This is the first in a series of articles which examines the growth of the Global Outdoor Hospitality Industry and its broad geographic spread. Part Two will examine the attractiveness of outdoor holidays to a range of consumer segments and consider their motivation for choosing various forms of outdoor holiday accommodations in preference to more traditional hotels and resorts. Part Three will look specifically at the RV sector and try to identify key factors which have stimulated growth in recent years. Part Four will focus solely on the Glamping segment and examine its growth over the last decade. Subsequent Articles will address other aspects of the Outdoor Hospitality Industry.

EARLY HISTORY OF CAMPING

The history of recreational camping is often traced back to Thomas Hiram Holding, a British travelling tailor, but it was actually first popularized in the UK on the River Thames. By the 1880’s large numbers of visitors took part in the pastime, which was connected to the late Victorian craze for pleasure boating. The early camping equipment was very heavy, so it was convenient to transport it by boat or to use craft that converted into tents.

Holding wrote the first edition of The Camper’s Handbook in 1908 so that he could share his enthusiasm for the great outdoors with a much larger audience. Although Holding is often seen as the father of modern camping in the UK, he was responsible for popularizing a different type of camping in the early twentieth century.

He had experienced the activity in the wild from his youth, when he had spent much time with his parents traveling across the American prairies. Later he embarked on a cycling and camping tour with some friends across Ireland. His book on his Ireland experience, Cycle and Camp in Connemara led to the formation of the first camping group in 1901, the Association of Cycle Campers, later to become the Camping and Caravanning Club.

After the First World War, Robert Baden-Powell, who was the founder of the Boy Scouts and the Girl Guides, became president of the Camping Club of Great Britain and Ireland, which fostered the establishment of camping organizations in a number of western European countries. In 1932 the International Federation of Camping and Caravanning (Fédération Internationale de Camping et de Caravanning; FICC) became the first international camping organization.

In the USA, camping may be traced to William Henry Harrison Murray whose publication of Camp-Life in the Adirondacks in 1869 resulting in a flood of visitors to the Adirondacks that summer. Industry growth was briefly interrupted by each of the World Wars, but its popularity spread across the USA, Europe, and Australia until it became a global activity.

Industry terminology to describe a “camping experience” varies from market to market. In Australia and New Zealand, camping and caravanning in rural areas is referred to as” boondocking”. In the USA “boondocking” is the practice of pulling off the highway to stay at free locations in your car, caravan, RV or Winnebago, in spots that have zero or limited facilities. For this reason, it is also referred to as “dry camping”.

Commercial parks are referred to as caravan parks, holiday parks or tourist parks. In North America, these same types of parks are commonly referred to as campgrounds, trailer parks, RV parks or RV resorts. In Europe, they are usually referred to quite simply as “campsites”. The term “campsite” in North America refers to a single site or component within a campground.

Camping has changed from being a cheap form of travel to a real outdoor experience with wide appeal to all age brackets and has become increasingly popular amongst younger generations, especially Millennials and Generation Xers. Baby Boomers have been camping devotees for many decades. Here are some noteworthy statistics. 77 million households in the U.S. [out of a total of 120 million[1]] or 64.17% contain someone who has been on a camping trip. In 2018, 4 million US families camped for the first time with 8% of those campers staying in the backcountry, whereas 65% chose to stay in campsites. Over the last couple of years, 40 million people took RV trips. 28 million Americans undertook some form of camping in 2018.

Broad overview of the Global Outdoor Hospitality Industry

Camping is most simply described as a form of outdoor recreation that is part activity and part accommodation. It has evolved from using various types of tents to include caravanning, recreational vehicles (“RVs”), and luxury offerings, where the different levels of comfort, style and uniqueness have contributed to its popularity in Australasia, Europe, and North America. Indeed, the demand for more luxurious and larger caravans is growing. Gone are the days when campsites could simply provide washing and cooking facilities. Demand is growing for wellness and recreational offerings, as well as wi-fi and other connectable utilities, proper showers, camp general stores and other amenities more usually found in hotels and resorts.

Different types camping may be named after their form of transportation, such as with canoe camping, car camping, RV-ing, and backpacking, which can involve ultralight gear. Camping is also labeled by lifestyle: Glamping (glamorous camping) combines camping with the luxury and amenities of a home or hotel, and has its roots are in the early 1900’s European and American safaris in Africa. The global camping and caravanning markets are expected to grow from $39.85 billion in 2020 to $45.07 billion in 2021 at a compound annual growth rate (CAGR) of 13.1%.

This growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The market is expected to reach $56.6 billion in 2025 at a CAGR of 6%.

Camping is gaining traction in Asia, particularly in China and India. Growth has resulted from cheaper alternative to traditional vacations, a rise in disposable income, rapid technological advances, increased aging populations and early retirement which affords more leisure time, a greater interest in personal wellness, plus curiosity and a desire for both adventure and increased social interaction. Camping per se embraces a range of outdoor holiday activities, including campgrounds, caravan sites and RV [“recreational vehicles”] parks, all of which cater to vacationers seeking to immerse themselves in the joys of the great outdoors.

The industry also includes the sale of caravanning and camping services and related equipment, usually by entities which own and operate sites which can accommodate campers, and the sale of any required equipment, including tents, tent trailers, travel trailers, static and moveable caravans, and RVs.

Whilst on vacation, travellers like to indulge in hunting, fishing, mountain-biking, hiking, off-roading, and water sports as well as wellness-related activities. For the future, it is anticipated that the fastest growing regions in the camping and caravanning market will be Asia-Pacific, especially China plus Africa followed by South America and the Middle East.

Camping and caravanning sites may provide access to facilities such as laundry and showers, playgrounds, convenience stores, bars, and cafes. These establishments may also offer accommodation facilities of their own, such as cabins and fixed campsites plus food services, recreational facilities and organized recreational activities.

The camping market generates in the order of £9.2billon a year in visitor expenditure in the UK alone[2]. Factors that could hinder the growth of the camping and caravanning market in the future include enduring disruption caused by the COVID-19 Pandemic, continued travel restrictions, political uncertainties/adversities, climate change effects due to global warming and opposition from NGO’s and environmental activists relating to recreational activities in campgrounds and RV camps.

GEOGRAPHICAL SPREAD OF THE INDUSTRY

North America

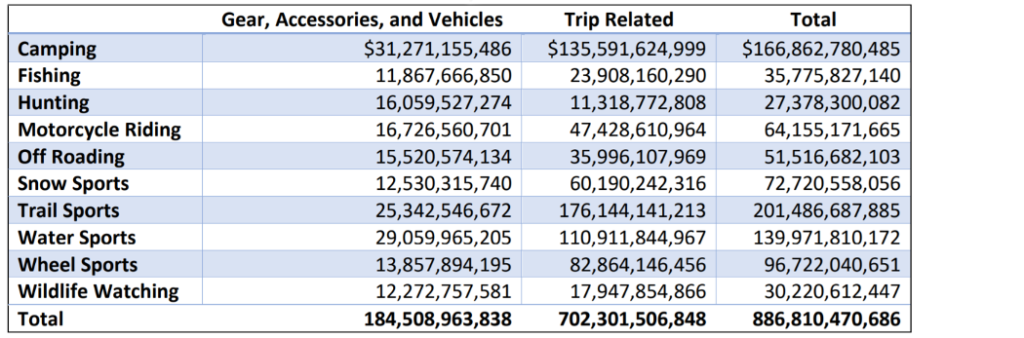

The North American Campgrounds and RV Parks industry has exhibited strong year-over-year growth over most of the five years to 2021. Overall, the cost of using campground and RV facilities is less expensive relative to other types of accommodations and, thus, is especially appealing to millennials and Generation X. The table below provides data for the year 2018 on what is termed Outdoor Recreation with camping having generated USD $166 billion[3].

Rising disposable income and time spent on leisure and sports have driven strong industry growth during most of the last five years. Campers come from diverse backgrounds and varied ethnicities. Interestingly, the demographic breakdown of campers is similar to the population of the United States with one notable exception. Asian-American campers represent approximately three times more than their proportion of the US population.

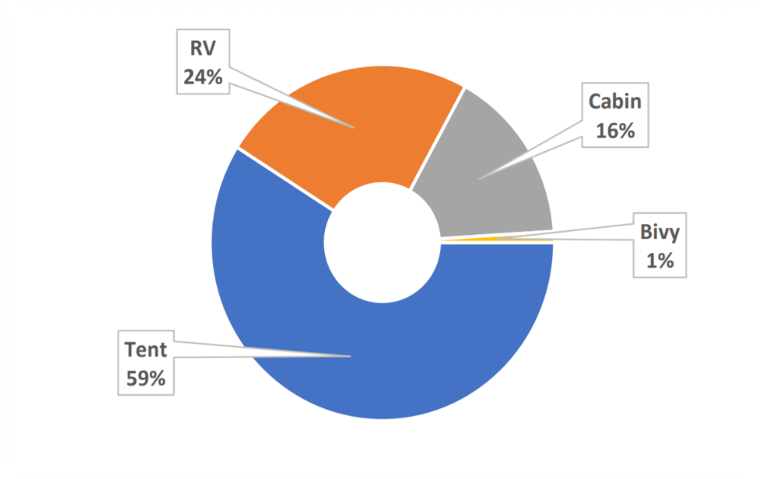

The chart below[4] indicates North American camping accommodation distribution in 2017. Tents were the most popular. “Bivy” refers to bivouac shelter- i.e., a sack in which campers sleep out in the open.

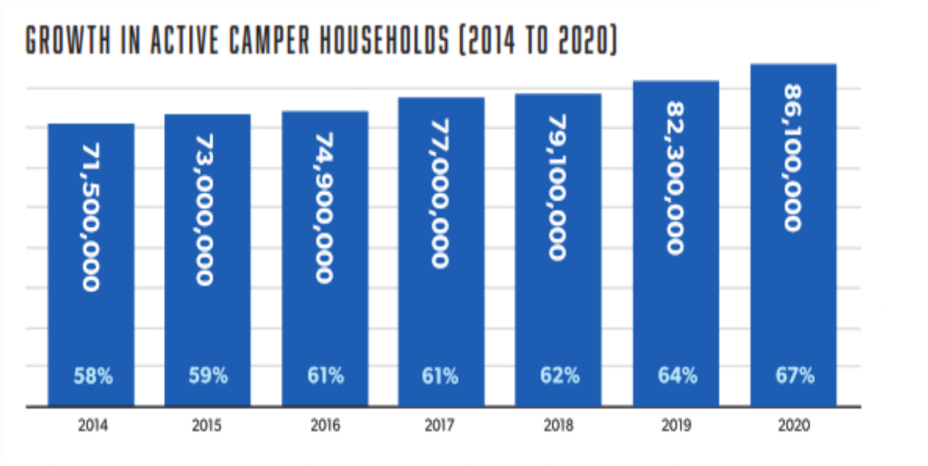

The table below shows growth in US camper households – 2014 to 2020[5]

Growth prospects for the Outdoor Hospitality Industry in North America are bullish, as the industry is embraced by new demographic cohorts and is responsive to changing consumer preferences, especially the desire to get closer to nature, availability of more leisure time, as well as the increasing demand for Glamping experiences amongst more affluent consumers.

Europe has historically held a significant market-share, but North America is the largest region for camping, recreational vehicle, and caravanning vacations, accounted for around 40% of the global market in 2019. Within the European Union, there were 27,960 campsites registered in 2018 from which to choose. Around two thirds of these campsites were in just four of the Member States: France (28%), United Kingdom (17%, 2016 data, prior to Brexit), Germany and the Netherlands (both 10%). One of Europe’s biggest industry participants is the European Camping Group[6] which generated €276m net revenues in 2019. It has a fleet which includes 23,000 units, which are primarily mobile homes and has provided vacations to more than 250 000 families.

The three countries with the highest number of tourist nights spent in campsites in 2017 were France (31% of all nights spent in campsites in EU), Italy (14%) and the United Kingdom (13%). The three countries with the highest proportion of tourist nights spent in campsites in 2017 were Denmark (33% of all nights spent in tourist accommodation in the country), Luxembourg (32 %) and France (29%).[7] It is projected that the revenue of camping grounds, recreational vehicle parks and trailer parks in Denmark will amount to approximately USD $173.8 million by 2024.[8]

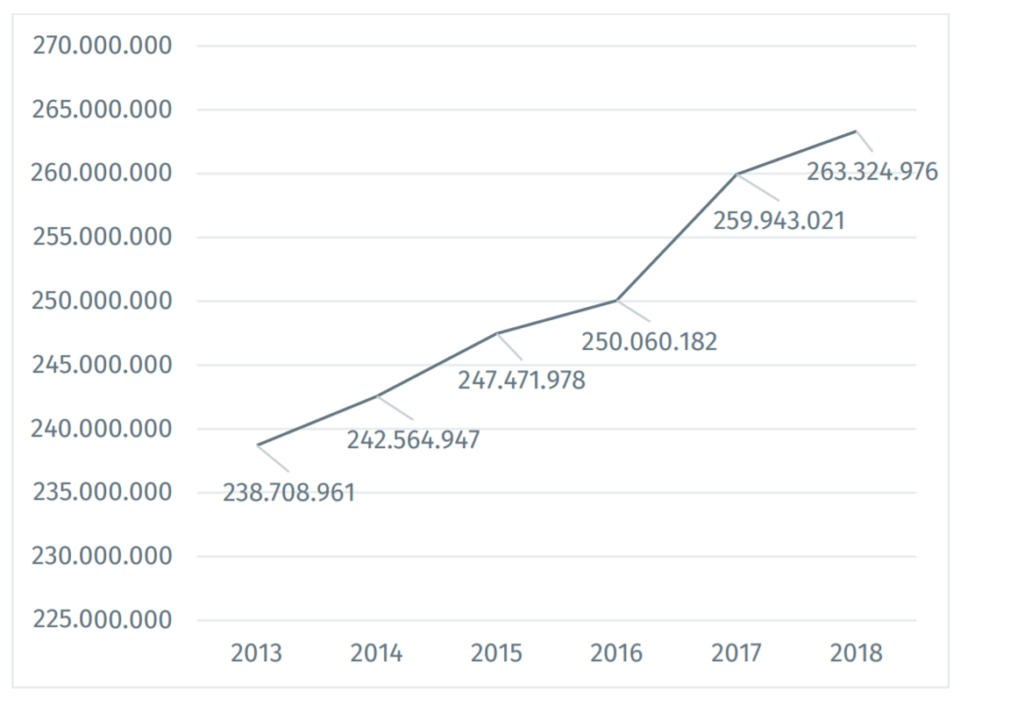

Nights spent at camping grounds, recreation-vehicle-parks, and trailer parks in the European Union before the Covid-19 Pandemic are shown in the chart below, demonstrating a steady growth trajectory.[9]

EU – Nights spent at Camping sites for period 2013 to 2018.

In terms of cost, two adults with a ten-year-old child would pay an average of €35.70 for an overnight stay at a European medium category camping ground in the 2017 peak summer season. In 2019 the most expensive destination was Italy. Here the average price for an overnight stay on a campsite was €48.35. Sweden was the cheapest at €31.46.

In France, the outdoor hospitality sector constitutes the largest accommodation supply. It represents more than half of the supply (59%) of the national metropolitan territory. There were 8,297 campgrounds or 906,883 pitches in 2019, compared to 642,779 tourist hotel rooms (source: INSEE).[10]

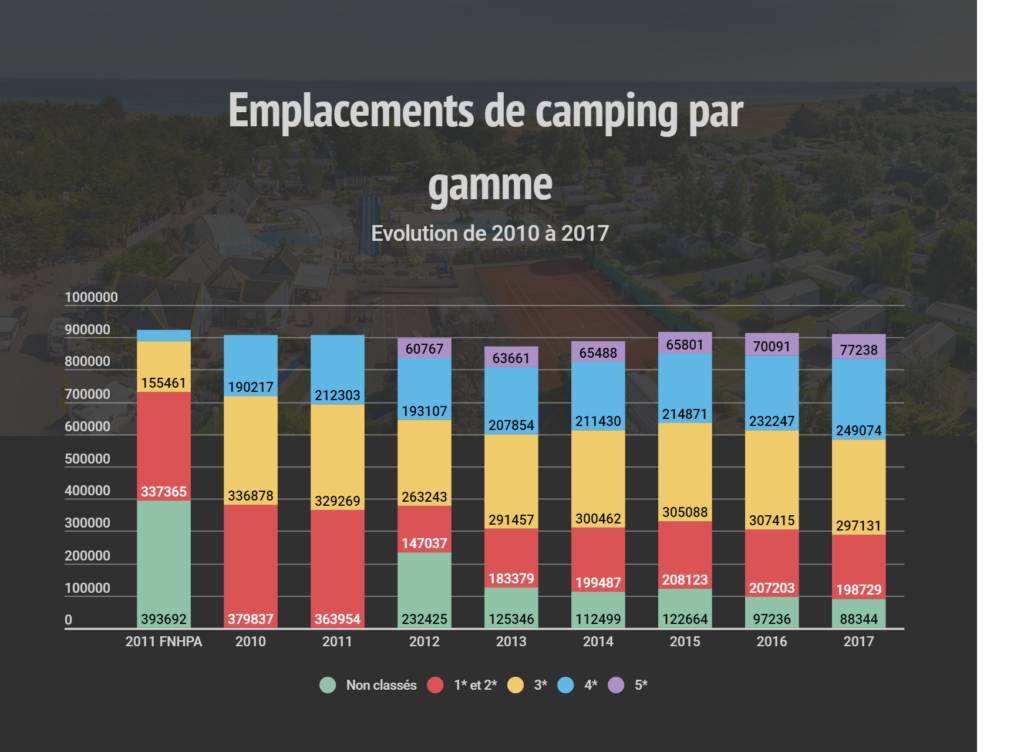

Following a decree law of 23rd December 2009, implemented in July 2012, quality tiers have been introduced within the entire French Hospitality Industry. In reality, standards have been redesigned to meet expectations in terms of safety and comfort for the 21st century. This has impacted campsites across France and led to various improvements making outdoor hospitality more attractive to affluent consumers, because of higher quality campsites.

Campgrounds are largely concentrated along the coasts, particularly on the Côte d’Azur, the Atlantic coast (from Brittany to the Pyrenees) and the Hauts de France. Some of the facilities are scattered in the hinterland, such as along the Rhône Valley (Drôme, Ardèche, Gard), and in the Dordogne, in the New Aquitaine region. The supply is limited around urban centres and across the rest of the country.

As with traditional hotels, 2 and 3-star establishments dominate the outdoor hospitality sector in France, which accounts for half of the supply (51%). Then come the top-of-the-range campsites (4 and 5 stars) which represent about one third of the market (37%), followed by the 1-star or even unrated campsites which account for 12% of the total. This sector is quite concentrated with the four biggest corporations, Leading Campings of Europe (17%), Yelloh! Village (17%), Vacanceselect (13%) and Flower Campings (10%) owning more than half (57%) of the supply of pitches on the market.

The chart below tracks the evolution of French camping between 2010 to 2017 by camp numbers and quality tier.

In Western Europe, the UK had been the stand-out growth market from 2011 to 2016, growing at an average of 7.3% annually despite its strong seasonality and varied and sometimes unpredictable climate. France, with its Mediterranean climate in the south, characterized by a varied landscape, cuisine, and culture, has around 9,000 campsites, reflecting its diversity, offering everything from urbane holidays to wild forests to shore camps along with a growing number of luxury pitches. The French clientele accounts for about two-thirds of the traffic on campgrounds, with the rest coming from foreigners. They tend to flock to the west and north coast of France, while the south is also rich in terms of campsites.

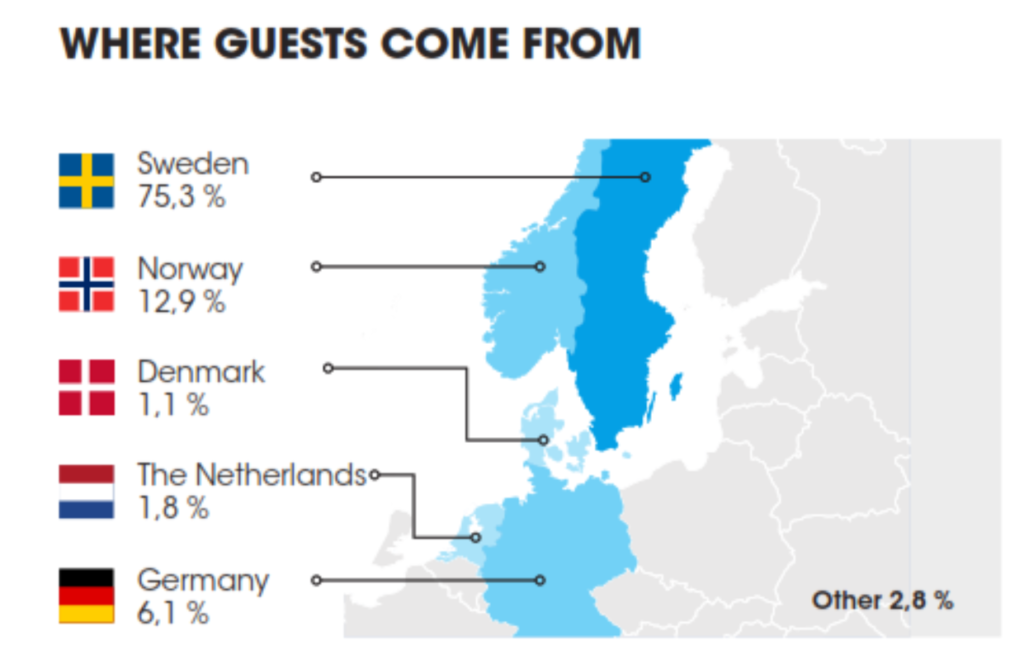

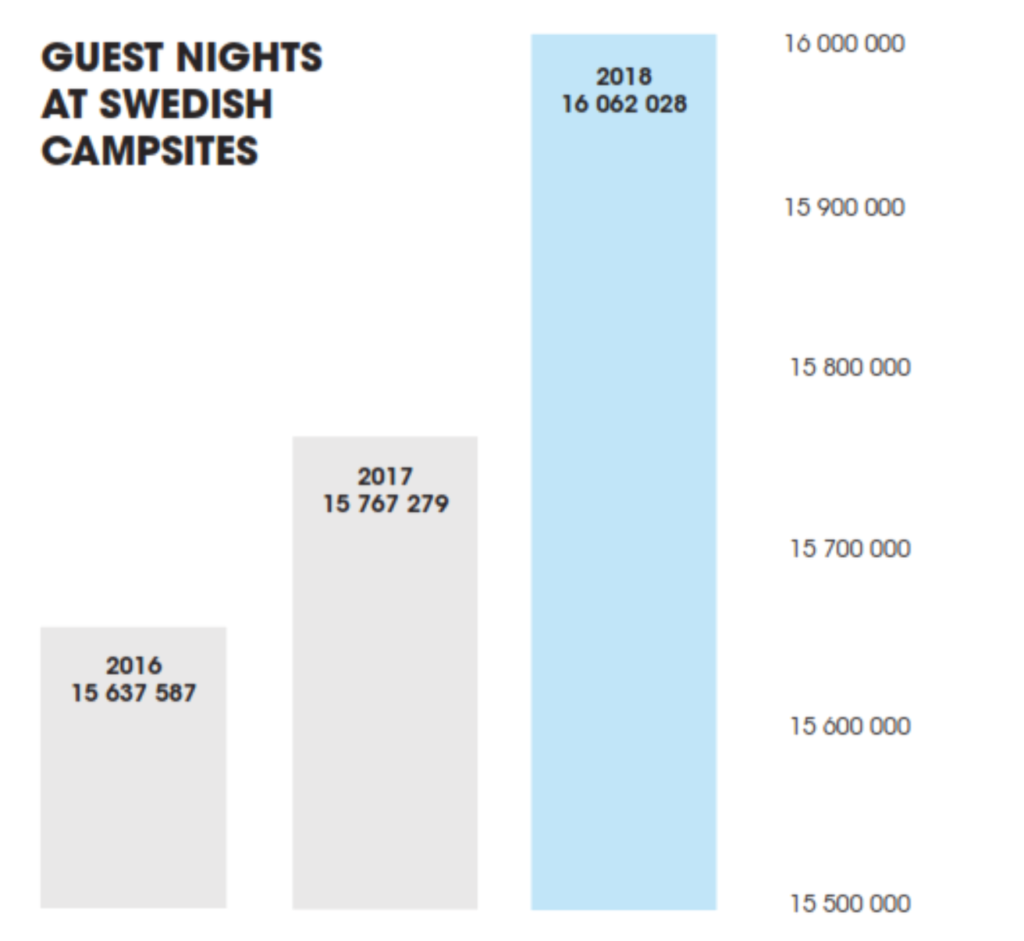

The Scandinavian market is highly fragmented and has more than 2,200 campsites, with First Camp being by far the largest player. Most players in the market are family-owned single-site entities. The number of guest nights at Swedish campsites has increased continuously over the past ten years.

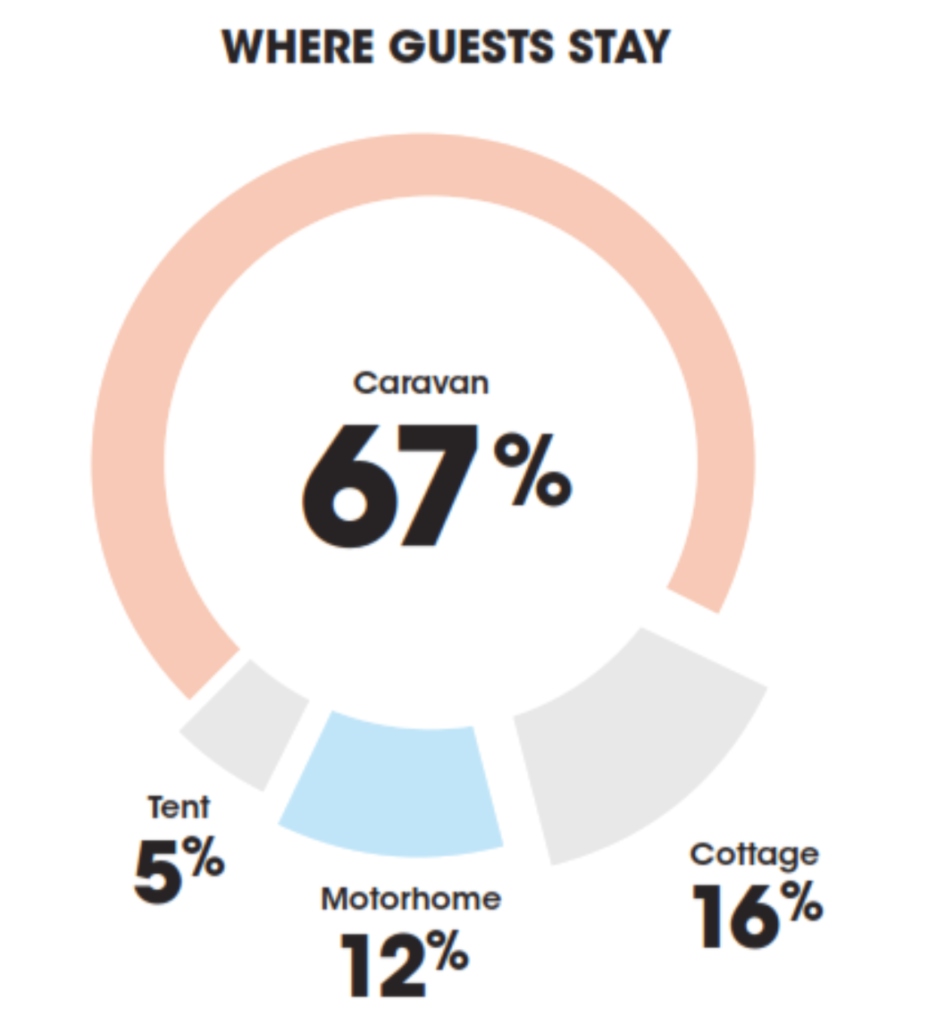

Selected Swedish Camping Industry Statistics[11]

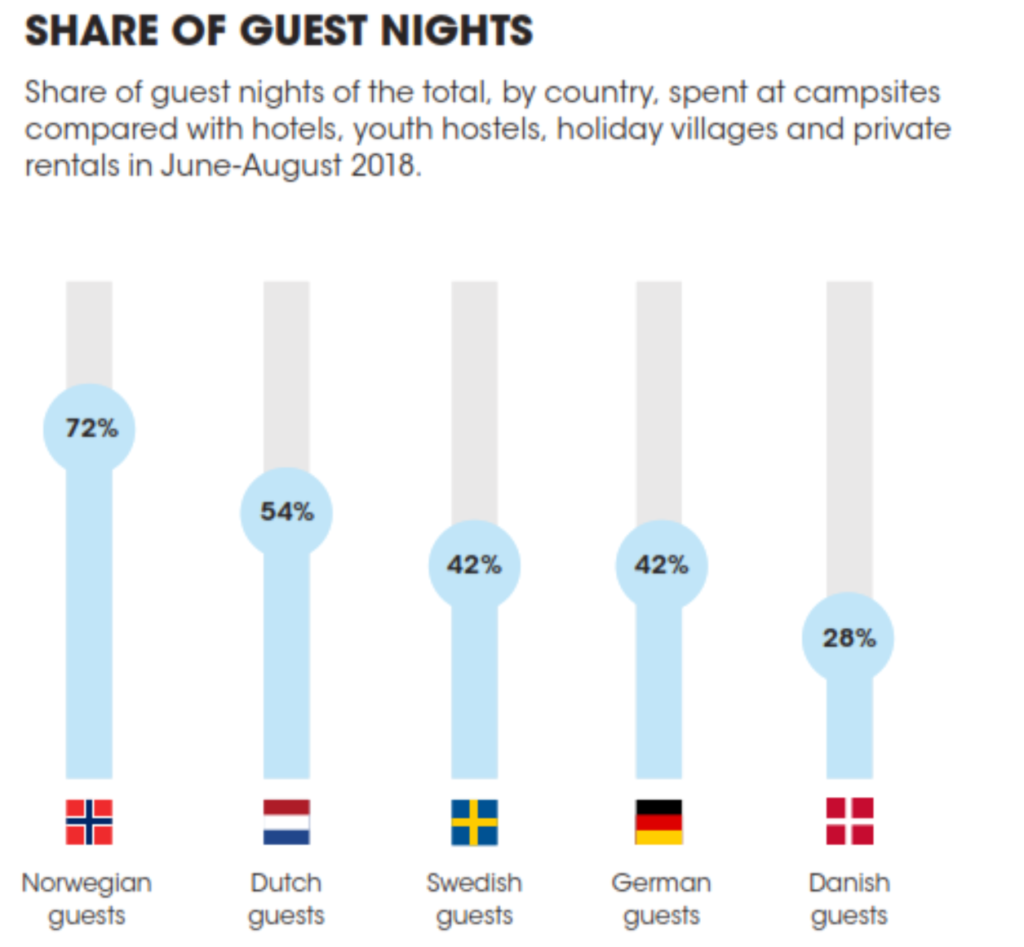

In 2019, during the holiday months of June to August, more than 40 per cent of all of Sweden’s commercial stays were at campsites. In some counties, the market share is higher than 70 per cent. When it comes to guests from the important foreign markets of Norway, Denmark, the Netherlands, and Germany, 55% of visits in Sweden during the summer months are at a campsite. The campsites are the engine of summer tourism in most of Sweden’s destinations and an important factor for the Swedish tourist industry. In 2019, the industry broke a record with a total of 16,747,364 guest nights, an increase of approx. 4 per cent compared with 2018. International guest nights increased by 7.5 per cent. In total, Swedish camping tourism is estimated to turn over approx. SEK.7 billion.[12]

Norway has around 1,000 of Scandinavia’s sites. Camping and nature are integral parts of Norwegian culture, so the country has taken precautions to ensure that everyone can make use of the land[13]. Henrik Ibsen, an iconic Norwegian writer, first defined this aspect of the culture in 1859 with the word “friluftsliv”, which means open-air life. In 2019, Norwegian camping sites had a capacity of 86,792 units.

A recent German Caravan Industry Study[14] has revealed that in 2019 the industry was worth a staggering €15billion to the German economy. The figure represented an 18% jump from the 2016 figure, and according to this Study, the rise was being driven predominantly by motor caravan or motorhome tourism There were 1.6million leisure vehicles registered in Germany of which approximately 43% were caravans and 36% motorhomes.

There were 51 million overnight stays on German campsites by tourists in 2019, which is an increase of 2.6 per cent on 2016. Motor caravan pitches recorded 16.6 million of those stays, which is up by 23% compared to 2016 and estimated to still be growing. The average caravan and motorhome owner spends about €50 per day on their camping holiday in Germany. As part of the study, the dwif[15] conducted a quantitative survey of the 4,200 motor caravan pitches in Germany. In total, these offer capacity for 67,230 motor caravans – 8.4 per cent more than in 2016. The number of overnight stays increased by 19.5 per cent in the same period, followed by an increase in capacity utilisation.

Italy also has a host of camping attractions spread across its cities including Venice, Rome, Florence, Turin, Naples, and Verona. Campsites, located in Northern Italy, as well as along the Mediterranean and the Adriatic coastlines, plus Tuscany, are among the most frequented places for camping sites. While the summer months of July and August typically witness the highest tourist influx, there is a growing realization that the country is an all-year destination.

In Croatia, camping makes up about 25 percent of the total tourist accommodation capacity in the country, and in terms of overall quality, it is one of the strongest segments of Croatian tourism according to German ADAC ratings. Croatia has a total of 785 camps, of which 66 are in the category of 4 or 5 stars, and their capacity covers up to 40.5 percent of the total capacity of Croatian camps.

On an annual basis ADAC, the German Automobile Association, publishes its internationally recognised camping guide, the ADAC Campingfuehrer, in which it evaluates and scores around 5,400 campsites throughout Europe. In 2019, this guide ranked Croatia second in the European Union behind the Netherlands. In terms of Croatia’s direct competition in the Mediterranean, France is the third, Italy is the fifth, and Spain is the seventh. The average rating of campsites in Croatia was 6.31, the Netherlands ranked first with 6.74, and the average rating of camps in Europe was 5.46 according to the ADAC Campingfuehrer.

In 2019 campsites in Switzerland recorded 3.8 million overnight stays representing an increase of 5.0% compared with the previous year. Swiss guests accounted for 2.5 million overnight stays, up 5.7%. Foreign guests generated 1.2 million overnight stays, up 3.4%. German guests accounted for 494,000 overnight stays (+ 7.7% compared with 2018), which corresponds to the highest absolute result among the foreign countries. They were followed by visitors from the Netherlands with 255,000 overnight stays (+ 1.7%), France with 106,000 (+ 1.2%) and the United Kingdom with 91,000 (- 9.3%).

With a total of 810,000 overnight stays for 2019, Ticino ranked first among all tourist regions in terms of absolute overnight stays and saw a 15.9% increase compared with the previous year. The Bern Region followed it with 485,000 overnight stays (+ 5.3%). For Switzerland as a whole, the average length of stay was 3.2 nights in 2019. Swiss guests spent an average of 3.5 nights on campsites while foreign guests stayed 2.8 nights. Of all tourist regions, Ticino recorded the longest average length of stay with 4.2 nights.

Spain

Camping is the tourism accommodation sector which has grown the most in recent years. In 2019, Spain’s campsites accounted more than 40 million overnight stays, becoming the second most popular tourism accommodation segment in the country. Camping in Spain appeals to both foreign and domestic tourists. Spain has approximately 1,100 registered campsites distributed throughout the country, with the highest percentage in Catalonia and along the Mediterranean coast. Spain is also home to approximately 60,000 motorhomes, 10,000 camper vans and 230,000 caravans, many of which are owned by rental companies.

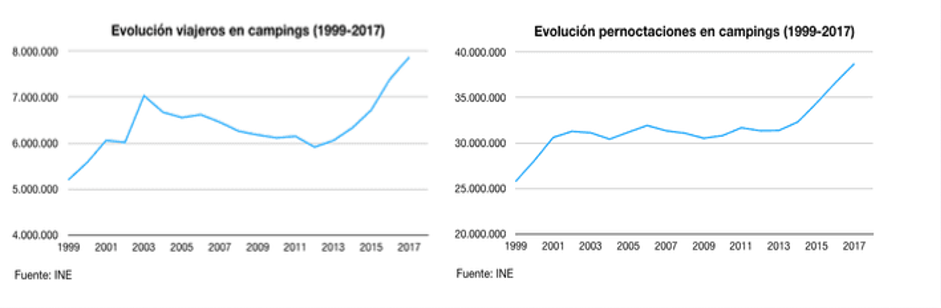

The graphs below show growth in the total numbers of campers over the period 1999 to 2017 as well as growth in the number of nights spent in camping accommodations.

In summary, The Outdoor Hospitality Industry is ubiquitous across Western Europe and, as might be expected, is especially popular in the warmer regions of southern France, Italy, Portugal, and Spain, as well as being the most popular form of holiday accommodation in several Scandinavian markets. Going forward, Europe is expected to retain a dominant position in the global camping and caravanning market, second only to North America, for a variety of reasons including:

- Rise in “staycations” due to the Pandemic, forcing vacationers to take holidays within their own countries.

- Increased frequency and length of holidays by younger demographic segments.

- Growing popularity of mobile homes and the freedom they confer.

- Wider appeal to more affluent consumers through the rise in Glamping.

Australia

The State of Industry 2020 Report from The Caravan Industry Association of Australia indicated that in 2019, the total caravan and camping visitor nights exceeded 60 million and 14 million trips for the first time. When you reflect that there are around 25 million Australians and 8.4 million households, caravan and camping holidays have become an integral part of the Country’s national travelling behaviour.

The industry has been overshadowed during the last 18 months by an uncertain world where a devastating bushfire season, as well as unprecedented flooding in Australia’s Eastern States, coupled with the COVID-19 pandemic and restrictions on inter-state travel after state border closures, has firmly applied the brakes on what was an incredible period of growth for Australia’s caravan and camping industry.

To put this into context, since 2010 the market has grown by:

- an additional 5.5 million caravan and camping trips.

- an extra 17.3 million nights spent caravan and camping annually; and

- over 196,000 recreational vehicles have been manufactured and registered.

According to Tourism Research Australia, 2019 was the year that caravan and camping became the most popular holiday type for Australians.

The Asia Region

A study published by C9 Hotelworks in February 2016 covering the southeast Asia tented accommodation market specifically identified the advent of Glamping where this particular lodging segment was in the early stages of development within the region. At the time of that Report, there were 14 standalone and 15 hybrid resorts providing a total of 533 tents [and four pipeline projects] within the region.

The upscale segment was leading the market with forest and beach locations the most popular [83%]. Thailand was the market leader with 39% of the supply and the average rack rate across the region, per tent, was US $270. Glamping, per se, will be considered in detail in a subsequent article.

Growth trends are evident in various parts of Asia-Pacific and in other regions where climate is conducive to nature-based holidays. It was anticipated that North America would register the fastest CAGR over the next five years, prior to the onset of the Pandemic but China must be also examined, as the rate of growth in the last five years, starting from an extremely low base point, is especially significant.

China’s camping activity appears to be strongly focused on the RV segment and has undergone significant changes over the past several years, including a national focus on the development of tourism, campgrounds, and the RV industry. With a growing demand for RVs and a shift in consumers’ travel preferences, tourism experts in China anticipate a surge of RV-related business in the coming years.

More people are choosing to explore the countryside and hit the roads with recreation vehicles.[16] China’s domestic RV market is in the early stages of development. By the end of 2016, Chinese consumers had purchased an estimated 25,000 RVs; this number could be as high as 500,000 at the end of 2020 as China’s growing economy and rising middle class continues to energize an increasing demand for leisure-related goods and activities, such as RVs and camping.[17]

China has 56 active RV manufacturers. Chinese manufacturers offer a variety of products from towable RVs to motorhomes. Domestically produced RVs dominate the marketplace, accounting for most overall RV sales. Despite the growing popularity and demand for RVs, China has a shortage of available campgrounds. In 2014, China had around 200 campgrounds nationwide, of which less than 50 were RV-ready.

By the end of 2016, the number of operational campgrounds increased to 469, with an additional 489 under construction.[18] The lack of an adequate RV infrastructure, however, has led to unrealized need for downstream goods and services by RV travellers (e.g., camping equipment, clothing, fuel, food, etc.).[19]

Campground development has received great support from the government in China. In August 2014, the State Council called for the development of campgrounds and campground standards and an updating of existing requirements on travel trailers. In October 2014, it called for “building auto campsites and RV campgrounds,” and it included RVs and camping among one of the six growth areas the government is focusing on in an effort “to promote consumer spending on tourism and leisure activities.”

In August 2015, the State Council set a goal of establishing 1,000 RV campgrounds by 2020 nationwide as part of China’s 13th Five Year Plan (2016-2020). In a March 2016 government report presented at the annual session of the National People’s Congress, Premier Li Keqiang reiterated the government’s support for developing campgrounds in the country.

These guidelines included some specifics on promoting the use of RVs, including a call to review and improve driver’s license requirements, vehicle registrations, and an allowance for motor vehicles to tow travel trailers weighing 2.5 tons or less.[20] The State Council noted in a statement accompanying the announcement that RV tourism has developed at a “staggering speed” over the past two years with an annual growth of 85%.[21]

In November 2016, China’s National Tourism Administration (CNTA) and 10 other national ministries and departments that have oversight of RV and camping-related issues made a joint announcement endorsing the promotion of “self-driving” tourism and RV tourism. The announcement included several guidelines, from RV manufacturing to land use for campground development and infrastructure for RVs, such as roadside services, campground networks, self-driving clubs and related outdoor activities, and RV rental services. The guidelines also called for the development of 2,000 campgrounds by 2020 (which is an increase over the State Council’s goal in August 2015 of establishing 1,000 campgrounds by 2020).

In addition to public funding for campground development, the government has begun promoting private-public partnerships as well as encouraging private investment to speed up the development of campgrounds. Also, the Chinese automotive industry has listed RVs as a key emerging sector to boost healthy, rapid, and stable economic development. Groups and organizations representing the growing interests of the RV industry, campgrounds and campground development also continue to emerge.[22]

At the local level, large cities, such as Beijing and Shanghai, have been actively involved in efforts to develop tourism, campgrounds, and the RV industry. In October 2014, the first campground for RVs in Shanghai opened on Chongming Island. It features recreation areas that offer a range of activities for RV owners and visitors wanting to rent RVs onsite.[23]

Newly developed campgrounds continue to emerge monthly across China. Among these include sites in the Anhui, Chengdu, Guangdong, Guizhou, Heilongjiang, Hebei (including Zhangjiakou City where many of the events for the 2022 Winter Olympics will be held), Henan, Liaoning, Ningxia, Shaanxi, Sichuan, Yunnan, and Zhejiang provinces. National and local tourism officials have plans to develop other campgrounds in some other locations, as well.[24]

With most international borders having been closed for the best part of 2020, mainland Chinese tourists have been exploring their own country instead. A small but growing number have been taking the road less travelled, driving rented or their own recreational vehicles (RVs). Such freedom is increasingly appealing to mainland Chinese in the Covid-19 era: according to figures from data platform Qichacha, 849 companies related to RV rental were established in China in the second quarter of 2020, a 36 per cent year-on-year increase.

A major beneficiary has been the Shanghai Automotive Industry Corporation (SAIC), which both makes RVs and rents them out, through the RV2Go booking platform. The state-owned enterprise claims that, when it comes to RVs, it has 50% of the manufacturing market and 70% of the rental market in China. The company says rental income has risen 510% in 2020 compared to 2019, and it has introduced new routes to appeal to customers.

RV2Go was set up in 2018, a year after SAIC established a 1.8-billion-yuan (US$275 million) factory in Jiangsu province to develop and manufacture RVs. The platform now has 2,000 vehicles on its books, which can be rented from shops in 31 cities, in 18 provinces, manned by 500 staff. The company has so far mapped out 1,000 suggested routes. A network of RV parks and hotels with fields equipped for camper vans has also sprung up around the nation. Many offer power and water supplies, Wi-fi, shower blocks, convenience stores, and kitchen and barbecue facilities.[25]

Hainan, often referred to as the Hawaii of the east received some 83m tourists in 2019 of which only 1.42m were foreigners and the Island’s Tourism Authority is now promoting Hainan as the best place to go camping during the winter season.

India too is witnessing a huge level of interest in camping and the use of RVs for vacations. According to the Economic Times of India for 24th April,2021, the backpacker segment alone has seen a 60% rise in activity over the last 24 months. Precise figures for the size of the outdoor accommodations industry are hard to come by but the importance and growth potential of the sector has already been recognised by the Indian Ministry of Tourism who have published a 15 set of guidelines regarding the development of new campsites.

Factors driving the growth of the outdoor accommodations segment in India include:

- Expansion of the youth market

- Entry of new segments, e.g., families, middle-age groups, to the camping market

- Growth of camping sites, particularly in Uttarakhand, Himachal Pradesh, Ladakh, Rajasthan, Maharashtra, Goa, and the Northeast

- Improvement in the quality of tents and facilities at camping sites.

[1] Source: US Census bureau’s 2019 figures

[2] Source: US Census bureau’s 2019 figures

[3] Source including table- CBRE Campground Industry Trends Report 2019

[4] Source: CBRE Campground Industry Trends Report 2019

[5] Source: The 2021 North American Camping Report sponsored by Kampgrounds of America, Inc.

[Author’s note- The Study referenced in footnote 5 covers the USA and Canadian Camping Industry]

[6] https://www.europeancampinggroup.com/uk

[7] Source: Eurostat

[8] Source: Statista

[9] Eurostat

[10] Source: Hon “Outdoor Hospitality: evolution, revolution published 10th July2019 and updated 5th February 2021

[11] Source: SCR Svensk Camping

[12] Ibid

[13] Source: Norway’s Outdoor Recreation Act of 1957

[14] Source: Germany’s Caravaning Industrie Verband (CIVD) 2020

[15] A think tank which is associated with the University of Munich.

[16] Source: Zheng Xin, “RV Enthusiasts at Home on Wheels,” China Daily, April 7, 2014.

[17] Source: Ma Ziping, “More Families Hit the Roads in Homes on Wheels,” China Daily, January 7, 2016.

[18] Source: “An Exciting Future for Recreation Vehicles,” China.com, April 1, 2017.

[19] Source: Robert Paschen, “Kings of the Road: The RV Comes to China,” City Weekend, May 14, 2014:

[20] Source: Zhao Xinying; “Opinions on Promoting the Development of Self-driving Tourism and RV Tourism,” National Tourism Administration,November 11, 2016, http://www.cnta.gov.cn/jgjj/jgsz/sszwz/ghfzycws/gzdt/201612/t20161202_808335.shtml.

[21] Source: Recreation Vehicle Industry Association, “China to Establish 2,000 Campsites for cars by 2020,” The State Council, 11th November 2016.

[22] Ibid

[23] Source: Robert Paschen, “Kings of the Road: The RV Comes to China,” City Weekend, May 14, 2014.

[24] Source: Recreation Vehicle Industry Association, “China to Establish 2,000 Campsites for cars by 2020,” The State Council, 11th November 2016.

[25] Source: Elaine Yau article published 6th December 2020 entitled “Chinese tourists are discovering their own country in RVs as avoiding crowds becomes the norm”