This is the third article in a series which looks at the Outdoor Hospitality Industry in all its various manifestations. Earlier Articles have looked at the history, growth and spread of the industry and its segmentation. Article Three focuses specifically on Recreational Vehicles [“RV’s”] a sector which is already well established in Australia, Europe, and North America and which is now showing signs of growth in China.

What are Recreational Vehicles?

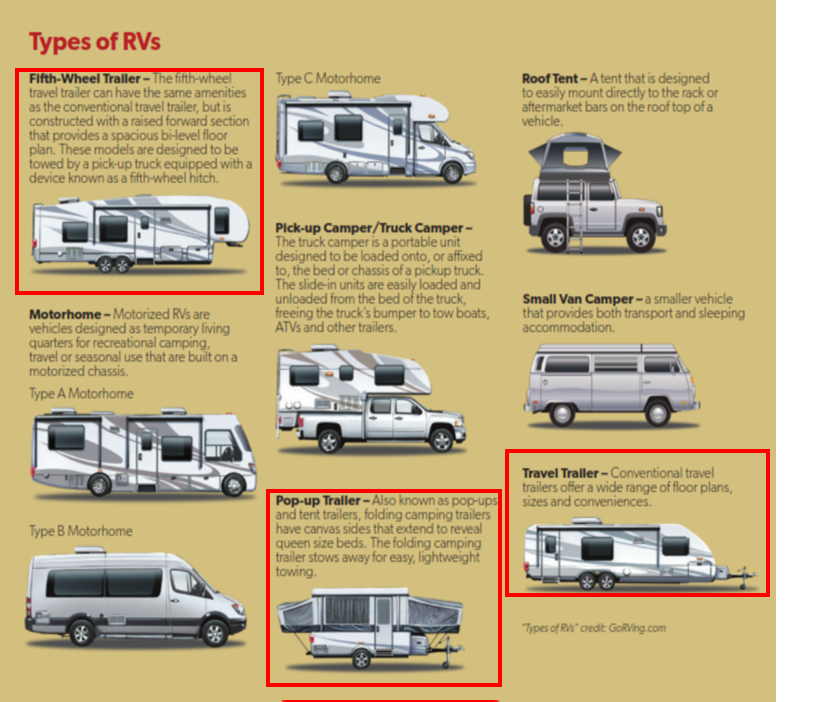

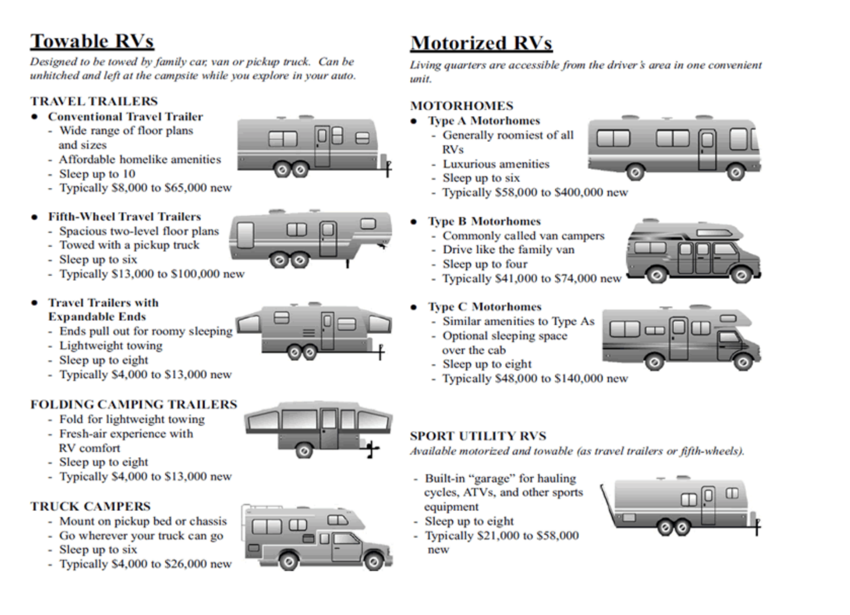

The infographic below[1] identifies most types of RV’s that are currently found within global markets. Note that only the three trailers outlined in red in the list below are what are referred to as “towables”.

The towable recreational vehicle market is expected to grow at a CAGR of over 6% during the period 2019–2025. Towable RVs are more prevalent in North America than in Europe. Travel trailers are the most popular towable segment. Consumers often prefer them as they are the most inexpensive. They are cheaper and more straightforward than motor homes and are also available in a wide range of designs, sizes, and prices.

Aside from the “roof tent”, the camper van and the pick-up or truck camper, motorhomes usually come in three varieties – Class A, Class B, and Class C. The Class A segment is one of the most common motorized RVs. It accounted for over 40% of the global motorhome revenue in 2019. Class B motorhomes accounted for over 12% of the worldwide motorhome revenue in 2019, and the segment is witnessing the fastest growth. They are typically more affordable to maintain and have better fuel economy than larger counterparts. The class C segment is expected to reach over $13 billion in sales by 2025. Class C combines the best features of both Class A and B into a more versatile and affordable mid-size motorhome.

How Buyers choose the most suitable RV[2]

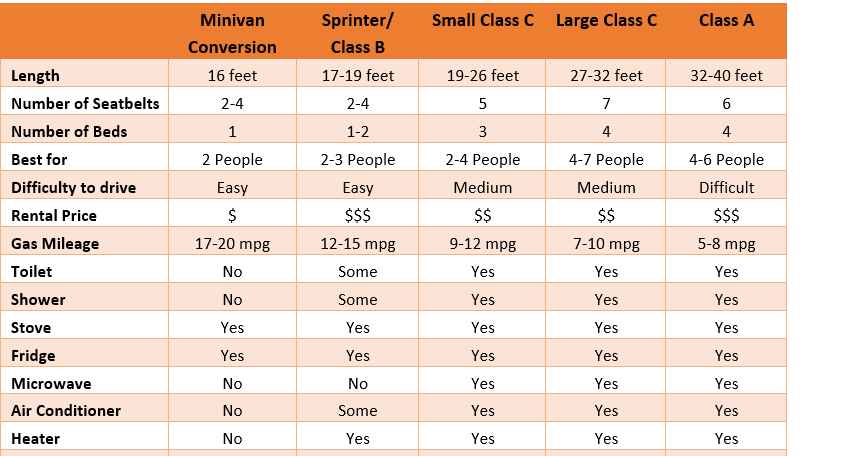

An important element in RV holiday planning and usage is choosing the right type of RV. The following descriptions and illustrations outline the main types in current usage.

Examples are shown below with their respective pros and cons.

TOTERHOME

A toterhome is found primarily in Australia and is essentially a motorhome built around a semi-truck chassis such as a freightliner. This type of motor home allows the pulling of large and heavy trailers.

MINIVAN CONVERSION (Best for 2 people)

| These campers come equipped with stove, small fridge, and sink. The kitchen is in the back of the van, and some require set up of the sleeping area. PROS: Good gas mileage, very manoeuvrable. CONS: Rarely equipped with showers or flushing toilets. Beds must be converted. |

CLASS B or SPRINTER VAN (Best for 2-3 people)

| Class B vans are known more recently as sprinter vans. They are becoming popular due to their fuel efficiency and amenities. They have a small kitchen, beds and toilets and can park in a traditional parking space. PROS: Fuel efficient, nice finishes. CONS: Rarely equipped with showers or FLUSHING toilets. Beds usually converted from seating area. |

SMALL CLASS C. (Best for 2 – 4 people)

| Small Class C motor homes are a great alternative to the minivan or Sprinter van. They have three beds (2 permanent beds and one convertible bed from the dinette area) and full bathrooms. The full bathroom (toilet and shower) makes this vehicle a good choice for small groups. PROS: Full bathroom, multiple sleeping areas, good interior space. CONS: Boxy, not sleek. |

LARGE CLASS C. (Best for 5 – 7 people)

| These are the best vehicles for large groups and families. They typically have 4 beds and can sleep up to 7 people. Many of these vehicles also have “slide-outs” allowing for more space when parked and camping. PROS: 4 sleeping areas, large interior space, fit in most campgrounds. CONS: Not as fuel efficient, sometimes difficult to find parking. |

CLASS A RV (Best for 5 – 6 people)

| These are the largest of all – and a favourite of the full-time RV’ers. They are truly more like “homes” than any of the others, offering all the amenities (full bathrooms, kitchens, slide-outs) but what you get in space, you lose in agility and fuel efficiency. It can be difficult to find appropriate campsites and they are often difficult to park. PROS: Full ‘master” bedroom, large windows, all amenities. CONS: Excessively big, difficult to drive, not fuel efficient and expensive. |

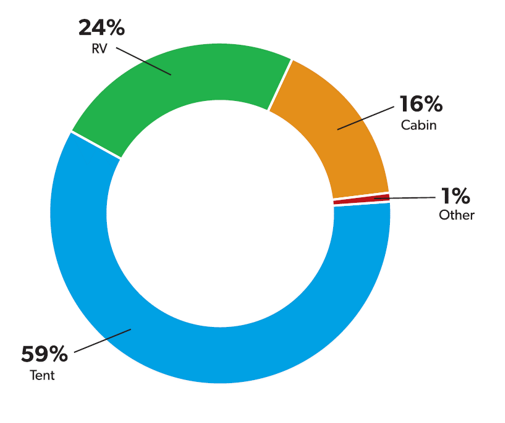

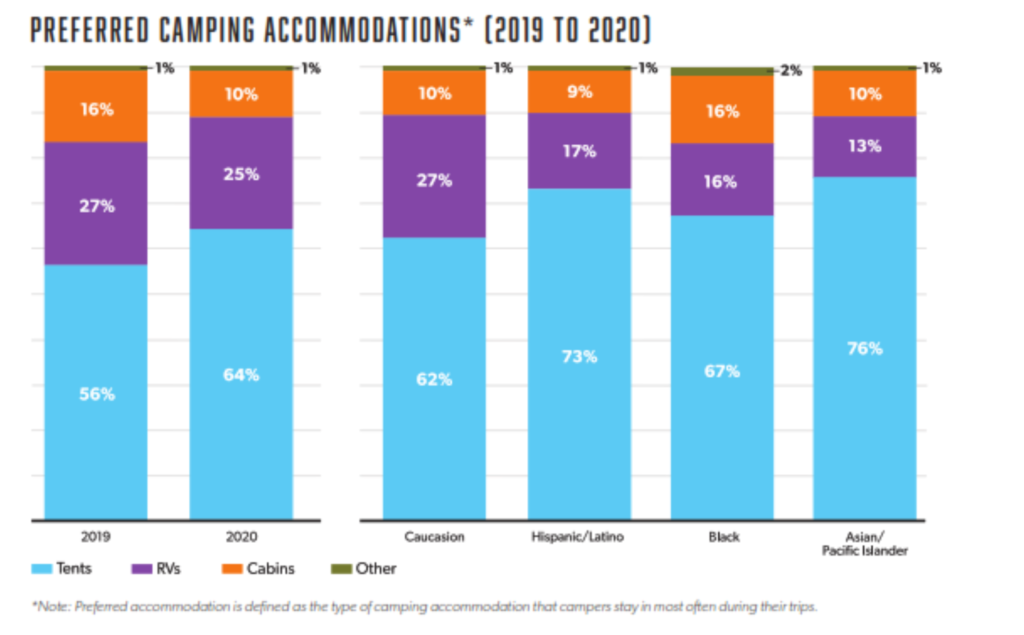

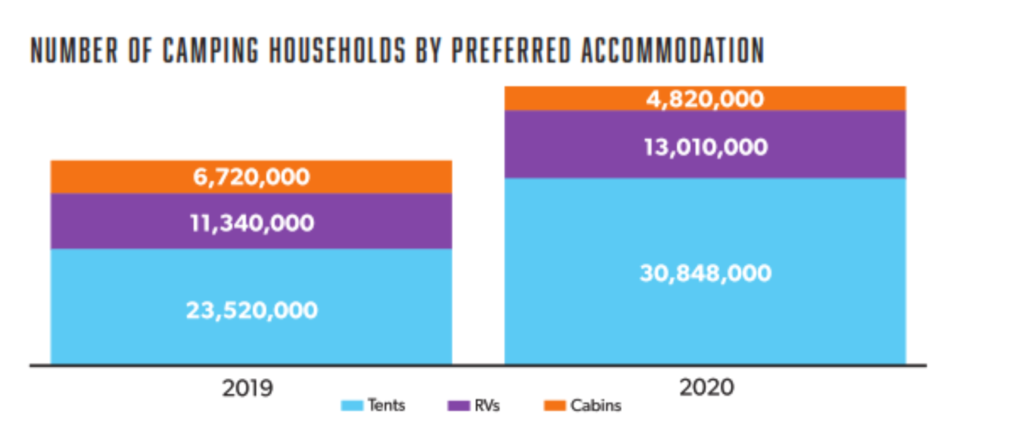

The 2019 KOA North American Camping Report[3] segmented camping into four major categories: (1) Tents, (2) RV’s, (3) Cabins and (4) Other. As the following diagram illustrates, the primary outdoor accommodations used are Tents, followed by RV’s.

The focus within the remainder of this Article is entirely on the RV campground business and RV usage by consumers in various markets.

The Global Markets both for RV Campgrounds and for RV’s

The global market for Recreational Vehicle Parks and Campgrounds was estimated at US$34.6 Billion in the year 2020. Companies in this industry operate facilities to accommodate campers using travel trailers, and RVs. Major companies include Kampgrounds of America (KOA) and Thousand Trails (both based in the US), as well as Discovery Holiday Parks (Australia); Siblu (France); and the UK-based Camping and Caravanning Club, and Parkdean Resorts. It is projected to reach a revised size of US$47.6 Billion by 2027, growing at a CAGR of 4.7% over the period 2020-2027. Operating Campgrounds are projected to record a 5.2% CAGR and reach US$12.7 Billion by the end of 2027.

The US recreational vehicle parks industry comprises approximately 4,227 RV parks and campgrounds with combined annual revenue of about $3.1 billion. Outside the USA, RV camping (or caravanning, as it is frequently called in Europe) is popular in countries such as the UK, Australia, Canada, France, Germany, Norway, Sweden, and Spain. RVs are also growing in popularity in China as consumers spend more on vacations and leisure activities and more domestic campsites are being rapidly developed.

The global recreational vehicle market by revenue was projected to grow at a CAGR of over 7% during the period 2019–2025 prior to the onset of the Global Pandemic, whilst the global RV market size was projected to have reached $42 billion in 2020. Continuing growth is driven by the increasing demand for camping and outdoor recreational activities in the millennial population, especially in the USA.

The growing number of active campers is contributing to the demand for RVs whilst the demand for rental facilities is also boosting market growth, especially among millennials who are increasingly seeking rental options to gain some familiarity with the RV experience before considering a purchase. Millennials are young adults ranging in age from 25 to 40, having been born between 1981 and 1996.

There are now approximately 13 million RV-er households in the USA. Households who identify as “RV-ers” having increased by 17 million between 2019 and 2020. The rapid rise in ownership indicates a resurgent interest in the RV lifestyle. An increasing number of millennials are embracing this lifestyle so that about 38% of the 40 million recreational vehicle owners in the USA are now millennials. The USA is the largest commercial RV market globally [as well as the market with the largest manufacturing capacity] although this market is becoming heavily populated by rental agencies as the commercial usage of RVs continues to grow via rental agencies.

Having described RV’s, the focus within the remainder of this Article is on four mature markets comprising Australia, the United Kingdom, Europe, and North America plus the emerging RV market in China.

Australia

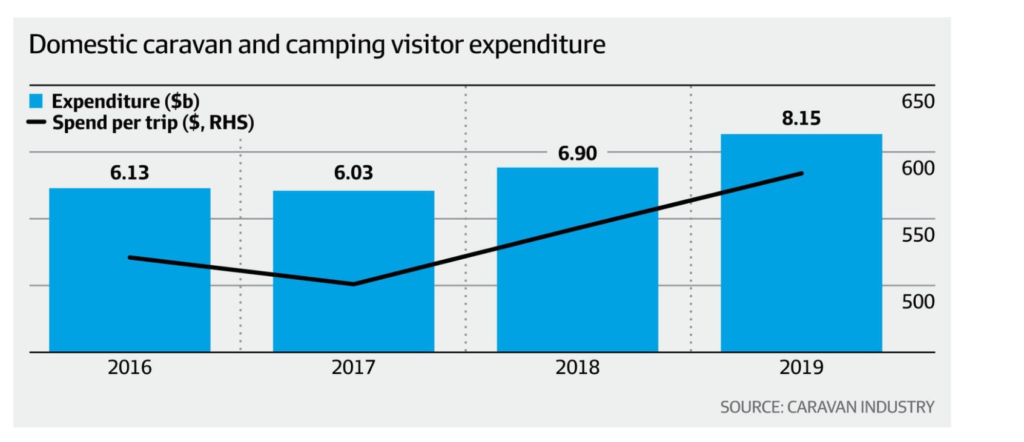

The Australian Outdoor Hospitality Industry is an AUS$23.1 billion industry directly employing 60,000 people. It manufactures 25,000 vehicles per annum, services over 740,000 vehicles on the road, generated 14 million+ trips in 2019 [up by 9% on 2018] and created 60 million visitor nights across the country. More than 33,700 new caravan registrations were recorded in 2019. There are 24.8 million Australians and 8.4 million households who take caravan and camping holidays so that camping and caravanning has become an integral part of Australia’s national travelling behaviour. Domestic spending exceeded AUS$8 billion whilst the average caravanner spends AUS$584 per trip across 4.2 nights.

The first ever RV Consumer Report published in 2018 examined recreational vehicle purchasing and usage preferences among current vehicle owners, former owners, potential new market entrants and consumers who had limited preference for buying into the RV lifestyle. Of the respondents surveyed, the average age of an Australian RV owner was 33 with an average income of between AUS $48,000 and AUS$72,000.

The research indicated that 1 in 13 Australian households owned an RV. One of the most significant factors for consumers was the importance of children, where 42% of current RV owners had children under 15 living at home. Consumers also indicated they were more likely to purchase an RV if they had camped as a child, with 67% of current RV owners having camped in their childhood.

A core aspect of the research was identifying the elements of RVs that prospective buyers looked for, with a clear trend towards functionality over aesthetics. Price was also rated a vital element of an RV purchase, with 80% of consumer stating this was the most influential factor. The modern RV consumer’s path to purchase appears to be significantly changing, with 47% of new market entrants indicating they would consider hiring an RV in Australia to ‘try before they buy’, especially amongst the under 40’s.

Caravan and camping accommodations accounted for 20% of all nights spent in regional Australian destinations in 2018. In terms of total nights, older non-working ‘grey nomads’ were the demographic segment leading the way with 32% of total nights, and the family segment at 30%. In terms of age demographics, the family segment (i.e., a parent with a child living at home) accounted for the largest numbers of trips at 4.4 million, with the younger midlife demographic (no children) following with 4.2 million trips.

In Australia, many RV’s sit idly in garages or driveways for a large part of the year, since average owner usage is normally around 40 nights per year. Some 62% of Australian RV owners have considered joining the “Sharing Economy” whilst 74% of buyers are keen to hire before they buy. The industry is currently being “disrupted” by an entity named Camplify which has created an innovative platform enabling RV owners to list their vehicles for rental on the Camplify website and pay a commission of around 11% of rental income thereby generated.

United Kingdom

The UK travel market has taken a big hit because of the lockdowns and travel restrictions arising from the COVID-19 pandemic. The camping and caravanning market was no exception with a 34% drop in camping and caravanning trips in 2020 as compared to 2019.

Despite this decline, the camping and caravanning market witnessed a rise of 2%, with 41% of consumers taking a camping or caravanning holiday over the last 3 years. This increased attraction for outdoor accommodations has been fuelled by its affordability and connection with nature, as well as perceptions regarding its safety.

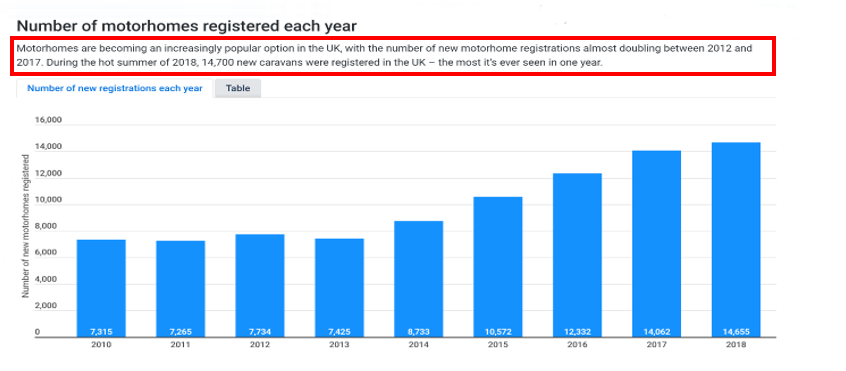

Historically, the industry has contributed more than £9.3 billion to holiday parks and campsites every year and has employed around 170,000 people. Caravanning has also been part of the growing popularity of “staycation” holidays, as people look to save money while enjoying the convenience of a home on the move.The most popular type of caravan experience has been a break in a touring caravan, with Brits spending circa. 19.2 million nights in touring caravans, motorhomes, or campervans in a normal year. Static caravans have been the second most popular type of break, with 18 million nights. Tents were in third place with 14.7 million nights. With 1,489 camping and caravan sites in the UK, there has historically been plenty of choice for a family-friendly, affordable break.

Here are some key industry facts:

- In 2019, UK residents took 13.1m holiday trips camping and caravanning, spending £2.2bn during their trips[4]. By contrast, they made 13.8m holiday trips to Spain, 6.0m to France, 3.1m to Italy and 2.3m to Portugal[5]. Overall, 51% of holiday trips were taken domestically and 49% abroad.

- Currently, there are approximately 555,000 touring caravans in the UK plus 365,000 caravan holiday homes and nearly 250,000 motorhomes[6]

- Of the 13.1m trips, 43% were spent in static caravans, 31% in touring caravans, motorhomes and campervans, 23% tent camping and 4% glamping.

- In 2019, some 55m holiday bed nights were spent in caravans, tents, glamping, and motorhomes by UK residents. The accommodation category received more 6% more nights than hotels/motels, 23% more than ‘built’ self-catering and 364% more than guest house/bed and breakfast accommodations[7].

- In 2019, average trip length was 4.2 nights and average spend per trip £168 per person, and £40 per person per person for domestic camping and caravanning holidays[8]

- Around one-quarter of holiday parks and campsites are open all year round[9]

- Average trip length in 2019 was 4.2 nights in the UK[10].

Europe

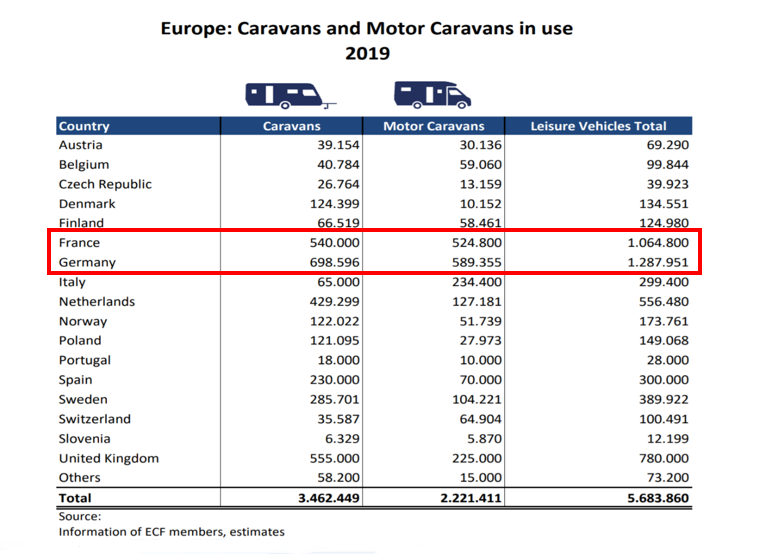

RV’s and caravans are extremely popular across large parts of Europe where the top 5 caravan hotspots were recently identified and comprised the UK, Sweden, France, Switzerland, and Denmark.

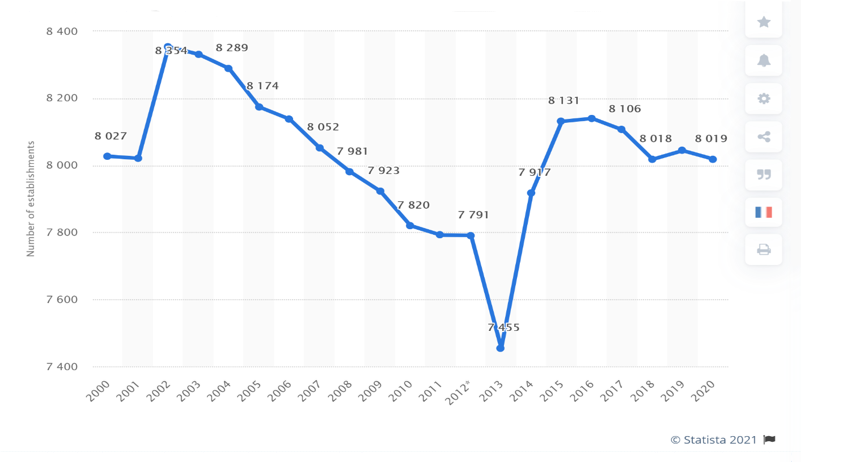

France is a nation of caravan enthusiasts, thanks to the amount of camping and caravanning sites in the country – currently over 8,000 although the number experienced a significant downturn during the last 20 years, especially in 2013. The French were also big spenders, spending just over €2 million on renting sites for a holiday in 2017.

Variation in the number of campsites in France 2000 to 2020

The French camping market is also growing strongly and experienced a 15% increase in utilization between 2011 and 2019, reaching 129 million overnight stays in 2019. The increase in the sector’s sales was also driven by the quality upgrading of the market in response to growing customer demand for greater comfort. The two most popular types of accommodation for campers were the mobile-home and the personal tent. The recent success of the mobile home has contributed significantly to the renewed popularity of outdoor accommodations.

Sweden is noteworthy for its 550 camping and caravan sites. The Swedish prefer exploring their own terrain, taking over 1.6 million domestic trips in 2017. The country also had a significant number of new motor caravan registrations that year. The campsites are the engine of summer tourism in most of Sweden’s destinations and an important factor for the Swedish tourist industry. In 2019, the industry once again broke a record with a total of 16,747,364 guest nights, an increase of approx. 4 per cent compared with 2018. International guest nights increased by 7.5 per cent. In total, Swedish camping tourism is estimated to turn over approx. 7 billion SEK.

Within Europe overall, 420m nights were spent camping or caravanning by EU residents in 2019, of which the UK accounted for 59m, France 129m, Italy 55m, Spain 41m, Germany 36m and Netherlands 22m[11]. For those who like to have a camping holiday in the European Union (EU), there were 23,200 campsites recorded in 2018 from which to choose. The vast majority of these were in rural areas (68%) or towns and suburbs (26%), while 6% of sites were in cities.

Over two thirds of these campsites (70%) were in just four EU Member States: France (35% of EU’s campsites), Germany (13%), the Netherlands (12%) and Italy (10%). Visitors spent a total of 352 million nights in EU campsites in 2018, accounting for 13% of all nights spent in tourist accommodation within the EU.

Camping activity is highly seasonal. Late spring and summer are the most popular seasons for camping. In 2018, the number of nights spent in campsites across the EU in August (31%) and July (27%) together accounted for more than half of the annual total. June (11%), May and September (both 9%) were also popular months for camping. Among the EU Member States, the highest proportions of tourist nights spent in campsites in 2018 were recorded in Denmark and Luxembourg (both 33% of all nights spent in tourist accommodation in the country), France (28%) and Sweden (26%).

The table below provides a summary of all caravans and motorhomes in use across Europe, by EU Member State, in 2019[12]

NORTH AMERICA

The North American recreational vehicle market [here deemed to include the USA and Canada] is the largest across the globe. RVs are highly popular among North Americans and over 11% of households own an RV. Over 1 million households in the US live in RV’s full time. It allows traveling at 20%–60% less cost, which is mainly driving the popularity of RVs among millennials. The recreational vehicle market contributes an overall $114 billion to the US economy, employing over 600,000 people. Millennials are particularly driving the market for RVs in North America. About 44% of campers in 2018 reported being interested in traveling in an RV across different destinations. Within the USA, the average nightly price of an RV park ranges between $40 and $50.

Rather like the Airbnb market, RV rentals are becoming more common to people wanting to vacation on the road without becoming saddled by a 10-year loan or other responsibilities such as maintenance and insurance that will inevitably come with RV ownership. This is especially true of Millennials who often exhibit a preference for sharing rather than for outright ownership. In terms of total units, towable RVs represent the bulk of the RV market. In fact, towable units for 2020 were forecast to significantly outsell non-towable recreational vehicles. The diagram below identifies towable versus motorized RV’s.

According to ongoing research conducted by the University of Michigan over the last decade, more RVs are owned by people in the 35-54 age demographic than any other age category. More than 9 million families in the U.S. report ownership of an RV. Additionally, there are about 16,000 campgrounds and parking facilities throughout the country, both public and private, which support RV camping[13].

The typical household income for RV owning households is about $62,000. These families spend an average of 4 weeks each year using their RV in some way. There has been a 16% increase in household ownership of recreational vehicles in the United States since 2001. Additionally, 60% more households own an RV now compared to 1980. About 54% of RV owners bring their pets with them when they travel thanks to how their RV is designed[14].

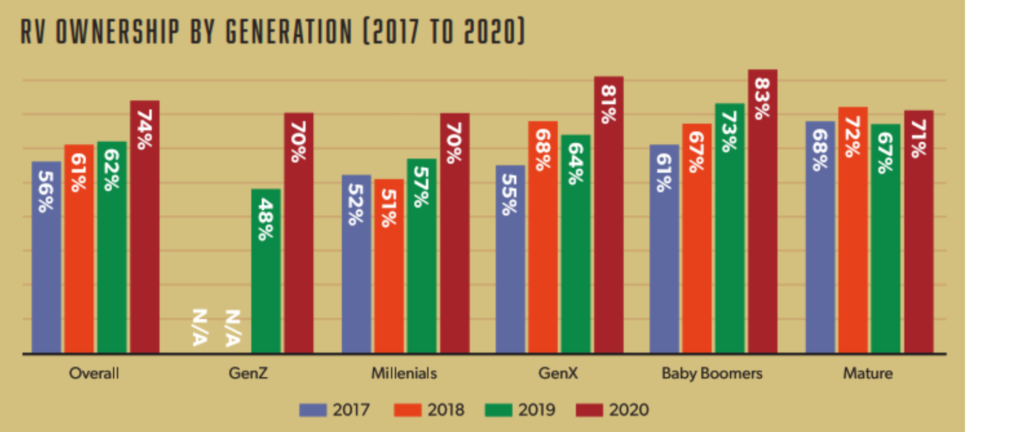

The “Go-RVing RV Owner Demographic Profile 2021” prepared by the RV Industry Association is the most comprehensive study of RV ownership ever conducted. The study found RV ownership had increased over 62% in the last twenty years with a record 11.2 million RV owning households, split almost equally between those over and under the age of 55, with significant growth among 18-to-34-year-olds, who now make up 22 percent of the market.

The chart below identifies the preferred outdoor accommodation types as well as their appeal to specific ethnic groups with North America.[15]

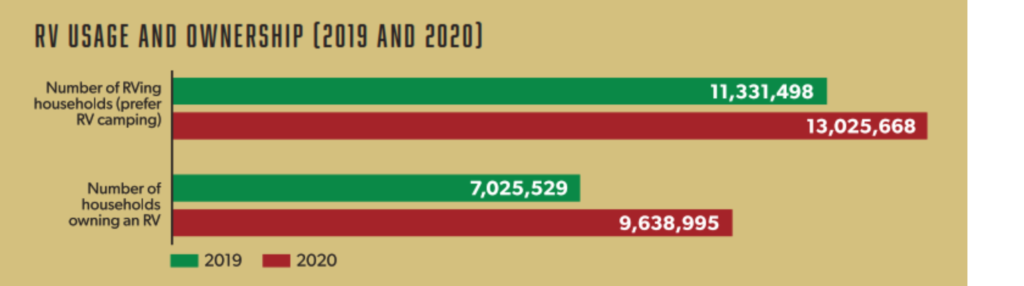

RV-er households increased from approximately 11 million to 13 million over the 2019/2020 period. Additionally, an incredible 9.6 million households indicated an intention to acquire an RV within the next 5 years. Among current RV owners who planned to buy another RV in the next five years, the numbers for Millennials and Gen-Zers stood out, with 84% of 18-to-34-year-olds planning to buy another RV, with a 78% preferring to buy a new model.

While the median annual usage for current RV owners remains steady at 20 days, people intending to buy an RV planned to use their RV a median of 25 days per year. This increase is indicative of the changing attitudes towards remote work and the ability for more people to be able to work from a destination more frequently than traditional vacation days afforded in the past.

A large influx of first-time campers in 2020 resulted in a much higher usage of tents as the outdoor accommodation type, as shown in the table below.[16]

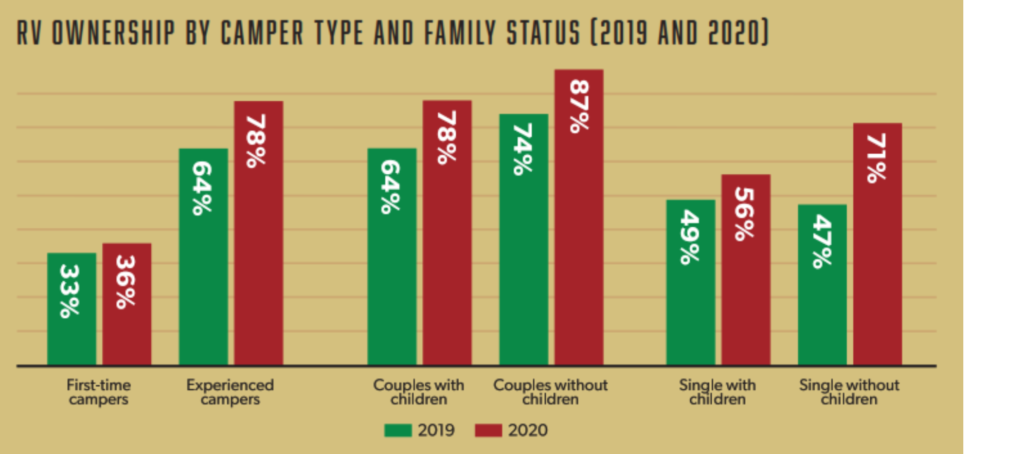

RV ownership has also increased across all generations but is being driven primarily by couples without children, baby-boomers, and Gen X-ers.[17]

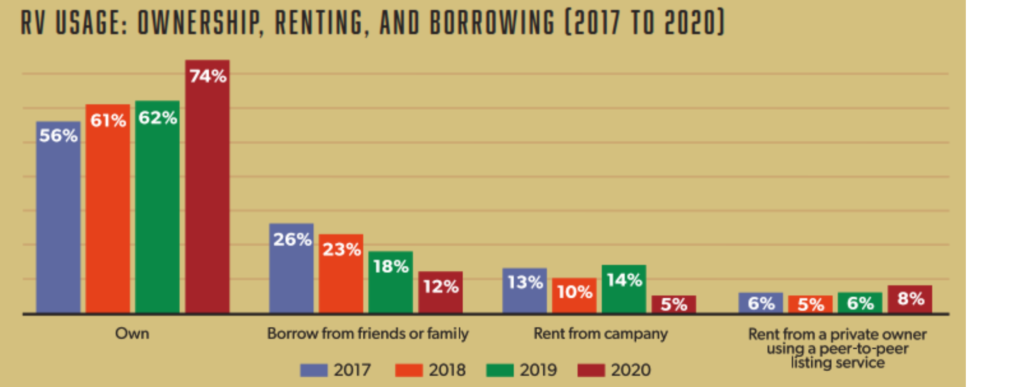

Within America during the last couple of years, there has been a significant rise in actual ownership as compared to borrowing or renting RV’s as well as the number of RV-ing households within the USA. The 12% rise in RV ownership has been attributed to wider concerns regarding the COVID-19 Pandemic. The table below illustrates this rise in ownership over the period 2017 to 2020 inclusive.[18]

As noted above, the increase in RV ownership appears to be closely tied to the COVID 19 pandemic with 6 out of 10 RV owners of the view that RVing was a safer way to travel by reason of the pandemic.

The table below illustrates how RV usage is tied either to ownership, borrowing from friends and family, renting from an agency or peer-to-peer rental services over the period 2017 to 2020, with a significant 12% leap in ownership in 2020.[19]

Nearly a third of the respondents in the study (31%) were “first-time owners,” underscoring the growth of the industry in the past decade. Ownership is spread widely not only across age levels, but also across genders, as well as household income and education.[20]

N.B. These are selected extracts form the 2021 North America Camping Report, based upon a total of n=3,926 surveys among a random sample of US [n=2,436] and Canadian [n=1,500] households.

CHINA

The China Outdoor Hospitality Market has been considered within Article One, where market growth was skewed to the RV sector. Readers are referred to pages 11-13 inclusive of that initial Article for the China RV market coverage.[21]

By way of update, there were around 130,000 RVs in China by the end of 2020, data from the China Auto Dealers Association showed. A total of 1,274 RV companies were registered in the first half of 2020, up 17 percent from a year earlier, according to Qichacha, a major enterprise credit record investigation agency in China. Maxus, a major RV producer in China, said it sold almost 1,000 RVs in 2020, as the sales started to rise in the second half of last year. The vehicle-maker expects to sell 2,700 RVs in 2021. In all, 11,359 new RVs were sold, and 1,217 pre-owned ones were traded last year, according to CADC data. Most of them were sold in cities in the Yangtze River Delta region as well as Sichuan and Guangdong provinces.[22]

Car rental and self-driving tourism surged in popularity as domestic tourism recovered in China, as it allowed tourists to travel in a way that felt safer, and to access off-the-beaten-track destinations more easily. The rising demand for self-drive travel is boosted and facilitated by China’s increased efforts in improving the road network, especially in the vast rural areas.

According to the Ministry of Transport, China’s rural road network now extends 4.35 million kilometres, accounting for about 84 percent of the country’s total road network. From 2016 to 2020, China built or rebuilt more than 1.4 million km of rural roads. By 2035, the length of the rural road network will exceed 5 million km, according to a development blueprint recently released by the ministry. China is working on improving other infrastructure as well. There are around 1,200 campsites for RVs and other vehicles in the country, and more are under construction.

The sudden increase in RVing and camping is likely attributed to the extended lockdowns in China last year as a result of the COVID-19 pandemic. Months of confinement indoors and restrictions on physical movement resulted in a markedly increased demand for outdoor experiences. And exploring the country solo in rented or owned RVs or through self-driving trips drew in millions of Chinese tourists, according to travel agency site Qunar.

While still small compared to the United States and Western Europe, analysts expect China’s RV market to reach RMB 13.6 billion ($2.1 billion) in sales by 2023. This is up from practically nothing 20 years ago. From 2014 to 2018, RV sales in China climbed from RMB 3.5 billion ($.54 billion) to 7.2 billion ($1.1 billion). The compound annual growth rate was 19.8 percent.

Article Four in this series looks at the Glamping segment of the Outdoor Hospitality Industry and in particular, its growth and development over the last decade.

[1] Kampgrounds of America – North America Campgrounds Report 2021 at page 57[redlining is author’s own highlighting.

[2] Sourced by author primarily from https://tumbleweedtravelco.com/rv-resources/drive/.

[3] Source: KOA,2019 North American Camping Report published by Kampgrounds of America

[4] Source: Great Britain Travel Survey

[5] Source: UK Identity & Passport Service

[6] Source: Parklink

[7] Source: Pitchup.com

[11] Source: Eurostat

[12] Source: The European Caravan Federation (ECF) This is the umbrella organisation representing the national organisations of the European Caravanning Industry. Membership of the ECF consists of 13 caravanning federations and numerous national members of the caravanning industry within the EU member states.

[13] Source: RV Industry Association [USA]

[14] Source: University of Michigan RV Industry Study 2016

[15] Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

[16] Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

[17] Ibid

[18] Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

[19] Ibid

[20] Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

[21] The Outdoor Hospitality Industry Part One at pages 11-13 inclusive

[22] Article entitled “Where there’s a road, there’s an RV” by Li Fusheng in CHINA DAILY. Updated: 04-03-2021