This is the second in a series of articles which examines the Outdoor Hospitality Industry. This article looks at the various segments which comprise the largest elements of this Industry; it looks specifically oat camping and caravanning in their various manifestations and provides data from the North American Camping Industry which illustrates its growth and appeal, as well as demographic data, including household income [North America only] motivations and preferences including some additional insights from other markets plus some comparisons with the Recreational Vehicle [“RV”] sector.

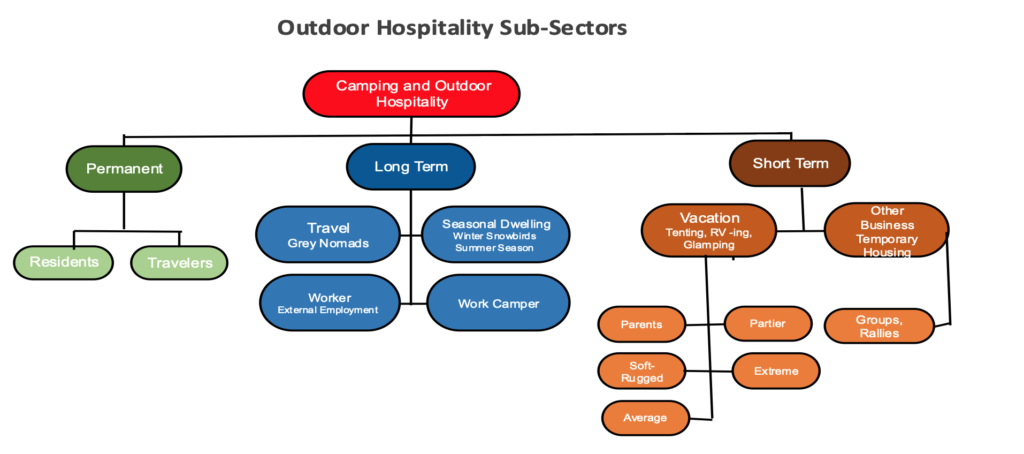

To better understand the Outdoor Hospitality Industry, it may be helpful to look at its segmentation as well as the demographics of the Outdoor Accommodations Communities. Whilst the initial focus will be on camping in all its various manifestations, other segments such as the Recreational Vehicle [“RV”] will be examined in a subsequent article, given the size of the RV industry in mature markets like Australia and North America as well as in parts of mainland Europe and its growth potential in emerging markets such as China and India.

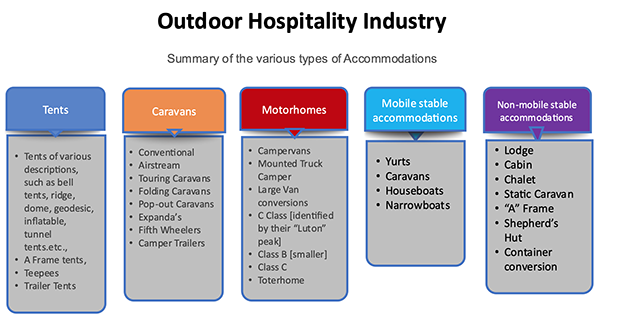

“Camping” in the popular sense originally referred to living in a tent for a short period of time but it now embraces a host of other forms of temporary shelter and product lines. These are summarised in the diagram below.[1]

The Study referenced in the footnote below drew attention to camping’s “Push-Pull” aspects where the “push” factors were explained as the consumers’ internal motives for escapism, rest, relaxation, personal wellness, curiosity, adventure, and social interaction. “Pull” refers to a destination’s own unique “pull” factors which are becoming more elaborate over time as offerings become more remote, desirable, sophisticated, experiential, or even transformative.

The importance of climate and accessibility must not be overlooked. For obvious reasons, Outdoor accommodations are most popular and sought after in warmer climates, hence their popularity in North America, Australia, southern Europe and their current growth in India and parts of China, especially Yunnan Province and Hainan.

Camping has wide demographic appeal to virtually all age groups and can be broken down into three primary segments namely “full-time”, “long-term”, and “short-term”, as shown in the diagram on the previous page. Each will be described briefly before looking at the industry’s bigger picture.

The “permanent” category covers residents who choose to live all year round in a caravan or motor home [RV] situated within a permanent site, as well as those who live permanently in their motorhome or trailer but choose to move around. For those living permanently within a campground, advantages include lower costs, location, convenience as well as access to amenities and proximity to family and friends.

The transient category is popular in Australia where according to the Campervan and Motorhome Club of Australia, there are some 340 “RV-friendly towns” across the country which provide a site for “free campers” to stay. The Club also indicated that Australia had almost 700,000 registered recreational vehicles on the road and one-third of them were free camping with 12% of the club’s 70,000 members on the road permanently. 93% of their members had toilet facilities on board.

These “free campers”, as they are known, stay in public places rather than established caravan parks and camping grounds, and they do create some controversy with local councils, not all of whom welcome them into their hinterland. They are usually not popular within coastal communities but more welcome within Australia’s interior. This category is also referred to as ‘the Grey Nomads” and is mirrored to some extent by some of the Snowbirds found in both Europe and the USA who travel for up to 4 or 5 months a year to escape to warmer climates and often stay in one location once they have reached their destination.

Non-traditional, long-term segments can be found in locations where work requires them to stay in temporary accommodations within a camp-style environment, again found in Australia with workers who undertake Fly-in/Fly-out [“FIFO”] in the resources sector, who may be required to use these camp-style accommodations.

The short-term category and its sub-categories, as shown in the diagram, are largely self-explanatory. A USA Study by the Outdoor Foundation in 2011 put campers on vacation into five categories: “parents”, “partier”, “soft-rugged”, “extreme”, and “average”.

Parents tend to view camping as an attractive and affordable holiday alternative which provides quality time with children plus access to outdoor leisure activities. “Partiers” view camping as an opportunity for fun and entertainment, where they can participate in special events such as music or beer festivals. “Soft rugged” are mature campers who purposely overcome traditional camping discomforts by utilizing RV’s, caravans, and cabin accommodations to be in a home-away-from-home style environment. “Extreme” campers are predominantly males who seek out primitive, intense and challenging wilderness experiences. The “average” segment comprises the mainstream camping enthusiasts for whom camping holidays are the norm.

Outdoor accommodations can also be split into five specific “accommodation” categories, as show in the diagram below:

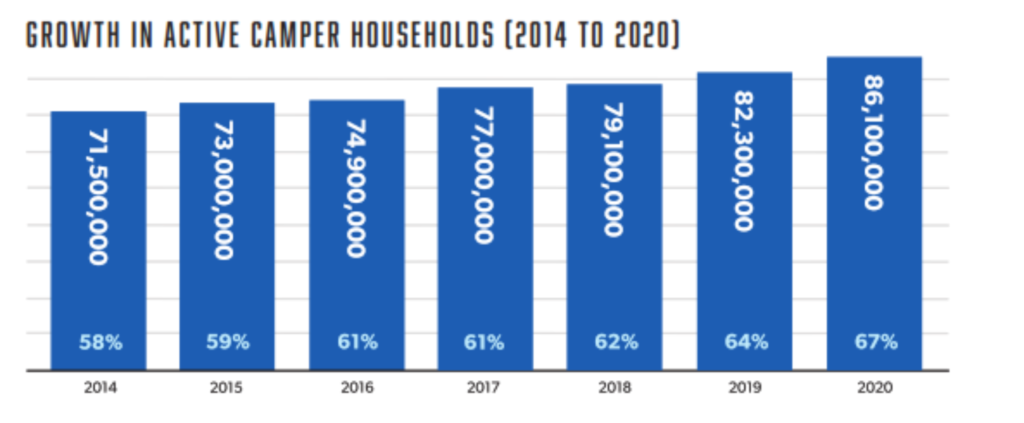

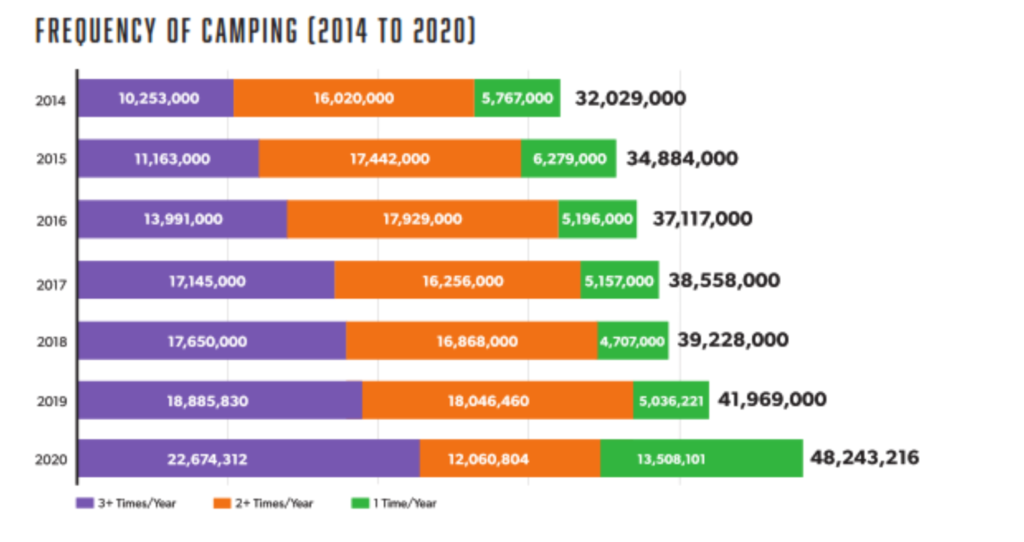

As is often the case, most of the accurate data regarding the outdoor Accommodations Industry is found within the mature markets where there are well-funded entities, including Member Associations, able to undertake meaningful, accurate and up-to-date research. Foremost amongst these is The North American Camping Report sponsored by Kampgrounds of America[2] . Some key data from the 2021 Study [covering year 2020] are included in the following pages to provide insights into mainstream camping within North America.

Chart 1 details growth in active campers in North America for the period 2014 to 2020.

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

Chart 2 shows growth in annual camping frequency over the same period

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

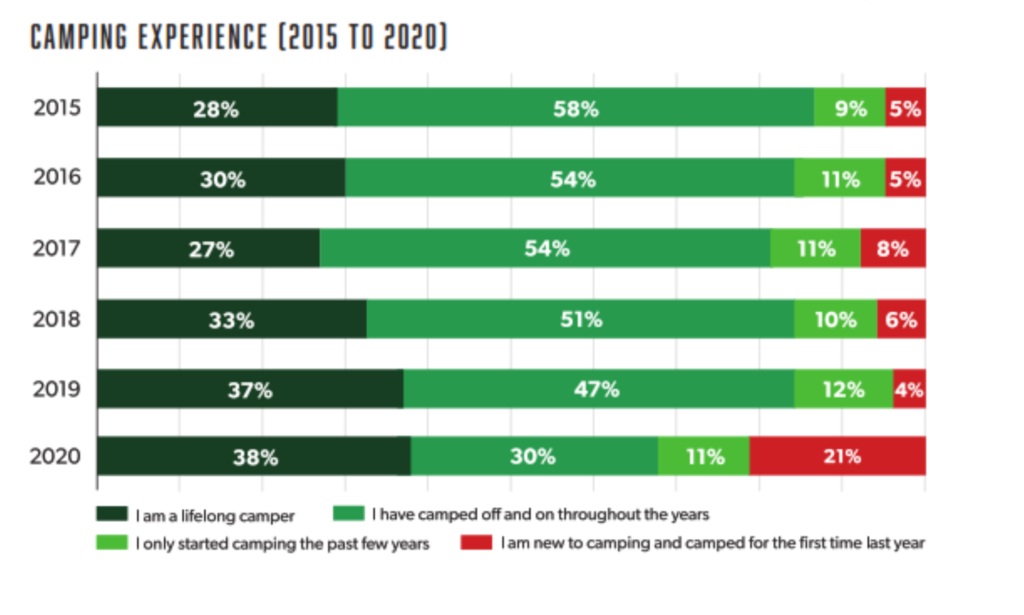

Chart 3 highlights the various levels of experience amongst campers in North America.

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

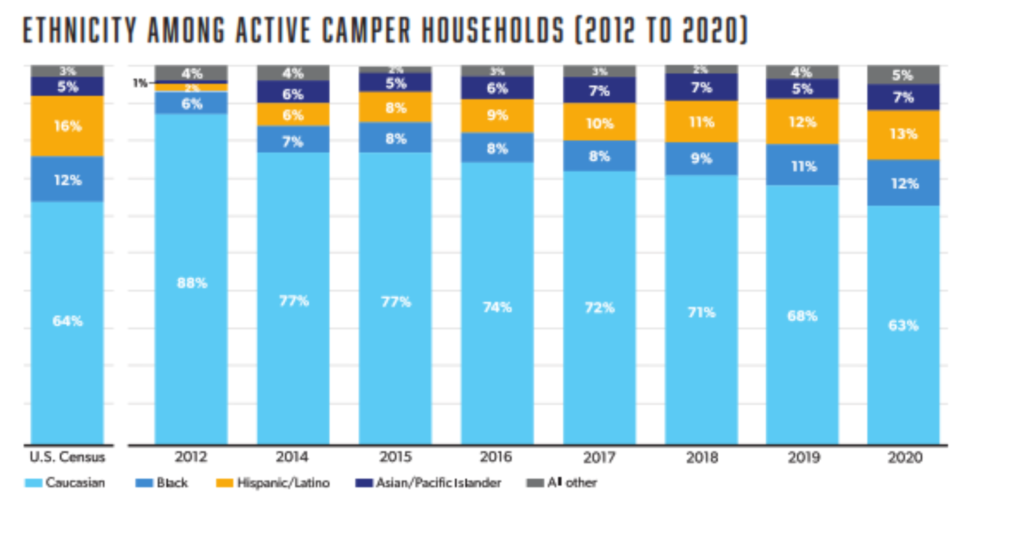

Chart 4 provides an analysis of the ethnicity of campers in North America over the period 2012 to 2020 but with a clear and still growing trend since 2014 towards greater ethnic diversity.

Chart 4.

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

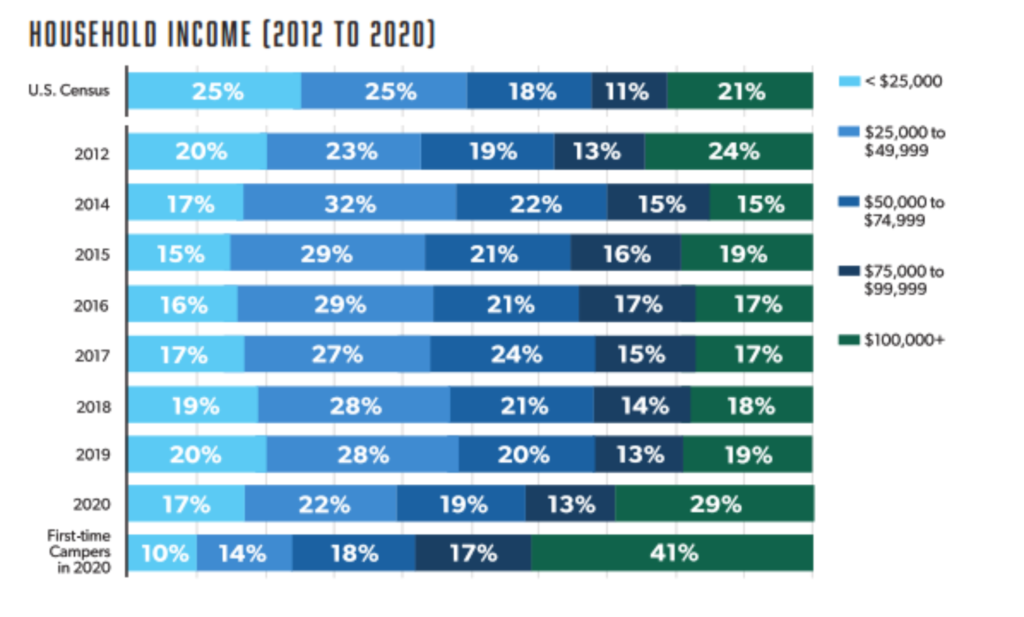

Chart 5 below sets out household income for North American campers with 2019 and 2020 showing a significant jump in income [29%] during 2019 and 2020, especially in the percentage of camping households with incomes above USD $100,000, possibly because of the COVID-19 Pandemic, with curtailment of international travel.

Chart 5.

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

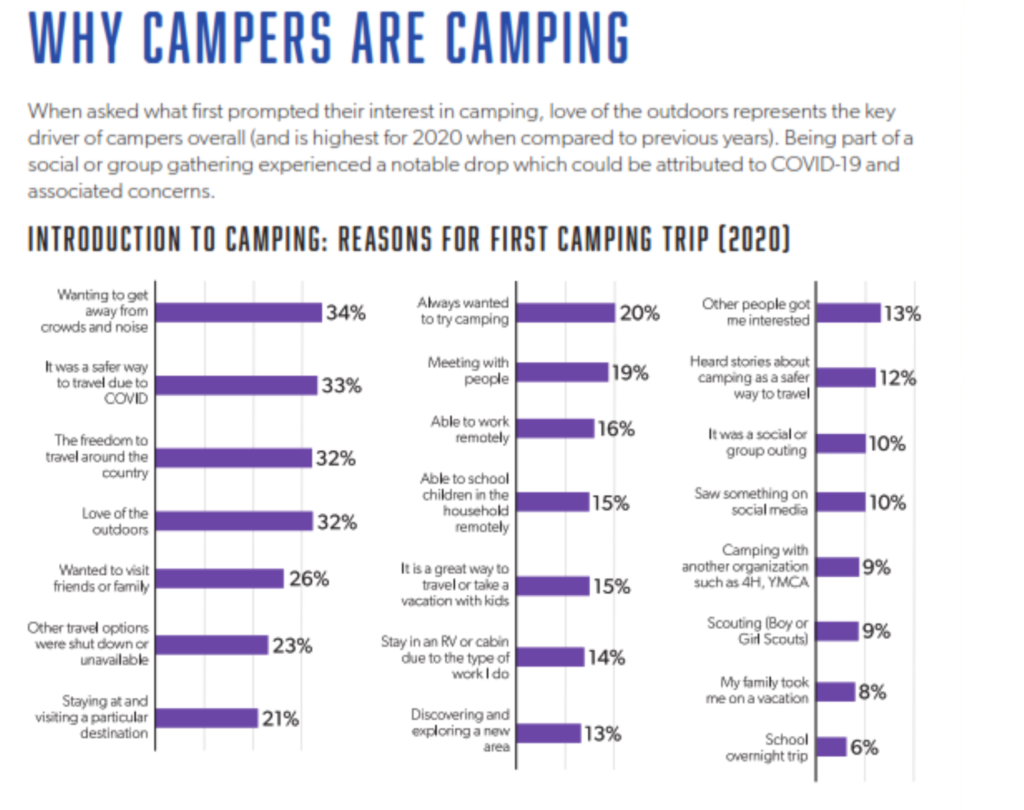

Chart 6 below provides detailed insights into campers’ motivations to go camping.

Chart 6.

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America

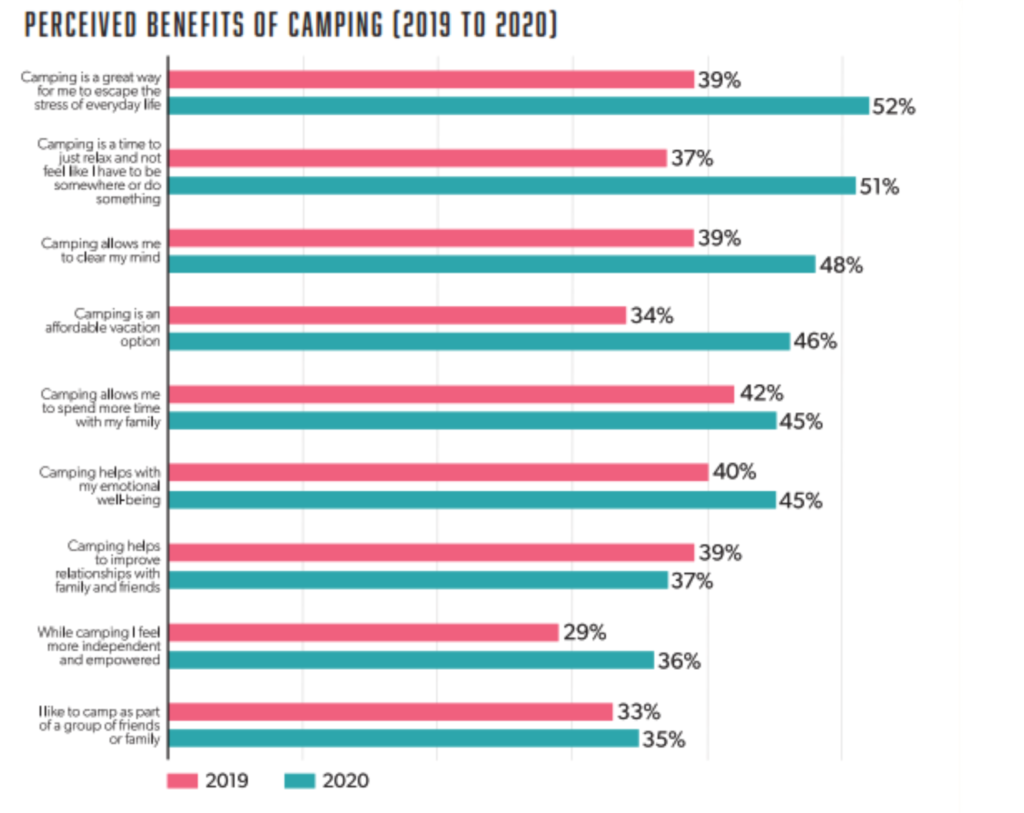

As previously highlighted, the notion of “escape” has already been documented as a catalyst for undertaking an outdoor accommodation experience, where the escape is intended to help avoid daily routines, or because of ambivalence towards urban life, as well as the need for rest and relaxation and the desire to spend time with family and friends.

According to a Report by the British Camping and Caravanning Club back in 2011, spending time outdoors surrounded by nature improves an individual’s psychological wellbeing. It provides an opportunity for mental, physical, and emotional recovery from the stresses of daily life. This subject, the potential health benefits associated with the outdoor hospitality industry, will be considered in greater detail in a subsequent article.

Chart 7 on the next page sets out the perceived benefits of camping as noted by North American survey respondents in respect of the years 2019 and 2020.

Chart 7.

Source: The 2021 North American Camping Report sponsored by Kampgrounds of America[3]

Beyond North America, accurate published data covering the demographics of the outdoor hospitality industry is difficult to source, other than through acquisition of some of the proprietary research undertaken by specialist publishers. The absence of a single EU entity which coordinates current research into the industry across all Member States necessitates searching for relevant data from within the European Union’s travel and tourism statistics and through a myriad of rather disparate press articles, publications and data from Trade Bodies and Associations in France, Germany, the United Kingdom and elsewhere. Data for camping and caravanning tourism is readily available in some of the Scandinavian markets, most notably Sweden[4].

Some similarities between the market demographics of campers in North America, Australia and Europe do exist, especially as they relate to Millenials participating in outdoor hospitality. Of the 75 million active camper households in the U.S., in 2017, 38% were aged 18 to 35—up from 34% in 2016. According to the 2017 North American Camping Survey from KOA[5] Millennials made up 38% of campers, but 31% of the general population.

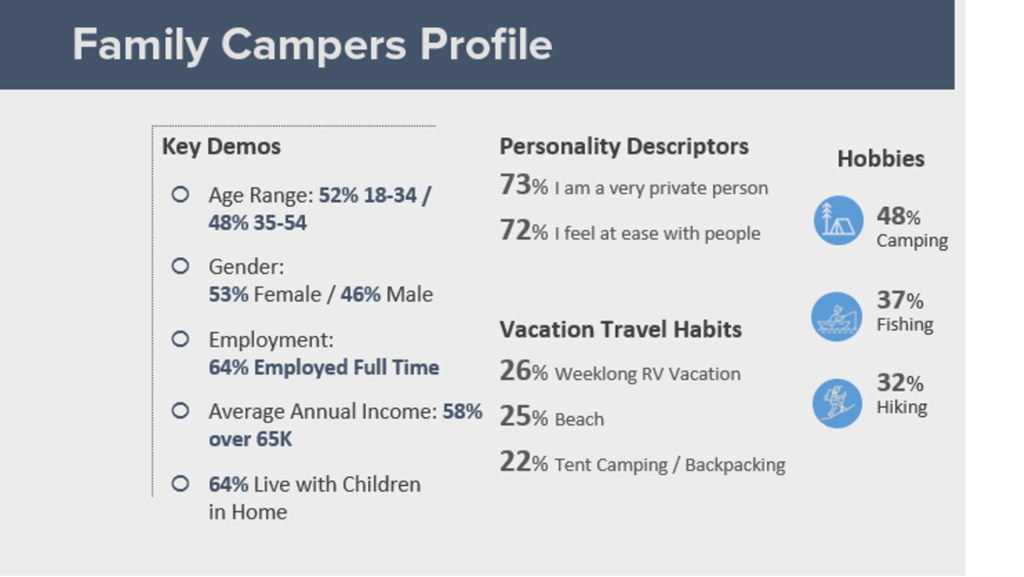

A more recent North American Study[6] published in 2021 provided deeper insights into the demographics and ownership habits of RV Owners, former RV Owners, and prospective RV Buyers. The study identified seven distinct clusters based on RV owners’ unique motivations, needs, and habits. One of the major clusters, as shown in Chart 8 below, was the “Family Campers” which made up 33% of total RV owners.

Chart 8

Source: Go RVing RV Owner Demographic Profile

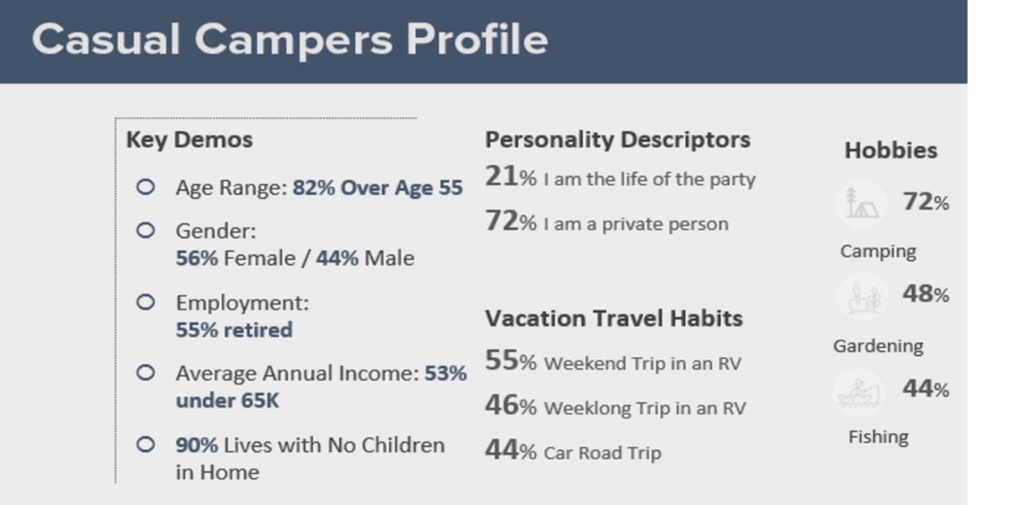

Among current RV owners who planned to buy another RV in the next five year, the numbers for Millennials and Gen-Zers stood out, with 84% of 18-to-34-year-olds planning to buy another RV, with 78% preferring to buy a new model. Millennials and Gen-Zers are thus major target markets for RV Companies. The other clusters comprised Casual Campers at 39%, [profile shown below within Chart 9] Escapists at 16%, with the remaining clusters described as Avid Campers, Adventure Seekers, Full-Timers, and Happy Campers making up the balance.

These insights are useful to identify possible similarities between campers who utilize tents and caravans for their vacations, as compared to those who rely solely on RVs for their vacations.

Chart 9.

Source: Go RVing RV Owner Demographic Profile 2021

If we then look at Germany which has the largest number of caravans of any EU member State, [assessed in 2020 at a total of 698,600[7]] a 2019 study undertaken by GfK[8], the largest German market research organization, revealed how significant the growth potential was likely to be for leisure-vehicle vacationing in the coming years.

According to GfK, some 14.2 million Germans over the age of 18 were considering a holiday in a leisure vehicle at some point in the next five years – a figure that represented nearly 25% of German adults. The study also confirmed that leisure-vehicle vacations appealed especially to people between the age of 23 and 37 and to individuals with above-average household incomes.

According to the study, 23% of Germans who were considering the possibility of undertaking a leisure-vehicle holiday within in the next five years were between the ages of 25 and 34 – with most of these individuals under the age of 45. Another interesting finding of the GfK study was the correlation between income level and interest in leisure-vehicle vacations. According to the study, 38% of individuals who were considering the possibility of embarking on a caravanning holiday had a net monthly household income of more than €3,000. Germany, France, and The Netherlands were the most popular caravanning destinations.

Still within Europe, a detailed Report [51 pages] on Dutch holiday taking[9] published in 2017 provides insights into their camping holidays, booking trends, party sizes and location preferences but contains no detailed demographic data regarding the campers themselves.

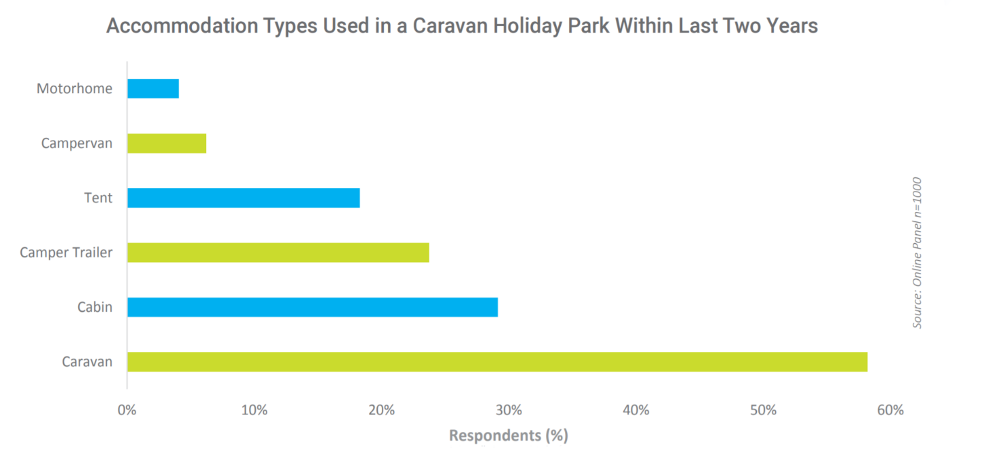

Looking next at Australia, in 2019, the total caravan and camping visitor nights exceeded 60 million and 14 million trips for the first time. Recognizing that there are 24.8 million Australians, and 8.4 million households, caravan and camping holidays has become an integral part of the national travelling behaviour.

Compare this with five years ago when friends’ and relatives’ places (34.1%) and hotels/motels (28.3%) topped the list for the types of accommodation used by Australians who took a domestic holiday in the previous 12 months. Only 7.3% of travellers reported camping in a tent and 6.0% stayed in a caravan, campervan, or motorhome on their last holiday[10].

However, among certain groups, these figures were considerably higher. Age played a very real part in determining whether a traveller would choose camping over caravans /campervans and vice versa. Without exception, Australians aged under 50 years were more likely than their older counterparts to have stayed in a tent on their last holiday, and those in the 50+ bracket were more likely to have stayed in a caravan or campervan.

The chart below shows the accommodation types used by Australian Camping vacationers during 2015 and 2106[11]. The methodology for the Study was laid out on page 28 thereof.

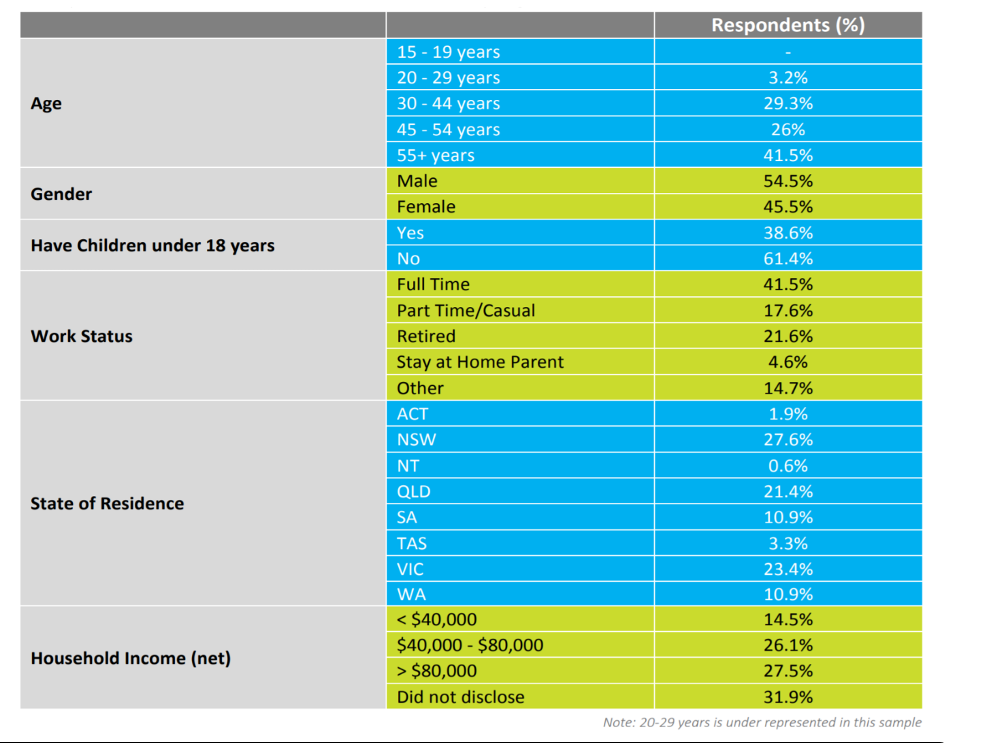

The chart below provides insights into the profiles of the consumer group surveyed for the Study[12]

What is clear is that the outdoor hospitality industry appeals to similar consumer demographics in the major markets although, as will be seen in a subsequent article, as campers have become more affluent, they have also become more demanding in terms of overall quality and the amenities available at the campsites that they utilize.

What is also clear is that the Global Pandemic has led to the rediscovery of the outdoor hospitality industry for many consumers as a vacation option which offers safety and proximity, especially with staycations, at a time when international borders have been closed. To further illustrate this growing popularity, Pitchup.com, an instant booking platform specializing in stays in campsites and tourist villages, which was founded in the UK in 2009 now has a presence and is active in over 67 countries with more than 5,000 partner facilities and receives more than 25 million annual site visits.

Article Number Three will examine the Recreational Vehicle segment of the Outdoor Hospitality Industry in greater detail, including the RV Campground business plus the various types of RV’s, their pros and cons, their sustained popularity in mature markets, as well as looking at emerging markets such as China.

[1] Source: Journal of Outdoor Recreation and Tourism 3-4 2013 “Trends in camping and outdoor hospitality- An international Review by Edward Brooker and Marion Joppe

[2] https://koa.com/north-american-camping-report/

[3] N.B. The results of the 2021 North American Camper Survey were based upon a total of n=3,936 surveys completed amongst a random sample of US [n=2,436] and Canadian [n=1500] households. All surveys were completed online via an outbound solicitation sent to a randomly selected cross-section of US and Canadian households.

[4] SCR Svensk Camping- https://www.scr.se/about-scr-swedish-camping/facts-and-statistics/

[5] Kampgrounds of America

[6] Go RVing RV Owner Demographic Profile 2021 published by RV Industry Association, USA.

[7] CIV-D Jahresband 2019/2020

[8] Wie relevant ist Caravaning in Deutschland und wie wird sich der Markt entwickeln? CARAVAN SALON Eröffnungspressekonferenz am 30.08.2019 in Düsseldorf.

[9] https://www.anwb.nl/binaries/content/assets/anwb/pdf/campingpartners/uk/lr_trendrapport_en.pdf

[10] Source: Roy Morgan Research