the value lies in its use over time, rather like buying a motor car. It will usually offer a significant saving on accommodation costs when comparing the cost of purchasing with the annual cost of renting similar quality accommodation. Most Timeshare resorts are affiliated with a major exchange company, such as Interval International or RCI.

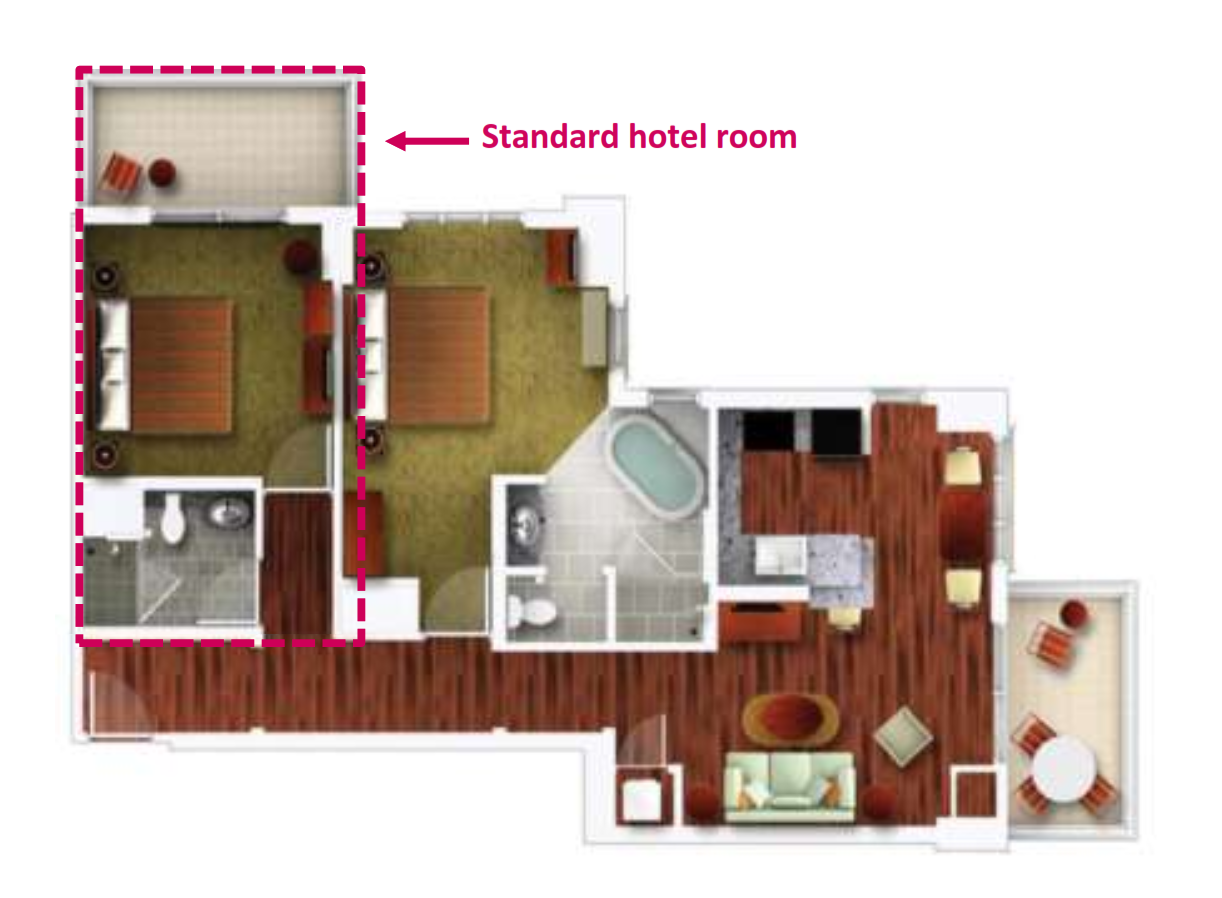

One particularly important point to understand is that timeshare and vacation club accommodations are significantly larger than standard hotel rooms. A typical hotel room, dependent upon location, might be in the order of say 30m2 whereas a one bed timeshare unit which may be able to sleep 4 persons in comfort would be around 70m2 and a two bed, sleep six persons unit would be in the order of 110m2. Timeshare units will usually have fully-fitted kitchens and large well-designed bathrooms.

The floor plans below illustrate the differences.

Vacation Clubs (also known as multi-site Timeshare plans)

Vacation Clubs were created when developers of Vacation Ownership projects began to focus on growth strategies based upon the development of a portfolio of geographically diverse resort locations,to enhance the appeal of their product and provide their Members with different holiday experiences and increased flexibility in usage.

Vacation Clubs also provide a means by which the developer brings consistency and quality to their customers’ exchange experiences at other Vacation Ownership resorts. This ownership concept allows the developer to sell more than one Vacation Ownership interest. Major USA developers, such as Marriott, Hyatt, Hilton, Wyndham and Disney, all operate Vacation Clubs.

Most, though not all, Vacation Clubs adopt “vacation points,” “membership points,” “vacation credits” or the like as the currency by which members may exercise the right to reserve, use, and occupy the club’s accommodations, pursuant to a set of prescribed reservation procedures. The reservation system is intended to maximize the collective use rights of all club members and may be susceptible to periodic point reallocations in order to alter the weight of the various demand balancing criteria. Vacation Clubs offer consumers the ultimate in flexible vacation options and related privileges.

Membership of this type of Vacation Club usually provides a Member with a designated number of points that can be used on an annual basis during the term of the Vacation Club’s existence, to access the club’s accommodations and facilities. Many Vacation Clubs also offer their members numerous ways to redeem their points for purposes beyond merely staying in the club’s own accommodations, such as for cruise products, hotel stays or other travel related services and benefits.

For example, Hilton Grand Vacations Company, Marriott Vacation Club International and Starwood Vacation Ownership allow their members to exchange their club points for frequent guest points which can be used to reserve nights at hotels throughout the world. In addition, Vacation Club members can often redeem their points for discounted airfare, cruises, car rentals, and even merchandise.

Members can usually purchase or rent additional points from the developer, “borrow” points from a succeeding year, or “bank” un-utilised points in a given year for use in making vacation reservations in the following year.

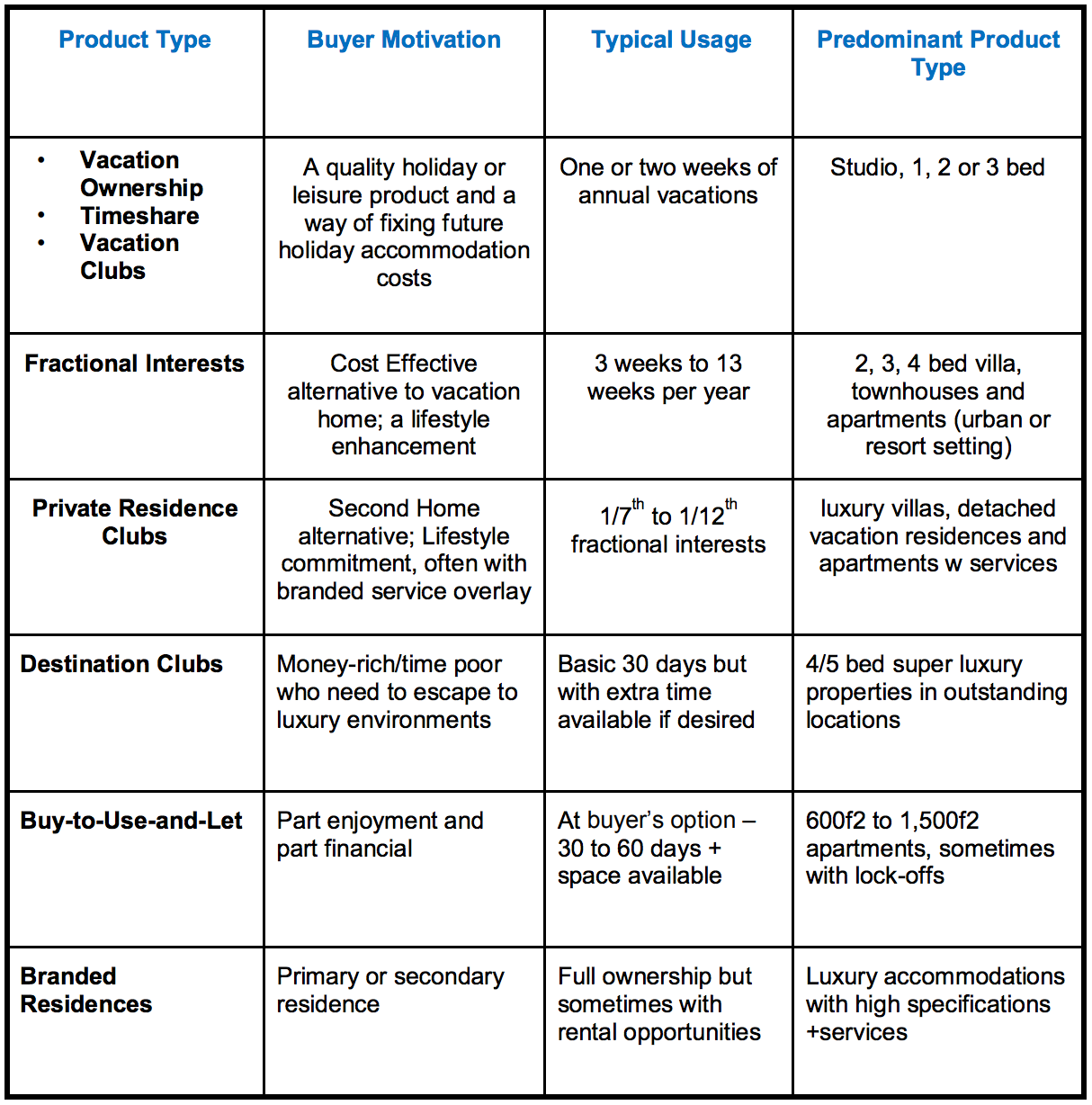

The table below identifies the various product types, their specific Buyer motivation, typical usage and the predominant product or unit type in terms of actual accommodation configuration.

Fractional Ownership

Fractional developers sell an alternative second home product, which provides expanded use rights along with extensive amenities and services. Fractions are typically between 1/10th and 1/4 ownership, giving the Fractional Owner between 5 and 13 weeks of flexible use per year.

The significant difference between Fractional products and traditional Timeshare products are the use of more spacious, higher specification accommodation inventory and longer use rights per year, as well as more usually, an actual ownership interest in the underlying real estate. Fractional owners regard this interest as an investment, as well as a lifestyle enhancement, rather than simply a holiday product so that it is, in reality, a hybrid product providing LIFESTYLE + INVESTMENT. Acquisition costs and annual fees are significantly higher than Timeshare. The exchange component of the Fractional product is very important with high-end exchange companies able to provide this additional benefit.

Private Residence Clubs

Private Residence Clubs are also fractional ownership products. Private Residence Clubs are in the upper end of the Fractional Products market. Private Residence Clubs are distinguished from other forms of Fractional interests by the extensive overlay of guest services, amenities, exclusive member benefits and privileges and are consequently marketed to the most affluent consumer groups. Fraction sizes are usually smaller for Private Residence Clubs as compared to traditional and high-end Fractional interests, ranging between 1/7th and 1/17th.

Subject to space available limitations, owners usually have unlimited use of facilities and lodging, a privilege they usually pay for through higher annual maintenance fees and in some cases a daily use fee. Branded developers and operators in this segment include Ritz-Carlton, St Regis, Fairmont, Four Seasons and Hyatt.

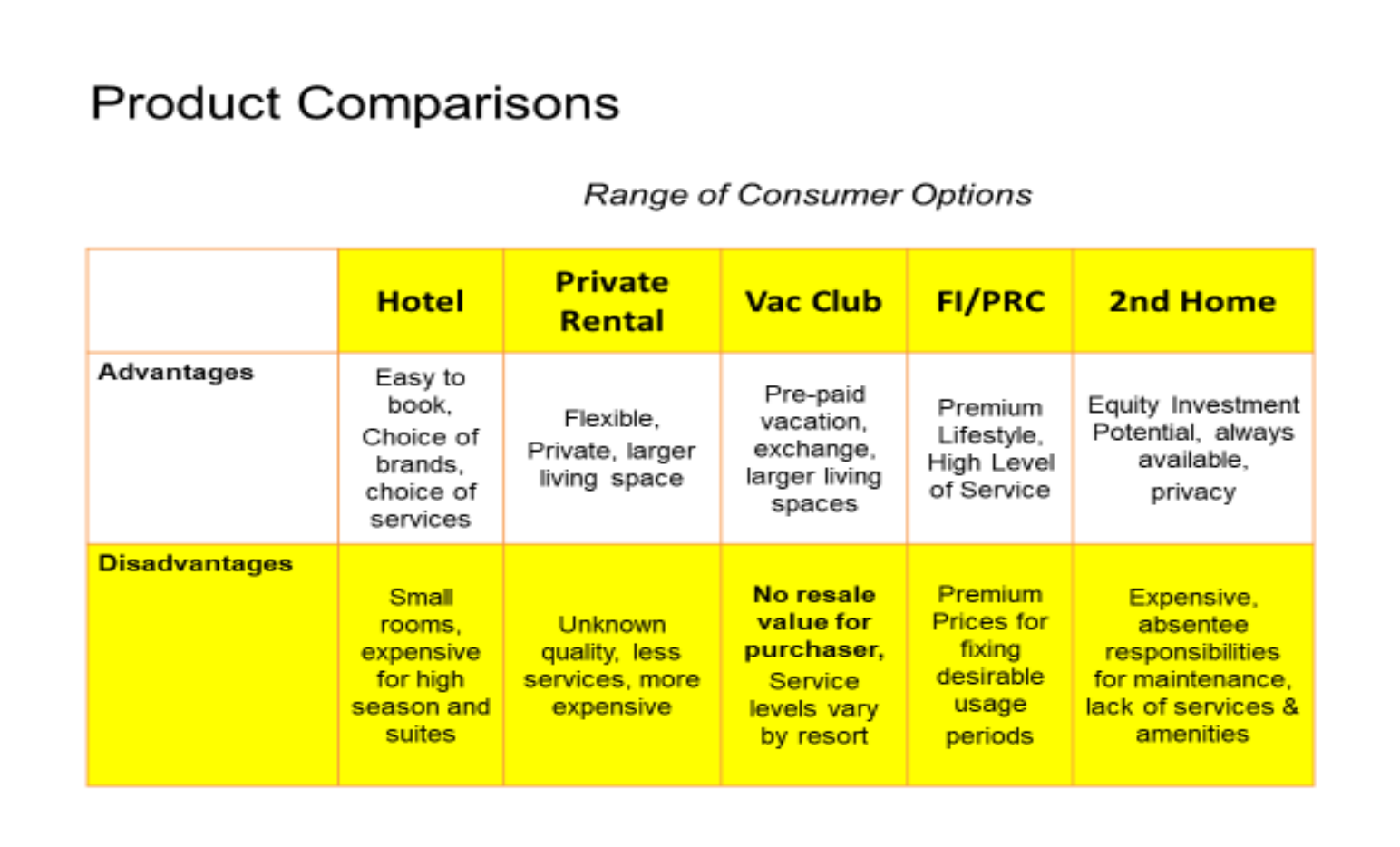

Comparative Advantages and Disadvantages of each Product Type

Financial attractiveness for both Developer and Consumer

Besides a number of very specific operating synergies that a shared ownership component can bring to a mixed-use development [predictable occupancies, reduction in seasonality peaks and troughs, incremental revenues through F. & B. spend, leveraging of existing resources, plus room nights taken for marketing purposes] there are financial benefits for both the Developer as well as the Buyer.

Developers should look seriously at this concept because of its commercial attractiveness:

• Selling units by a time interval increases total pricing by 4 to 5 times (as compared to.

whole ownership)

• Mark of Maturity: A natural extension of hotel/resort/residence business

• Utilize surplus land or unsold inventory and speed up sales of slow moving units

• Accelerated payback and increased IRR

• Potential to turn a financially marginal project into a financially viable one

• Provide lower debt & equity requirements for new developments or upgrading existing

facilities

• Generate additional profit from consumer loan payment plans

• Generate profits from the resort management activity

• Depending upon product structure, opportunity to re-acquire asset at end of the

Membership period

For Consumers, shared ownership provides a very cost-efficient way in which to enjoy quality

vacation accommodations:

• Cost Effective alternative to second home purchase—pay only for the time that you will use

• Taxes and Insurance expenses shared with numerous other owners -the Sharing Economy

• Enhanced Vacation Experiences: Yuan saved on accommodations available for more activities

on holiday

• Quality of accommodation guaranteed every year

• Annual Club Dues or Maintenance Fees ensure FF&E Upkeep & Replacement

• Flexibility – Multiple choices for destinations, unit types, number of nights and desirable seasons

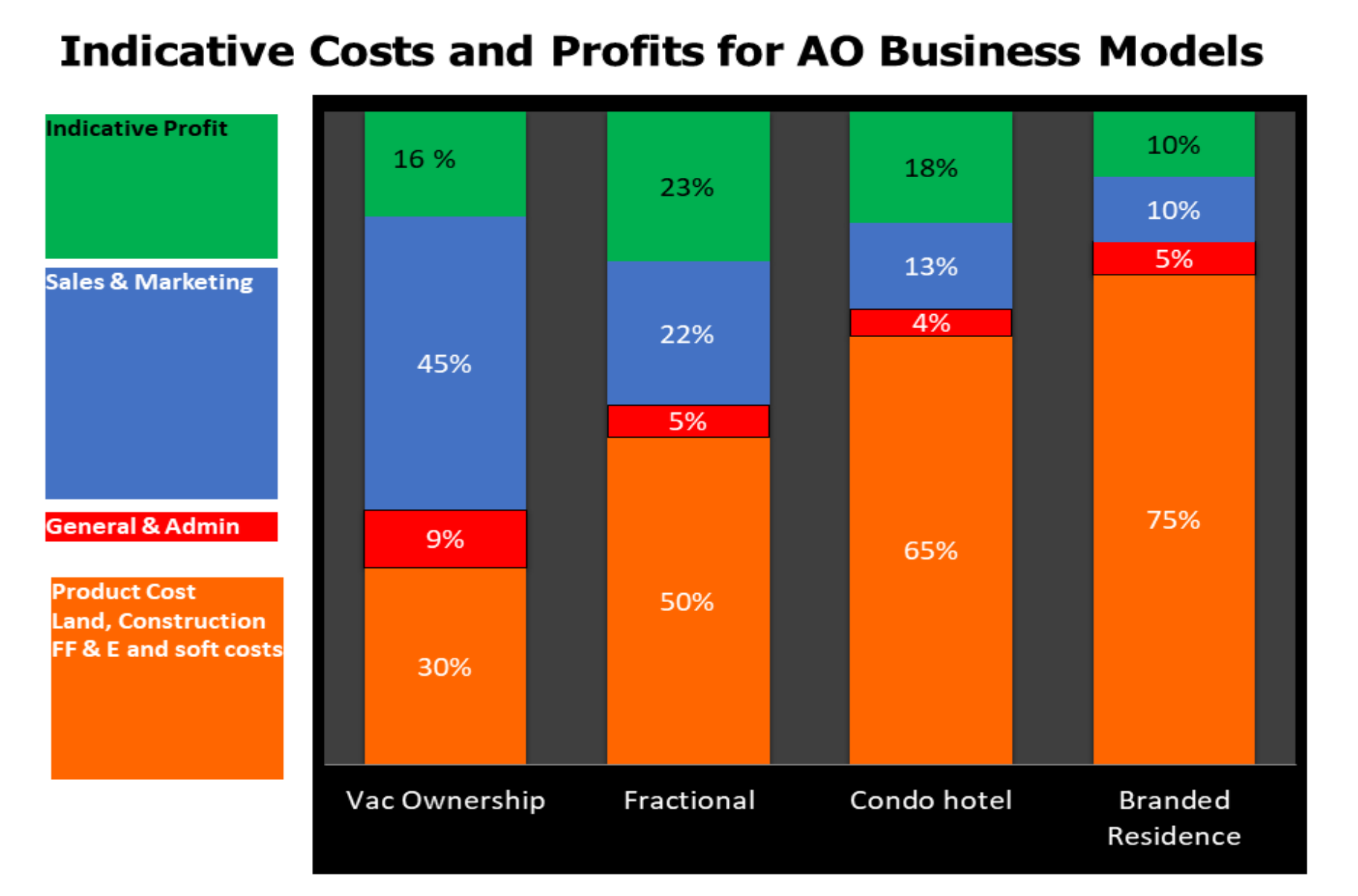

The Business Models related to each Product Type

Some Final Observations

Consumers who are able to see, feel and experience the product are often excited by the quality and spaciousness of the accommodations and the related resort facilities. Consumer satisfaction levels recorded through independent research in mature markets is around 85% whilst annual occupancy levels at timeshare resorts in the USA was 79.9% in 2015 and is consistently reported at around this level. Predictable occupancies, on a year-round basis, help address seasonality issues found in some resort destinations.

Unlike the West, where such offerings have been structured for long timeframes of 50 or 80 years or even “in perpetuity” Chinese consumers prefer shorter term membership programs necessitating the development of new business models specifically for the China domestic

market.

Historically, marketing costs for Shared Ownership products has been a significant cost, largely because Consumers did not understand the concept and needed to have it explained to them, as well as the need to bring the buyers to see the product [usually via short stay site inspection visits] rather than Developers being able to take their product to the market. This challenge is quickly changing because of the heightened use of technology, the offsite use of virtual reality capabilities, consumer connectivity via the internet with their mobile devices and the confidence which has been generated in recent years with online shopping and use of easy online payment platforms.

Conclusions

There is a a significant opportunity within the sharing economy in China, for Developers who hold quantities of recreational real estate inventory [whether high quality apartments or villas] to be able to monetize their inventory through the innovative use of new membership programs through the adaptation of existing shared ownership business models which are tailored to the holiday needs and preferences of Middle Class Chinese Consumers.

Platforms created to achieve such monetization create a number of very specific revenue streams for the Developer, including a higher yield on the real estate, the ability to eran profits through providing consumer loans to their buyers and highly profitable resort management operations from the provision of all necessary management and hospitality services to their Members, who will, over time, become a long-term captive customer base.

About the authors:

PAUL DEAN

Email: paul@dean-andassociates.com

Paul Dean has had over 30+ years involvement with international resort development and recreational real estate, with an emphasis on mixed use resorts. This includes hands-on involvement with the setting up of resorts and product legal structures in more than 20 jurisdictions. He has extensive experience of working with global hospitality brands including Hilton, Hyatt, IHG, Jumeirah, Kempinski, Mandarin Oriental, Marriott and Starwood as well as Gleneagles, Ping An Real Estate, Six Senses, Soneva, Onyx.

His expertise relates to all forms of Recreational Real Estate including Branded Residences, Condo-hotels, Fractional Interests and Private Residence Clubs plus vacation ownership. He provides feasibility analysis, financial modelling, concept development and product design, product legal structuring, usage plan design, preparation of operating budgets, reserve funding, marketing and sales strategies and subsequent project implementation.

Please check out the Dean and Associates website at: www.dean-and-associates.com for more information.

MICHAEL QU

Email: quqin@lawviewer.com

Michael Qu Qin is the managing partner of Law View Partners, a boutique law firm based in Shanghai, China, where his legal practice covers the areas of real estate, foreign investment and mergers and acquisitions. He has extensive experience as a lawyer for over 15 years. Michael has successfully represented investors in the real estate, retail and hospitality sectors, senior housing, asset management, in dealing with commercial transactions and disputes. Michael is active in the hospitality and senior housing industry. He is a frequent speaker in real estate and hospitality seminars, such as Alternative Ownership Conference Asia-Pacific (AOCAP) and International Association for Housing and Services for the Ageing (IAHSA). He is also a lecturer of China’s Legal Training Center, frequently deliver speeches on the topic of the practice on development and operation of commercial real estate.

Please check out the Law View Partners website at: www.lawviewer.com for more information.